The Boston and Cambridge (city) lodging market, both pre- and post-COVID, remains one of the most vibrant and dynamic in the United States. As of year-end 2024, according to STR, the Boston MSA ranked 5th highest in occupancy and 3rd highest in ADR among the top 25 markets. Only two top 25 markets, New York and Oahu Island (HI), exceeded Boston’s year-end RevPAR. Unfortunately, the Boston/Cambridge market is currently performing below pre-COVID levels when the city consistently achieved occupancy rates in the low 80s. While ADR remains strong, it has not kept pace on an inflation adjusted basis. For 2025, we expect the local lodging market to see continued positive results, albeit at a measured pace. This article examines the current state of the Boston/Cambridge market and offers short term projections for the future.

Dissecting 2024 Top Line Performance

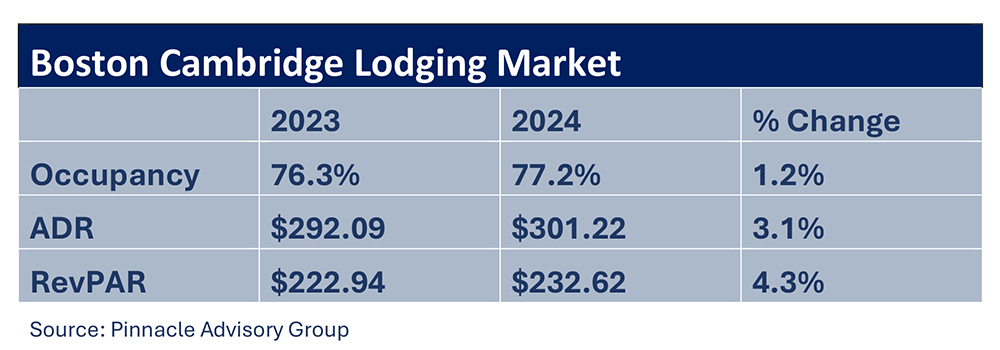

The Boston/Cambridge lodging market ended 2024 with an occupancy rate of 77.2%, reflecting a 1.2% increase over 2023’s 76.3%. This small increase in occupancy is a result of the market accommodating 1.5% more rooms in 2024 compared to the prior year; 2.3% more rooms occupied as compared to 2019. Seasonality patterns aligned with typical expectations, with peak season (April through October) occupancy ranging from 81% to 88%, averaging 85%. The shoulder months (March and November) averaged 75%, while the slow season (January, February, and December) averaged only 61%.

In terms of market demand mix, based on data from hotel managers in the city, the 2024 distribution was: group (26%), contract (4%), transient leisure (42%), and transient corporate (28%). This compares to an estimated 2023 mix of 22%, 6%, 45%, and 27%, respectively. Both group demand and corporate transient demand increased, continuing to rebound from the pandemic’s impact.

Overall, ADR increased by 3.1% in 2024 over 2023, though monthly growth was inconsistent. For instance, in January, March, June, and December, ADR increased by less than 2%, while November saw a nearly 3% decline. In contrast, the remaining seven months experienced ADR increases ranging from 3.5% to 7.1%. Business and group travelers contributed more to rate growth, generally paying above inflationary increases, whereas leisure travelers remained more price sensitive. The city also experienced stronger increases as a result of compression for citywide events.

With both strong occupancy and room rates during peak season, the Boston/Cambridge RevPAR reached $232.62 in 2024, up 4.3% from 2023. Local hotel operators and owners should be pleased with these results; however, concerns remain as the pace of growth has begun to slow.

While 2024’s overall occupancy and ADR figures were strong, performance varied across submarkets. The Logan Airport submarket achieved the highest occupancy (83.4%) but at the expense of ADR, resulting in the second-lowest RevPAR in the city at $189. The Fenway/Longwood Medical Area and North End/West End followed, both with approximately 81% occupancy. Conversely, Cambridge had the lowest annual occupancy at 74%, a notable decline from its pre-COVID performance (2019: Cambridge 81.7% vs. Total Boston/Cambridge 82.5%). Factors contributing to Cambridge’s weaker performance include decreased demand from tech companies, the shift to remote/hybrid work, and a softening life sciences sector.

From a rate tier perspective, luxury hotels faced ongoing challenges, with 2024 occupancy at just 60%. This segment continues to struggle primarily due to a 35% increase in luxury room supply since 2019, coupled with the larger gap in pricing between the upper-upscale hotels and the luxury tier. However, the luxury ADR grew 2.3% to $612, with RevPAR increasing 6% to $364. The upper-upscale tier also saw strong RevPAR growth, rising 6% to $268, aligning with national trends where higher-end hotels outperformed the overall market.

2025 Projections: A Steady, Balanced Market

Nationally, the lodging market in 2025 is expected to see muted growth, with stable occupancy levels and moderate ADR increases, leading to projected RevPAR growth of approximately 1.8%, according to STR. Most of this growth will stem from ADR rather than occupancy gains. Economic conditions, inflation, and interest rates will influence consumer spending, while the new administration’s policies could introduce further uncertainty.

