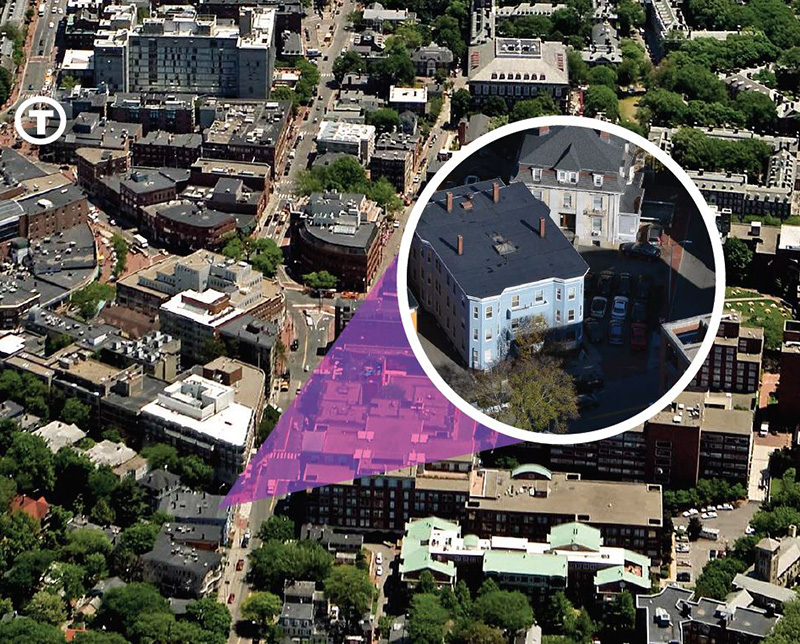

Colliers International facilitates the sale

of and arranges financing for 17 Story St. in Harvard Sq.

Cambridge, MA According to Colliers International, its Capital Markets team facilitated the sale of and arranged financing for 17 Story St. in Harvard Sq. First Cambridge Capital purchased the .32-acre site from 17 Story, LLC for $16.1 million. Leading the sale process was Colliers executive vice president Christopher Sower who expressed his enthusiasm for the outcome of the project. “From the time we began working on this assignment, our team was always motivated by the opportunity to help write a new chapter for 17 Story – no pun intended. Like us, First Cambridge saw this same potential and we are excited to watch their vision unfold in the year ahead.”

Colliers Capital Markets debt and equity specialists, executive vice president Tom Welch and senior vice president Adam Coppola, helped the buyer arrange financing as a covered land play through lender, Radius Bank.

In addition to Sower, senior vice president Bruce Lusa and assistant vice presidents Jonathan Bryant and John Flaherty provided additional support to the seller.

Atlantic Property Management expands facilities maintenance platform: Assigned two new facility management contracts in RI

New Quonset pier supports small businesses and economic growth - by Steven J. King

Tenant Estoppel certificates: Navigating risks, responses and leverage - by Laura Kaplan

Connecticut’s Transfer Act will expire in 2026. What should property owners do now? - by Samuel Haydock

(1).png)

(1).png)