Valbridge Property Advisors

The Hartford Central Business District (CBD) apartment market is booming with 795% expansion since 2002 (177 units to 1,585 units). With another 565 units in the planning/construction stages, the market could increase by another third in the next 24+/- months.

Background

Before the building boom, the CBD housed two projects totaling 177 units, but in 2003/04, 55 On the Park and Trumbull on the Park more than doubled that total. By 2007, the market quintupled and now totals 1,585 units.

Public economic development agencies have been a fundamental driver of growth, with direct investment and lending support underwriting much of the unprecedented growth and have bridged the gap between actual construction costs and property values based upon achievable market rents.

The apartment growth has had several ancillary effects. First, class B office vacancy, formerly in the 40%-45% range, has declined due to apartment conversion. Secondly, the new apartments have attracted empty nesters and young professionals and pumped life into an area that traditionally “rolled up” at five o’clock.

The focus of this article compares and analyzes projects developed since 2014 with pre-2007 housing stock, as well as the potential success of future projects.

One-Bedroom Rental Rates

Rental information obtained from CoStar and Valbridge Property Advisors has been reviewed and adjusted for utilities. The adjusted rent assumes the tenant incurs all costs except trash, cold water and sewer.

Prior to 2014, average rents stayed in the $1.55 per s/f to $1.65 per s/f range. Once new product appeared, rates for older units decreased to $1.57 per s/f, but have since rebounded to average $1.67 per s/f in first quarter 2017. As expected, post-2014 developments have generated rates which surpassed expectations at higher than $2.00 per s/f.

Inclusive of all properties, rates in first quarter 2017 mostly fall between $1.55 per s/f to $2.18 per s/f with a straight average of $1.87 per s/f. Most knowledgeable parties expect nominal rent growth over the next few years in anticipation of additional housing stock.

Occupancy

Apartment occupancy in the CBD remained flat (95% range) prior to 2013/14. As new units came online in late 2014 and 2015, occupancy levels dipped to 81%, but rebounded in 2016 to 93% and improved still further in first quarter 2017 to 95%. Current occupancy rates range from 86% to 100% with four projects reporting 100% occupancy.

Absorption

Absorption exceeded all reasonable expectations. Since December 2014, seven new developments have come online (697 units). Although rents dipped slightly and concessions were offered, all new inventory was absorbed. Information provided from developers and online articles (The Hartford Courant and Hartford Business Journal) result in estimated absorption of 26 units per month during December 2014 to September 2016 and a high-water mark of 50 units per month!

Pipeline Projects

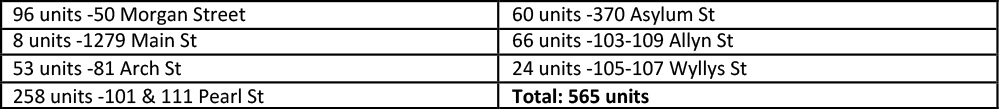

Assuming these projects come to fruition, the total number of apartments in the Hartford CBD could reach 2,150 units by 2019.

Development Realities

Financial challenges make apartment development infeasible without favorable government financing and tax agreements with the City of Hartford. Simply put, achievable rental rates do not support the development costs. All apartment projects developed since 2003 in the CBD (except for 55 on the Park) are partially funded by Capital Region Development Authority (CRDA) and utilize the residential tax assessment ratio instead of the typical ratio applied to apartments of 70%. This benefit remains in place into perpetuity. Front Street Lofts are fully tax exempt due to a land lease with the State of Connecticut.

According to Michael Freimuth, the executive director of CRDA, roughly $65,000 per unit has been invested in existing projects with a similar amount pledged to projects now under construction or in the pipeline. Whether this funding will be available for future projects is questionable given the state’s dire economic condition, which will likely determine if future projects move forward.

Summary

The Hartford apartment market has proven numerous times that demand exists. The old adage–build it and they will come–has proven true. However, developers must evolve to meet tenant demands. Given the high cost of urban construction, government subsidies will remain necessary and the market should be watched closely. Ideally, new development will be slowly constructed over time. Rental rate growth is not anticipated to increase significantly in the near term as new product is added. However, there is sufficient demand to enable absorption of new apartments which are under construction or in the pipeline, provided the projects are thoughtfully phased in.

Valbridge Property Advisors is a national commercial real estate valuation with 68 offices. This article was produced by the Connecticut office, which services the entire state of Connecticut, western Massachusetts and Rhode Island.

For full article: https://www.valbridge.com/appraiser/8/greater-hartford-ct/market-insights

Patrick Lemp is senior managing director and Josephine Aberle, MAI, is managing director at Valbridge Property Advisors, Hartford, CT