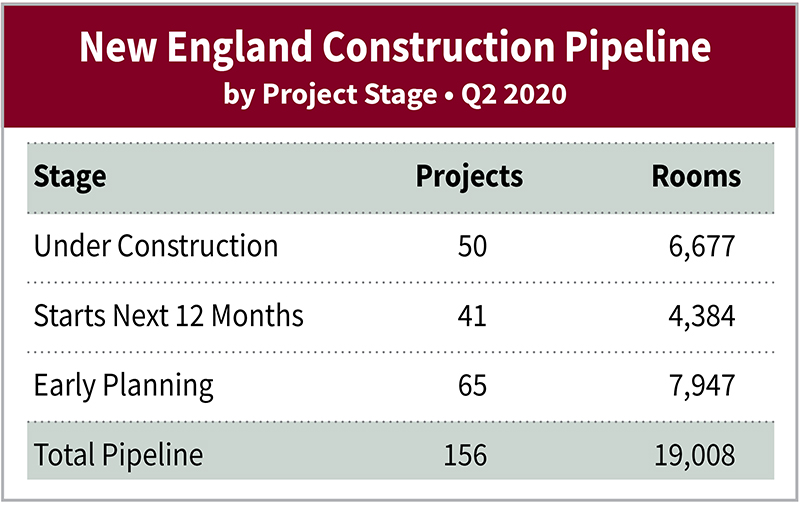

Analysts at Lodging Econometrics (LE), the global leader for hotel development intelligence, state that at the close of the second quarter of 2020 the total U.S. hotel construction pipeline stands at 5,582 projects/687,801 rooms. Remarkably, despite some project cancelations, postponements, and delays, there has been only incremental impact on the U.S. construction pipeline since Q4 2019. The New England hotel construction pipeline also remains strong with 156 projects/19,008 rooms at the close of the second quarter. Of the 156 projects in the pipeline, 50 projects/6,677 rooms are under construction, 41 projects/4,384 rooms are scheduled to start construction in the next 12 months, and another 65 projects/7,947 rooms are in the early planning phase (Chart 1).

Over the last eight years, robust pipeline counts have allowed for a total of 183 hotels/21,005 rooms to be added to the open and operating hotel supply base in New England. Through the second half of 2020, a total of 5 hotels accounting for 320 rooms have opened in New England. LE is expecting another 15 hotels/1,656 rooms to open by year end.

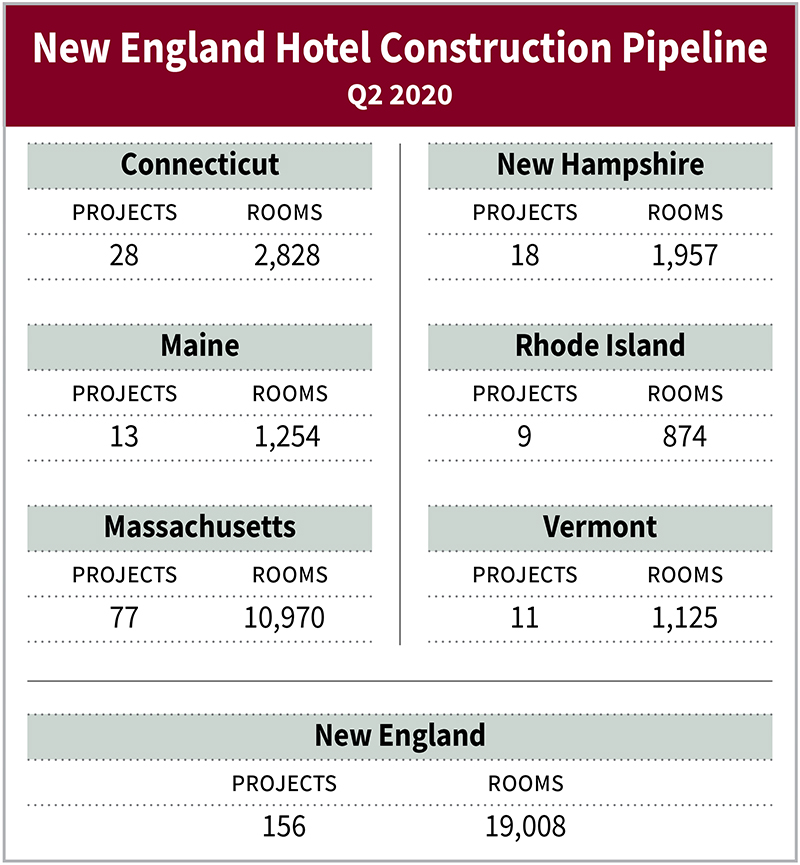

Over half of the new hotels that opened in New England in the last eight years are located in Massachusetts; which has had 102 hotels open, followed distantly by Maine with 25 and then Connecticut with 19. Massachusetts also leads New England in hotel construction pipeline counts at the end of the second quarter of 2020 with 77 projects/10,970 rooms, accounting for 49% of the projects in the New England pipeline. This is followed by Connecticut which has 28 projects/2,828 rooms, then New Hampshire with 18 projects/1,975 rooms, Maine with 13 projects/1,254 rooms, Vermont with 11 projects/1,125 rooms and then Rhode Island with 9 projects/874 rooms (Chart 2).

Branded hotels continue to be the most appealing in New England for developers accounting for 72% of the projects in the pipeline with 112 projects/13,792 rooms at the end of Q2 2020. There are 43 branded projects/6,115 rooms under construction, 34 projects/3,747 rooms scheduled to start construction in the next 12 months, and another 35 projects/3,930 rooms in the early planning phase. Unbranded hotels round out the pipeline total with 44 projects/5,216 rooms, with 68% of those projects in the early planning phase. As these unbranded hotels move through the pipeline approximately 85 to 90% of them will ultimately select a brand.

For more information on the hotel construction pipeline in New England, any individual market in the U.S. or for the entire U.S., contact LE +1 603.431.8740 or info@lodgingeconometrics.com.

Lodging Econometrics is the leading provider of global hotel intelligence. Combining unparalleled industry experience, a real-time pulse on market trends and extensive knowledge of key decision-makers, LE delivers actionable business development programs for hotel franchise companies looking to accelerate their brand growth, hotel ownership and management companies seeking to expand their real estate portfolios, and lodging industry vendors who want to increase their sales. LE’s programs turn a client’s business goals into opportunities that advances their competitive advantage.