It’s no secret that shifting demographic patterns are vital to understanding economic growth and commercial real estate markets. While the rise of the Millennials (aka Echo Boomers or Generation Y) has been a hot topic for the better part of the last 30 years, the impending demographic cliff due to accelerating Baby Boomer retirement is a concern both locally and nationally.

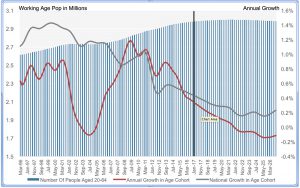

As Baby Boomers continue to age, growth in the nation’s working-age population is expected to slow to a mere crawl over the next five years. Projections for this deceleration are more pronounced in Greater Boston, with growth dipping negative during the forecast period.

What are the implications for commercial real estate fundamentals? As discussed in our recent recap of CoStar’s State of the Office Market, the short answer is this demographic movement will ultimately weigh on demand for space–particularly in the office market. Greater Boston will likely face steeper headwinds as the demographic outlook is comparatively less favorable. Lower demand will push office vacancies northward and impede rent growth during the latter half of the next five years.

Liz Berthelette, director of research at NAI Hunneman, Boston, Mass.