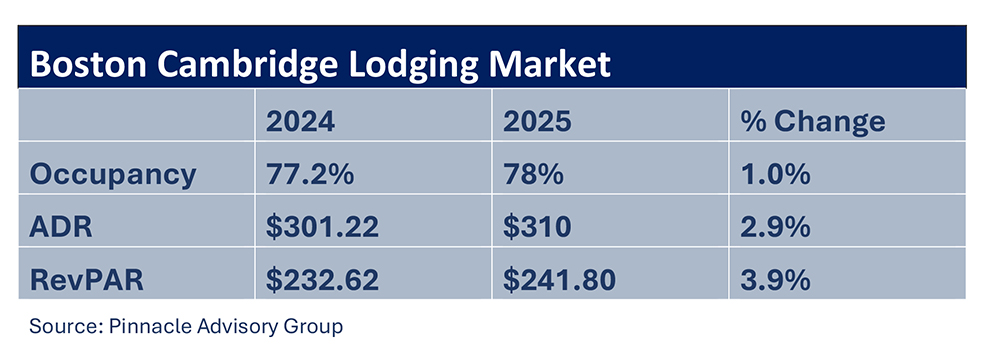

For Boston/Cambridge, projections indicate similar trends but with a more robust outlook compared to the national market. Demand will continue growing, albeit modestly, though occupancy is unlikely to return to pre-pandemic levels of 81%-82%. Key factors shaping the 2025 outlook include:

1. Minimal New Supply: The only significant addition is the Cambria Hotel, opening mid-2025, alongside partial-year impacts from the late-2024 CitizenM opening and a few renovated rooms returning to inventory, representing a 1.3% supply increase.

2. Convention Business Growth: Signature Boston reports 49 booked events generating approximately 575,000 total room nights in 2025 (vs. 48 events with 548,000 in 2024). 21 of these events generate rooms on peak of over 2,000, while three events expect 6,000+ peak rooms. Overall, the timing of the convention events in 2025 is similar to 2024, with the exception of slower business in July, August and September. It’s important to note that the Hynes Convention Center will be closed for renovations from June to August, impacting the Back Bay market.

3. Office Market Recovery: Boston’s office market recorded 1.9 million s/f of leasing activity in Q4 2024, with positive quarterly absorption. After 2 ½ years of negative absorption following 2021, the market saw its second consecutive quarter of positive absorption. Availability at year end 2024 remained constant at 22.7% as vacancy rose slightly to 18.1%. Unfortunately, the Cambridge office market faced the same headwinds that have been plaguing office markets across the country. However, Cambridge continues to struggle, with 171,000 s/f of negative absorption (a considerable improvement over 2023 when the market saw 821,000 s/f of contraction) in 2024 and a 21% vacancy rate at end of Q4 2024.

4. Evolving Leisure Demand: High-end leisure travelers will drive growth, while price-sensitive travelers may continue to reduce spending. On a positive note, several key events will occur in the city’s shoulder and slow seasons. According to Meet Boston, there are 11 major sporting events planned in the city, with five of these occurring in February and March. Additionally, Meet Boston stated that 80% of the top 10 international markets in 2025 are projected to exceed 2019 visitation levels, garner significant lodging demand. According to current forecasts, consumer spending is expected to slow down in 2025, with most experts predicting moderate growth compared to the previous year.

5. Logan Airport Growth: YTD November 2024, Logan Airport served over 40 million passengers (up 6% from 2023), including nearly nine million international travelers (a 14% increase). Continued growth is expected in 2025.

While ADR is projected to improve, rate growth will decelerate due to fewer compression nights, economic concerns, and Boston’s already high hotel rates compared to other urban markets. Pinnacle’s 2025 projection for the city is presented in Chart 1.

Challenges Ahead

Despite a positive outlook, several challenges could impact profitability:

• Political & Economic Uncertainty: Potential policy changes affecting travel, labor markets, and tariffs.

• Union Contracts & Wage Pressures: The new agreements that were recently approved will put more pressure on managing wage increases.

• Regulatory Changes: Health and safety ordinances under consideration may raise operational expenses.

• Hynes Convention Center Renovation: Temporary closures will reduce Back Bay room demand.

• Economic Pressures: Inflation, interest rates, and supply costs create uncertainty.

Conclusion

The Boston and Cambridge lodging market is steadily improving while adapting to the post-COVID landscape. Though full recovery remains a few years away, the market demonstrates resilience and is well-positioned for future growth. With strategic planning and investment, Boston’s hospitality sector is set to thrive in the coming years.

Rachel Roginsky, ISHC, is the owner and founder of Pinnacle Advisory Group. She is based in the firm’s Boston office.

Roginsky has more than 40 years of experience in hospitality consulting. Roginsky is the current co-chair for Boston University School of Hospitality Administration’s Real Estate Advisory Council (REAC). She also serves as a board member to numerous hospitality related organizations and societies and is a regular guest lecturer at prestigious institutes of higher education.

Additionally, Roginsky is an adjunct professor at Boston University. She is widely published and quoted and is the co-editor and author for Hotel Investments: Issues and Perspectives, a well-regarded book (5 editions) published by the Educational Institute of the American Hotel and Lodging Institute.