Holyoke, MA Kennedy Funding has closed a $1.3 million loan to Hampden Papers, Inc.

Proceeds from the bridge loan will be used as working capital for the borrower’s property, located at 100 Water St. Funds will be used to complete payments due for Hampden Paper’s prior business operations; the business was sold to a Kentucky-based company in 2020. Proceeds will also be used toward the continued costs to maintain the 5.611-acre property, which is zoned for industrial use.

“As Hampden Papers, Inc. enters the final phase of its operations, the bridge loan we provided can help them wind down and close this chapter,” said Kevin Wolfer, CEO, Kennedy Funding, adding that the direct lender was able to secure a low 9% interest rate for the borrower.

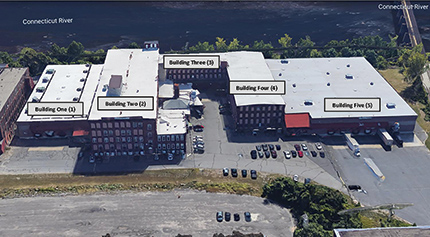

Wolfer said that three of the five buildings are under contract to sell to a cannabis company for $3.55 million.

“Knowing that the former Hampden Papers site was soon to be sold, we were able to quickly review and approve this loan application so the borrower could access the funding necessary to prepare for the sale. The current value of the properties, together with the pending sale, enabled us to offer a very attractive rate, despite the lack of a structural engineer report,” he said.

The former Hampden Papers site is located close to major thoroughfares, including I-391 and I-91 and U.S. Rtes 5 and 202. These highways allow for access to nearby major cities, like Springfield and Hartford.

“The opportunity is ripe for the next business or businesses that calls 100 Water Street home,” Wolfer said. “With plenty of warehouse space, truck bays, and office space for employees, each building offers plenty of room to meet the requirements of a commercial enterprise that wants to establish itself or grow its business in western Massachusetts.”

Kennedy Funding is a private lender specializing in bridge loans for commercial property and land acquisition, development, workouts, bankruptcies, and foreclosures.

Kennedy Funding has closed more than $3 billion in loans to date. The firm’s creative financing expertise provides funding up to 75% loan-to-value, from $1 million ($3 million international) to more than $50 million, in as little as five days. The company has closed loans throughout the United States, the Caribbean, Europe, Canada, and Central and South America.