NorthMarq

Boston’s residential and commercial real estate market is known for its strong fundamentals. With an expected slowdown in activity nationwide, Boston remains a point of focus for both institutional and non-institutional lenders looking to increase their exposure. Because short-term debt generally comes with a higher interest rate, institutional lenders, such as life insurance companies, start debt funds to offer short-term bridge loans. These will achieve the yield requirements for their investors. But what is the difference between Institutional and Non-Institutional Bridge lenders?

Short-term bridge loans allow investors to quickly acquire properties in situations such as:

• The property not yet being stabilized

• The property is in need of significant renovations

• The property is in the process of a sale

In these scenarios, borrowers may find it difficult to obtain traditional longer-term financing. Bridge loans will give borrowers this short-term solution. Once borrowers are ready to exit, via sale or refinance, most bridge loans have little to no prepayment penalties. When analyzing each situation, the key for bridge lenders will be the borrower’s business plan. This means laying out an exit strategy to pay off the loan.

Institutional lenders will not sacrifice loan quality (property location, sponsorship strength, asset quality, etc.), for loan volume. The flexibility to offer bridge loans for high caliber deals, however, is a new dimension for these financial institutions historically focused on long-term loans for cash flowing assets. Many, if not, all institutional lenders have long-term fixed rate debt available, allowing them to convert bridge loans to permanent loans at minimal cost to borrowers. This gives borrowers short-term solutions from many of the same lenders they would be looking to borrow from.

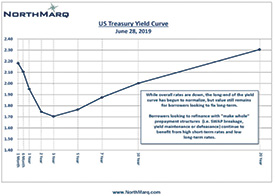

Institutional bridge loans are usually non-recourse and they use local servicers to be in contact with borrowers. Even better for borrowers, institutional lenders price these bridge loans very competitively. They range from as low as 250 bps over 30-LIBOR for floating – rate (30-Day LIBOR 2.37% as of July 9, 2019) to 300 bps over corresponding treasury for fixed-rate (3-Year Treasury yield 1.88% as of July 9, 2019).

Then come the non-institutional high-yield debt fund lenders, who are willing to underwrite higher leverage bridge loans with less provisions and lower quality metrics than their institutional counterparts. Historically, these lenders charged higher upfront fees and higher rates. But they succeeded by offering more proceeds with faster closing times. Their flexibility to get comfortable with many difficult situations was their competitive advantage.

In order to compete in Boston’s commercial real estate market, these lenders had to be willing to look at non-institutional quality assets in riskier locations with less sponsorship strength. Non-Institutional bridge loans can be either recourse or non-recourse, but will almost certainly not have a local servicer for the borrower.

This benefits borrowers looking outside of infill, urban locations for investment opportunities. Where investors can acquire top quality assets in Boston at a 3.5% cap rate, they can look towards suburban locations for assets to acquire north of 6%. In those secondary and tertiary markets, borrowers expect a higher cost of debt. But they are willing to pay a higher rate and fees to acquire these assets and cash flow the property until traditional long-term financing becomes available.

More good news for borrowers: non-institutional high-yield debt fund lenders have begun getting aggressive in top national markets such as Boston. Rates have declined and upfront fees have also decreased due to stiff competition in one of the nation’s most heavily banked markets. As expensive as it looks, many of these loans allow borrowers to pay down the loan balance at no cost as early as six months or sooner, which leaves borrowers less interest rate sensitive.

With such vast capital sources available for bridge loans, property investors are likely to benefit by reviewing their traditional financing channels and exploring new lenders in the market.

Jeffrey Muñoz is a vice president with NorthMarq, Boston.