One of the long-time concerns over the past 13 years has been the health of the industrial market. Vacancy rates in 2004 were at 18.8% and in 2009 reached 25%. This meant that one out of every 4 or 5 s/f of space was vacant. It would not be unusual for a property to take two years to find a tenant. That tenant would expect two months free rent on a 5-year lease and tenant improvements of $2 to $3 per s/f. With leasing commissions, total up-front costs exceeded one year's rent. Because of these conditions, two of the largest industrial investors in the United States had made the decision to liquidate their Boston portfolio. This article will describe the industrial market in 2002, steps in between, and where we sit today.

The Industrial Market 2002 to 2010

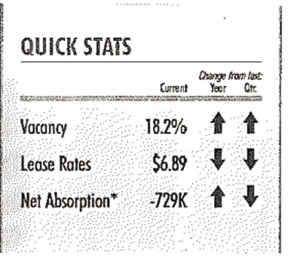

In terms of size, the industrial market contained general industrial buildings, high bay buildings and an R&D segment. Total market size was 124.5 million s/f. The Q4 2002 average vacancy was 9.5% and asking rents averaged $6.68 per s/f. 2002 was not a good year. Absorption was a negative (2.33 million s/f). Between 2002 and January 2005, negative absorption continued. Q1 2005 saw vacancy rates at 18.2% and asking rents similar to year end 2002. To place industrial markets in perspective, by 2005, Boston had shaken off the dot com bubble burst. The Boston office market was on its way to a 2007 peak while the industrial market languished. Quick stats from CBRE's records showed for Q1 2005 are shown in Figure 1.

Vacancy was rising, asking rents were falling and absorption was at "fits and starts." The industrial market uncertainties were continuous and became even more severe during the Great Recession. When the industrial market started to turn in Q2 2010, rents has slipped to an average asking rent of $5.53 per s/f. Over an 8-year period, average asking rents for industrial space had declined by 17%.

The Industrial Market - 2015

CBRE's Q2 2015 market overview starts by saying "the Greater Boston industrial market saw 1.24 million s/f of positive absorption in Q2 2015!" vacancy rates at 10.2% were the lowest we had seen in over a decade. 1.24 million s/f of quarterly absorption was the highest of any quarter in 13 years.

With the improvement in vacancy rates, average asking rents had started to rise. It took 11 years for rents to return to the Q4 2002 level of $6.68 per s/f. Because of the size of our industrial market and availability rate, asking rents have remained flat over the past 18 months. The Boston industrial market now contains 142.6 million s/f, an increase of 14.5%. Of major importance is that 100% of the growth in the industrial market has been in R&D space, not your traditional industrial/high bay buildings.

Conclusions

The industrial market in its recovery is tracking trends in the Boston market. The Boston market is in a technology boom. R&D users are often start up companies unable to afford inner Boston/Cambridge rents. Q1 2015 R&D rents were at $10.06 per s/f which is considered a cost effective alternative. Overall, the industrial market has experienced positive absorption. Then industrial market is now stable, a position not seen in over a decade.

Webster Collins, MAI, CRE, FRICS, is an executive vice president and partner in CBRE's Valuation and Advisory Group, Boston.

Tags:

Boston industrial market: Long-time trends reverse and market reaches tightest position in 13 years

July 30, 2015 - Spotlights