Defeasance, LLC

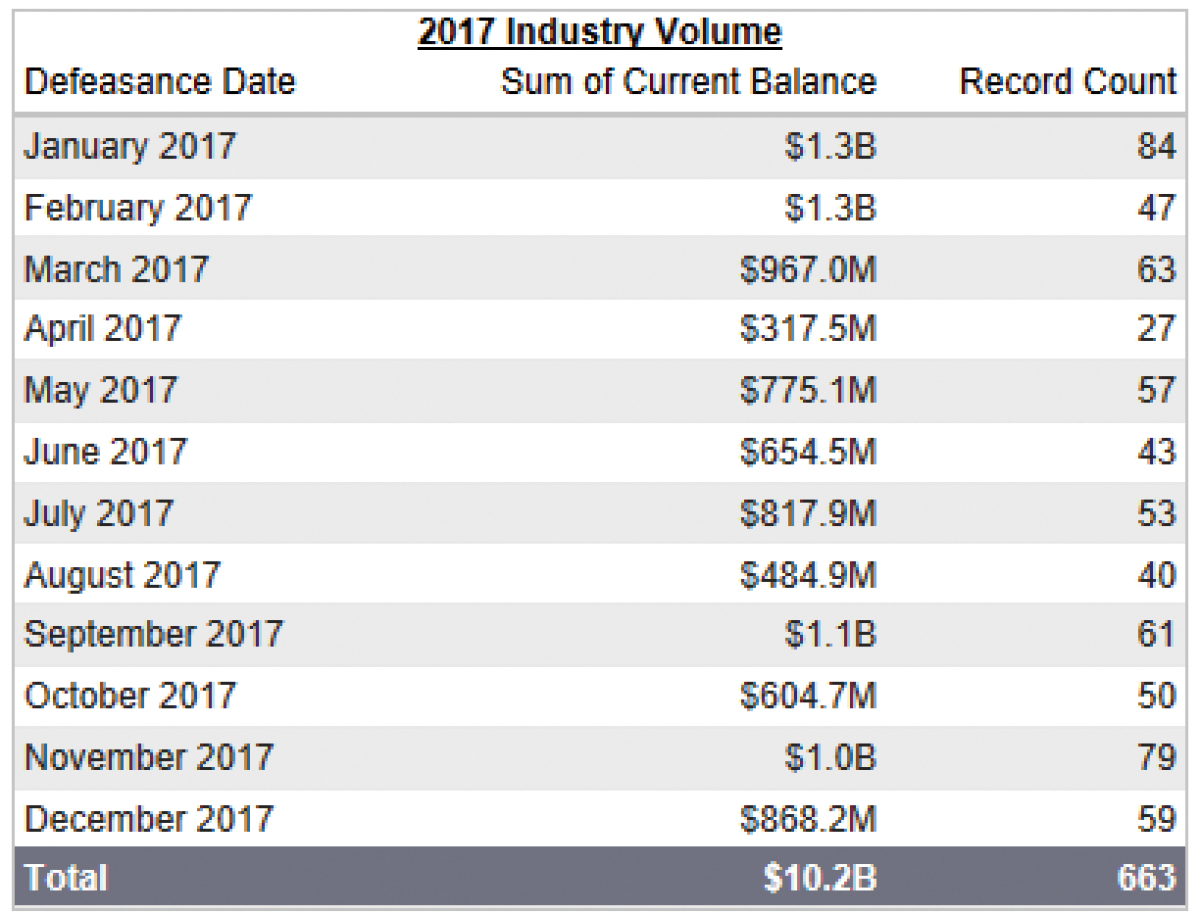

The final numbers are in for 2017 – defeasance activities fell a whopping 55% from 2016 totals of 1,200, compared to 663 transacted in 2017. The wall of maturing loans expected in 2017 came and went in multiple waves, whereas most of these deals were getting refinanced or sold in 2016.

Secondary and tertiary markets, where the recovery has been slow, took the wind out of the sails for those deals maturing in 2017, with debt service coverage ratios below 1 and lower valuations based on current cash flows, making it difficult for these deals to paper in 2017.

Early on in 2017 the banks were constrained by regulations, but by the second half the CMBS lenders rallied to finish the year strong, totaling $86.4 billion in new loan production, a 26% increase from 2016. New private capital continues to enter the markets along with bank and agency lenders as we are still experiencing both low interest rates and cap rates, which continue to create both sales and financing activity in the market place.

Defeasance comes into play when a borrower wishes to pay off a conduit loan prior to its maturity date. In these cases the borrower must provide the original lender substitute collateral (almost always in the form of U.S. Treasuries). The new collateral must produce an income stream sufficient to pay all the remaining loan payments and pay off the balance in full at the maturity date. The cost of completing a defeasance transaction depends on a number of factors, including the number of months left on the loan term at the time of prepayment, the current U.S. Treasury yield on securities sufficient to meet that goal. In addition, there are various third parties involved, all of whom play different roles in the entire process. The collective costs of the treasuries and third party expenses determine the total cost. The defeasance transaction then releases the property as collateral, allowing either a sale or new loan be put in place.

Defeasance comes into play when a borrower wishes to pay off a conduit loan prior to its maturity date. In these cases the borrower must provide the original lender substitute collateral (almost always in the form of U.S. Treasuries). The new collateral must produce an income stream sufficient to pay all the remaining loan payments and pay off the balance in full at the maturity date. The cost of completing a defeasance transaction depends on a number of factors, including the number of months left on the loan term at the time of prepayment, the current U.S. Treasury yield on securities sufficient to meet that goal. In addition, there are various third parties involved, all of whom play different roles in the entire process. The collective costs of the treasuries and third party expenses determine the total cost. The defeasance transaction then releases the property as collateral, allowing either a sale or new loan be put in place.

According to Bloomberg, approximately 400 loans that were defeased, totaling $6.9 billion, were multifamily property types, 80 loans totaling $755 million were retail property types, and 40 loans totaling $895 million were office property type.

With the federal reserve continuing to raise short term interest rates, U.S. Treasury rates have increased on the short end (1 to 6 months), closing in on 2%, while the 10 year rate continues to stay close to 2.65% creating a flattening of the yield curve. Federal policymakers expect another two rate hikes this year possibly three, as the current administration deliverance on big tax cuts and infrastructure spending which could produce higher inflation, has prompted the fed to continue to raise rates. It is reasonable to anticipate this factor may compel borrowers to pay off existing loans sooner for those loans that are due to mature in the next couple of years to take advantage of the current low interest rates available in the marketplace today and deals that were bought right during the downturn and have a positive equity position. In the meantime, it would certainly seem that keeping interest rates low will produce a large amount of economic activity in the commercial real estate market, at least through 2018 and most of 2019. Regardless of what interest rates do over this timeframe, it will be a busy time for commercial real estate professionals as owners decide whether to refinance or sell ahead of their pending loan maturities.

George Rodriguez is a partner with Waterstone Defeasance, LLC, Charlotte, N.C.