Despite having endured a long and challenging winter, Boston appears to have it all: a rich history in Americana, a trail of innovative leaders, a loyal and fiercely proud community, top universities, burgeoning business, the Vince Lombardi trophy, and a seemingly endless demand of visitors, both domestic and international.

The hotel industry in Boston that serves these domestic and international guests has never been better, having achieved (according to STR, Inc.) a 75.2% occupancy (just a half-occupancy point shy of the market's previous peak in 2000), and 7.6% average daily rate (ADR) growth in 2014, equaling a 10.8% increase in revenue per available room (RevPAR). This year, PKF Hospitality Research, a CBRE Company is forecasting another 8.3%% increase in RevPAR for the Boston market.

With all that this fair city has to offer, it is no wonder that Boston finds itself in contention for the Olympic Games in 2024.

As hospitality industry experts, utilizing an extensive database of hotel performance data and 80 years of publishing hotel performance in our Trends in the Hotel Industry report and quarterly Hotel Horizons forecasts for 59 U.S. markets, PKF Consulting USA and PKF Hospitality Research analyze a variety of hotel and tourism-related development opportunities through the lens of potential performance and impact. In this report we examine the lodging market impact of the Olympic Games on other host cities - namely Atlanta (1996), Salt Lake City (SLC) (2002), and London (2012). Additionally, we have looked at the impacts on employment and income. A look at the data available provides insight to what Boston might expect as the Olympic host city.

Olympic Impacts

The impact of the games on city hotel markets differ based on the market size, new hotel supply, and the market's baseline performance.

Size of Market and

Supply Increases

To put the Boston hotel market into perspective in our Olympic examination relative to size, at approximately 51,200 rooms currently it is sized between that of Atlanta (as of 1996) with 69,590 rooms and Salt Lake City (as of 2002) with 19,507 hotel rooms.

In preparation for the 1996 Summer Olympic Games in Atlanta, a spike occurred in hotel room supply additions, most notably in 1996 when 6,872 hotel rooms were added to the Atlanta market, a 9.9% increase in market supply. Savannah, where some Olympic activities were held, saw a spike as well, but to a smaller degree, with approximately 500 additional rooms opening that same year.

In preparation for the 2002 Winter Olympic Games in SLC, an increase of just under 900 rooms was realized in the market, representing 4.6%% of total room supply for SLC.

Occupancy Under-performs

Interestingly, a consistent pattern is the under-performance of occupancy during the Games. For Atlanta and Savannah, which achieved a combined market occupancy of 70.6% in 1995, prior to the Summer Games, overall occupancy in 1996 decreased 8.1% for Atlanta and 6.4% for Savannah. These declines resulted from the notable increase in supply, coupled with demand growth (1.5% in Atlanta) and contraction (-1.3% in Savannah) during that same period.

In the SLC market, which achieved occupancy of 60.5% in 2001, prior to the Winter Games, occupancy increased 2.5% in 2002. As the first quarter in the SLC market typically achieves the highest occupancies of the year, this occupancy growth is meaningful.

In the opinion of PKF hotel experts, the lower occupancy in Atlanta was likely the result of two factors, over-anticipation of demand in both supply increases and group blocks, and displacement of previously existing demand that opts to avoid visiting the destination during the games.

Room Rates Skyrocket

While occupancy underperformed expectations during the Olympic Games, as demonstrated in Atlanta/Savannah and SLC, ADR spiked significantly during the period of the games, by roughly 75% for Atlanta and Savannah, and approximately 180% in SLC.

Factoring this into annual performance numbers, Atlanta saw RevPAR increases of 8% and 8.1% in 1995 and 1996, followed by a RevPAR decline of 11.2% in 1997. SLC y experienced a RevPAR increase of 0.2% and 19.1% in 2001 and 2002, respectively, followed by a RevPAR decline of 17.6% in 2003.

Income and

Employment Impacts

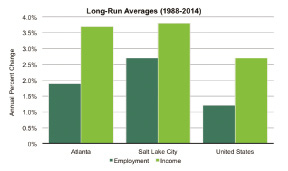

In addition to impacts on hotel demand and rate from the games, personal income and employment increases have been experience in Atlanta and SLC timed to their respective Olympic Games. In 1996, Atlanta saw a 4.8% increase in employment and a 7.2% increase in personal income, while the country as a whole observed a 2.1% increase in employment and 3.9% increase in personal income. Over the three years after the '96 games, Atlanta experienced a 4.1% average annual employment growth and 7.7% average annual income growth. The United States averaged 2.6% annual employment growth from 1997 to 1999 as well as 4.8% average annual income growth.

In 2002, Salt Lake City saw a 1.9% decrease in employment and a 0.4% increase in personal income; while the country as a whole observed a 1.1% decrease in employment and 0.5% increase in personal income. The three years after the 2002 winter games, Salt Lake City experienced 1.3% average annual employment growth and 3% average annual income growth. The United States averaged 0.9% annual employment growth from 1997 to 1999, as well as 2.6% average annual income growth.

Boston Olympic Perspective

Boston's hotel market is not exactly the same as predecessor host cities in terms of size, expected construction, and baseline performance, but the similarities are close enough to Atlanta, SLC, and London to perform an impact analysis. Preliminary findings show that the potential opportunity for the Boston hotel market as an Olympic host city could be a longer-term occupancy peak and absorption of new hotel rooms, as well as strong increases above the national average relative to employment and personal income.

Looking at the comparable market data, it also indicates that fewer hotel rooms are necessary than are typically planned to accommodate demand during the Games. Additionally, utilizing creative lodging solutions such as cruise ships and Airbnb, neither of which were options in the Atlanta or SLC Olympic Games, the number of hotel rooms required could reasonably be lessened. Though the specifics of such forecasts would require a more detailed analysis, it is clear that hosting the Olympic Games would further establish the Boston market on the international tourism stage.

Andrea Foster is senior vice president and new england practice leader for PKF Consulting USA, A CBRE Company. Foster is a graduate of Cornell University's School of Hotel Administration and a 20-year hospitality expert in operations, business development, marketing, feasibility and valuation.

Foster's career includes hotel management and destination resort business development and marketing, she is president of the Cornell Hotel Society New England Chapter; an active member of CREW Boston; a regular speaker at hospitality industry events and conferences, and at the hospitality schools at Cornell and Boston University; and frequently quoted in newspapers and hospitality industry publications.

Tags: