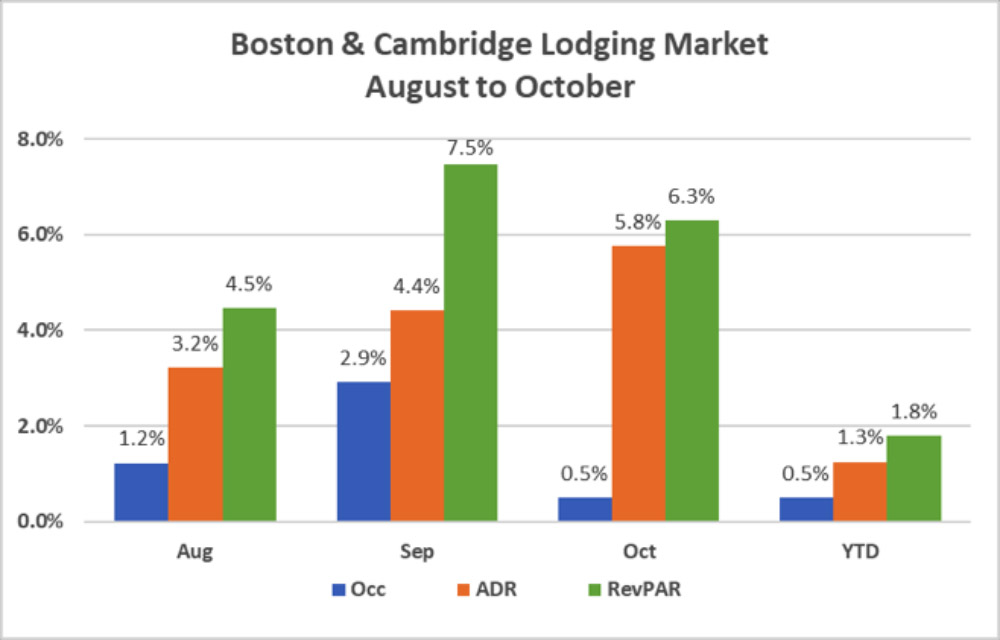

Through July, revenue per available room (RevPAR) in the Boston and Cambridge lodging market had experienced its ups and downs but overall had declined 0.6% compared to the same period last year. However, the market gained considerable traction beginning in August, a trend that continued through October. The gains in both occupancy and average daily rate (ADR) over the last three months have shifted the year-to-date RevPAR +1.8% over last year.

A solid base of group demand helped to increase compression and drive transient rates during both August and September, while October benefited greatly from three citywide events at the Boston Convention & Exhibition Center (BCEC), the Red Sox playoff run through the World Series. Additionally, certain areas of the lodging market, especially Logan Airport, accommodated a large number of displaced residents and workers as a result of the unfortunate Merrimack Valley gas explosions which occurred in mid-September. As a result of the performance during these three months, the market is positioned to end the year with RevPAR growth over 2017. (see Chart 1)

Largely driving the increases to demand in August, group related room-nights increased 10%. According to the Massachusetts Convention Center Authority (MCCA), the BCEC and Hynes Convention Centers generated over 51,000 room nights in the month, an increase of over 50% from August 2017. The month included 11 nights of compression, an increase from last year’s six. Rate growth of 3.2% in the month was driven entirely by transient rates which made up the majority of August’s 4.5% RevPAR growth.

The month of September experienced a 6.1% growth in accommodated room nights. A high level of compression in the month was created by a 15% increase in group demand, which in turn helped operators drive transient rates over 6%. The month included 13 compression nights, four more than last year, at an ADR of over $330.

October reached its highest occupancy on record, 91.9%, and represented the market’s 31st month of consecutive demand growth. Given the considerable amount of compression in the month, operators were able to increase rates 5.8%, the largest monthly rate increase since May 2017.

