Defeasance, LC

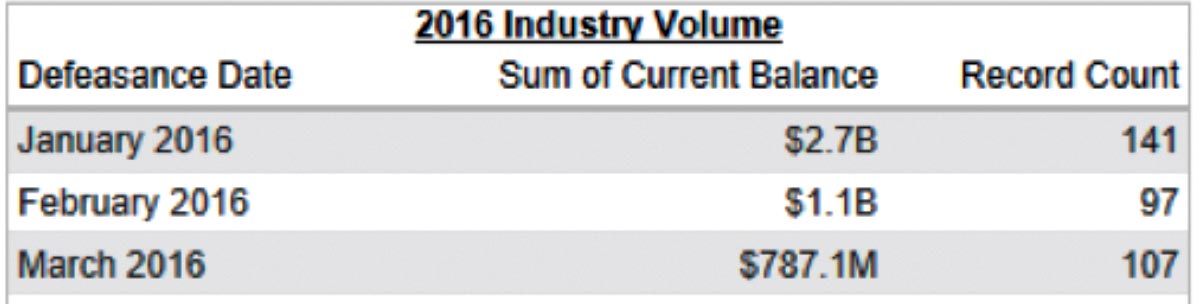

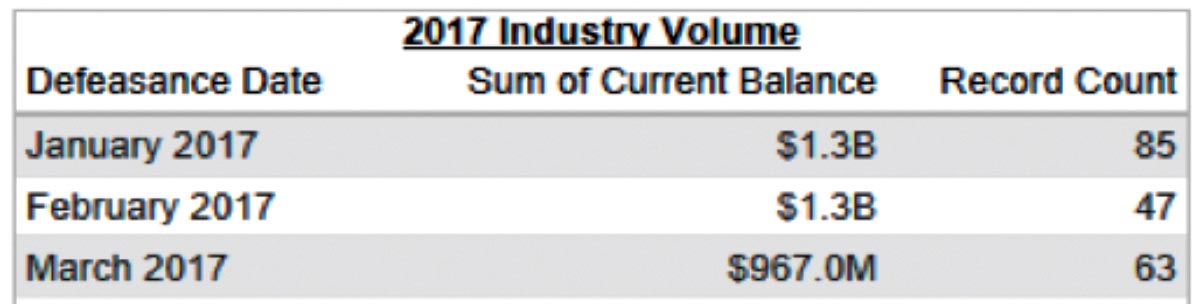

As we approach the top of the wall of CMBS loans maturing in 2017, we are still experiencing both low interest rates and cap rates, which continue to create both sales and financing activity in the market place. In 2016, the defeasance activity for CMBS loans increased 30% over 2015’s numbers due to deals with trapped equity and lower financing rates. However, Defeasance numbers for first quarter of 2017 are down over 55% as compared to first quarter of 2016.

The lower volume in defeasance deals in 2017 are due to most of the outstanding deals maturing in the near term are facing challenges in valuations as some of the secondary and tertiary markets have been slower to recover than the primary markets. CMBS lenders have been slow out of the gates (down over 30% in new loan production) in the first quarter of 2017 compared to first quarter of 2016 due to higher market spreads and risk retention rules kicking in December of 2016.

Defeasance comes into play when a borrower wishes to pay off a conduit loan prior to its maturity date. In these cases the borrower must provide the original lender substitute collateral (almost always in the form of U.S. Treasuries). The new collateral must produce an income stream sufficient to pay all the remaining loan payments and pay off the balance in full at the maturity date. The cost of completing a defeasance transaction depends on a number of factors, including the number of months left on the loan term at the time of prepayment, the current U.S. Treasury yield on securities sufficient to meet that goal. In addition, there are various third parties involved, all of whom play different roles in the entire process. The collective costs of the treasuries and third party expenses determine the total cost. The defeasance transaction then releases the property as collateral, allowing either a sale or new loan be put in place.

According to Bloomberg, approximately 195 loans have been defeased this quarter. Of that, 107 loans totaling $1.95 billion were multi-family property types, 32 loans totaling $443 million were retail property types, and 18 loans totaling $599 million were office property types leading the way.

With the federal reserve raising short term interest rates, U.S. Treasury rates have increased on the short end (1 to 6 months) at times closing in on 1%, while the 10 year rate continues to stay close to 2.3%. Fed policymakers expect another two rate hikes this year and three in 2018 as president Trump’s promises of big tax cuts and infrastructure spending which could produce higher inflation, has prompted the fed to continue to raise rates. It is reasonable to anticipate this factor may compel borrowers to pay off existing loans sooner for those loans that are due to mature in the next couple of years to take advantage of the current low interest rates available in the marketplace today and deals that were bough right during the downturn and have a positive equity position. In the meantime, it would certainly seem that low interest rates will produce a large amount of economic activity in the commercial real estate market, at least through the first half of this year. Regardless of what interest rates do over this period, it will be a busy time for commercial real estate professionals as owners decide whether to refinance or sell ahead of their pending loan maturities.

George Rodriguez is a partner with Waterstone Defeasance, LLC, Charlotte, N.C.