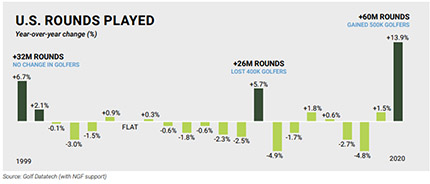

The golf industry has actually seen an increase in golf rounds played during 2020, as a direct result of the COVID-19 pandemic. Many more people were working at home with more flexible schedules. And, golf represented a safe, socially-distant recreational activity. Golf became a needed escape, both physically and mentally for millions of Americans. Nationally, there was an increase in the number of rounds played by nearly 14% over 2019 resulting in a total of 502 million, the most since 2007, or the year prior to the great recession. The net gain of 61 million recreational rounds over 2019 was the second largest rise on record, behind only the jump of 63 million in 1997 when a transcendent golfer named Tiger Woods won the first of his 15 major championships.

Private clubs were up 19.9% year-over-year while public facilities saw a 12.4% increase in rounds nationwide. These impressive results come despite course shutdowns during March and April. And in some states like Massachusetts, golf did not open until May 15 due to state mandates because of the pandemic. It was estimated that 90% of U.S. courses had re-opened for play as of early June of 2020.

On the supply side, there were 16,165 golf courses at 14,145 facilities as of the end of 2020. This reflects a 1.3% reduction amid the ongoing market correction in which closures have outweighed new openings for 15 consecutive years. The majority of these closures have been value priced public properties in competitive markets where owners took advantage of high demand for real estate. 193 18-hole equivalent courses closed in 2020; this was a 31% decrease from 2019. And although the U.S. market will continue to contract in the coming years, investment has ramped up in the form of renovations, restorations and other capital improvement projects.

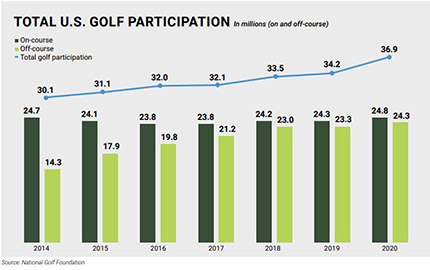

Factoring in both on and off course forms of golf, overall participation climbed to 36.9 million Americans, up eight percent year-over-year and almost 20% over the last five years. The pipeline got stronger according to the National Golf Foundation. About 17 million non-golfers indicated that they are very interested in playing golf on the course up from 15.5 million in 2019. This measure of latent demand has climbed by more than 40% since 2015.

At the same time however, revenue from golf club ancillary profit centers, most notably food & beverage sales and pro shop merchandise sales, were down in 2020 due to the physical limitations on hosting indoor customers. As such, those clubs that generate a relatively higher percentage of revenue from large food & beverage venues saw a sharp decline in sales as most large social and group golf events were forced to cancel. Likewise many private membership clubs experienced a drop-off in revenue from guest golf fees despite strong membership demand and increased rounds.

However, while, food and beverage sales were significantly lower, the operating margins are less favorable for this profit center such that net operating income was actually up in 2020 at most regional public golf courses surveyed.

Most owners/operators surveyed expect there to be some long-term positive impact on market demand factors going forward as a larger percentage of employees will continue to work from home even after the virus is fully under control. And, they are anticipating that the 2020 golf season has also re-energized demand amongst the golfing public that will carry over for some time. Furthermore, the second half of 2021 and into 2022 particularly are expected to be a boom period for food & beverage function venues as there is a good deal of pent up demand from canceled social events, primarily weddings that were put on hold during 2020. Therefore, considering the above factors, it is our opinion that public golf industry will not be negatively impacted by COVID-19 going forward and may in fact actually trend positively in the near term.

Jeffrey Dugas, MAI, SGA, is a partner with Wellspeak Dugas & Kane, LLC, and heads the golf advisory group, Cheshire, Conn.