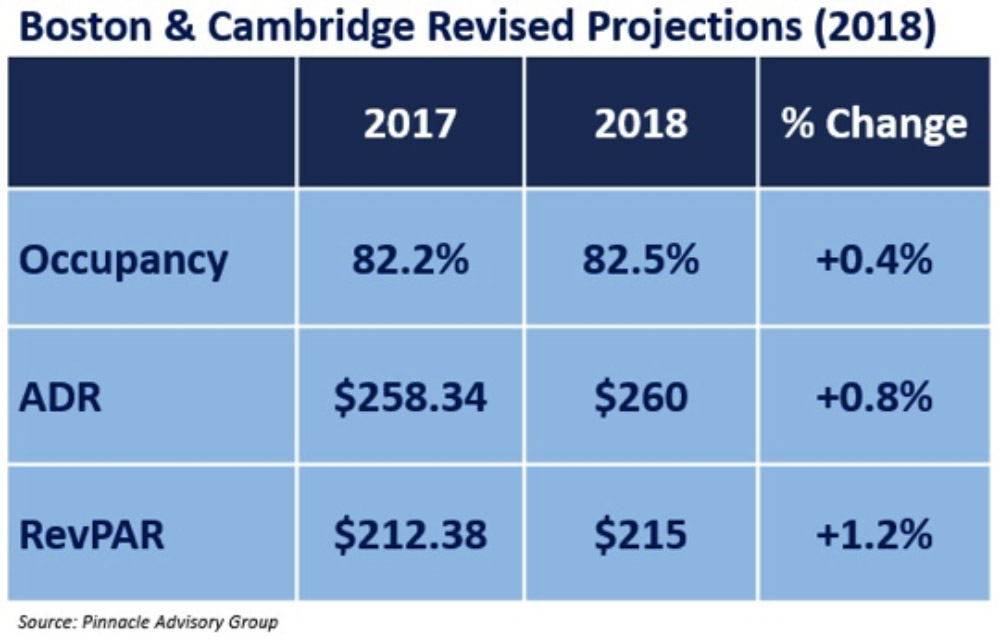

Pinnacle had originally projected the market’s RevPAR to decline 0.5% for calendar year 2018. As a result of the delays in expected hotel openings, above average increases in demand combined with the dramatic shift in market rate growth the last three months, revised projections indicate a RevPAR growth of 1.2% in 2018 (see Chart 2).

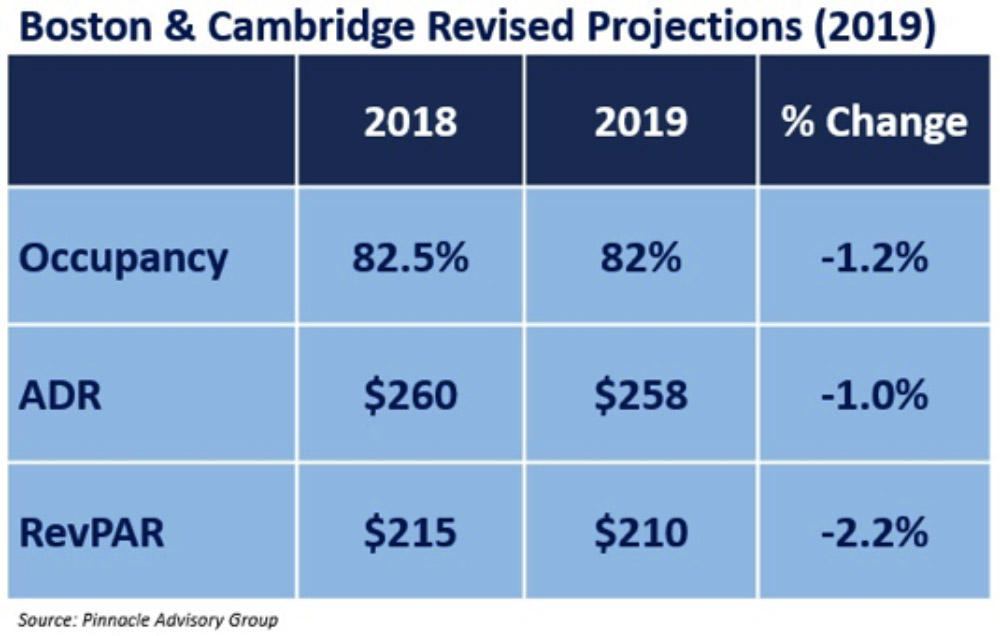

As a result of these positive shifts, Pinnacle has revised projections for 2019. Continued growth in demand of approximately 3.7% is forecasted, however it will not keep pace with supply which is expected to increase over 5%. As a result, occupancy is projected to decline to 82% in 2019 while ADR is projected to decrease 1.0%. Pinnacle is projecting a negative RevPAR in 2019, the first decline since 2016 when the market experienced a similar increase to supply. With the convention calendar indicating a decline of approximately 24% in room nights (only three months with growth over 2018) and two less citywide events, there will be a lack of base demand to drive rate growth seen in previous years (see Chart 3).

Pinnacle Advisory Group’s projections for the Boston and Cambridge lodging market are presented to the Massachusetts Lodging Association annually. The updated presentation can be viewed online at https://pinnacle-advisory.com/.

Sebastian Colella is a vice president with Pinnacle Advisory Group’s Boston office, completing assignments in urban and suburban markets throughout the country with primary responsibilities covering the firm’s work in Boston and Cambridge.

Colella holds a bachelor of science degree from the School of Hotel Administration at Cornell University with industry experience in hotels, resorts, and private clubs.