NorthMarq Capital

For borrowers seeking commercial real estate debt, 2018 kicked off with plenty of positive news. The passage of a major tax reform package at the end of 2017 was generally viewed as good for the industry. There were far fewer regulatory headwinds on the horizon, and there was still plenty of capital available from both traditional sources as well as a growing number of non-traditional sources. But what about interest rates?

Rising Interest Rates

Lenders continue to compress spreads as more capital competes for what seems to be a smaller pool of transactions in 2018. Unfortunately, borrowers are still seeing their cost of capital rising as spread compression has been unable to completely offset rising interest rates. The yield on the 10-year U.S. Treasury bond is up nearly 50 basis points since the start of the year and nearly 100 basis points since its 52-week low of 2.02% in early September 2017. However, the yield curve remains relatively flat with only 80 basis points separating the bond yields on the two-year and 30-year U.S. Treasuries. Rising interest rates have had a particular impact on short-term borrowing. Ninety-day LIBOR is now at just under 2.25%, a level not seen since prior to the recession in 2008. Also, the Federal Reserve, under new chairman Jerome Powell, just completed the first of what could be four increases to the benchmark rate in 2018. Whether the Fed ends up making three rate increases or four in 2018, the benchmark overnight rate could end the year at either 2.25% or 2.50%. For comparison, the yield on the two-year U.S. Treasury bond currently sits at 2.30%.

Early Rate Locks Up to 12 Months

What can borrowers do? The first and most important strategy is to early rate lock. Many banks, life companies and even Fannie Mae and Freddie Mac can offer borrowers some ability to lock in their rates for 60 to 90 days and remove interest rate risk during the closing process. For those looking further out, several life companies can help borrowers target favorable closing dates by locking in rates up to 12 months forward. There is generally a modest premium added to lock in a rate for each month after the first 90 days; however, it can be well worth it in a rising rate environment.

Take Advantage of Prepayment Structures

Unlike residential mortgages, commercial loans generally come with some form of prepayment protection. Over time, lenders have gravitated towards what are referred to as “make whole” prepayment structures and borrowers have had to become familiar with terms such as Yield Maintenance, Defeasance and SWAP Breakage. The typical talking point passed along to inquiring borrowers was that higher future interest rates would eliminate their prepayment penalties. When short-term rates fell to the floor after the last recession, however, many borrowers were either trapped or had to make large payments if they wanted to pay off their loans early. With rising short-term rates and a generally flat yield curve, the pendulum has swung back to borrowers with “make whole” prepayment structures in their loans.

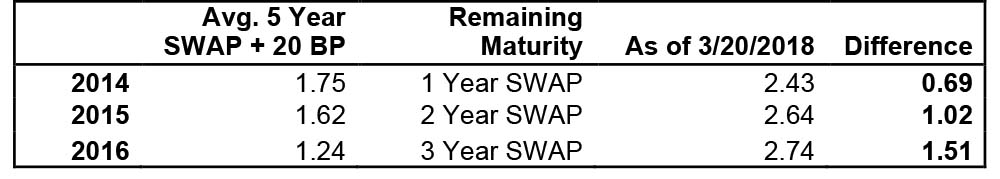

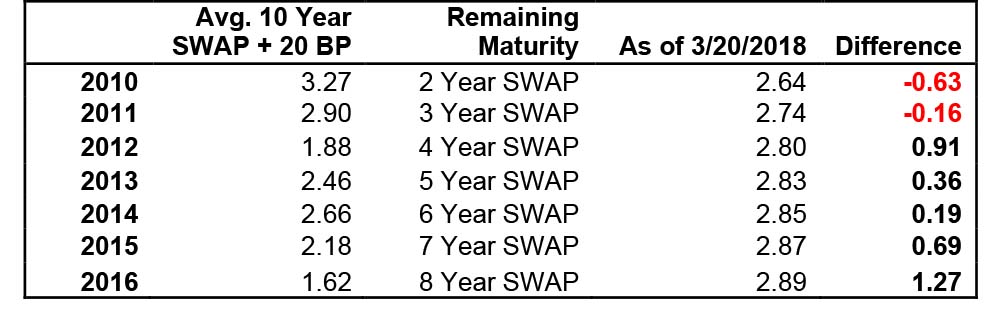

Since the end of the recession the use of SWAPS by banks has increased and allowed them to offer borrowers either lower rates or longer fixed-rate terms than what they could offer for on-book deals. Loans with SWAPS generally have a SWAP Breakage prepayment protection. The two charts below illustrate how today’s higher interest rates mean the SWAP breakage for many 5- and 10-year loans, particularly those originated since 2012, could currently be “in the money.” This means that instead of having a prepayment penalty, these loans could likely be paid off for less than the outstanding principal balance.

Similar scenarios may be possible for borrowers who have loans with defeasance prepayment structures or who took out caps to hedge floating rate loans.

While it is unlikely to make financial sense for borrowers to refinance their loans purely for rate considerations, those looking to pull out trapped equity or sell their property may finally be able to take advantage of favorable prepayment structures. Borrowers can even combine strategies by forward rate locking their new loan for up to 12 months while allowing interest rates to rise, making the payoff of their current loan even more advantageous.

Interest rates may be rising, but the market for commercial real estate loans remains positive for borrowers. Long-term borrowers can take advantage of a relatively flat yield curve, while being able to target future funding dates up to 12 months out and possibly benefiting from “make whole” prepayment structures that have finally become favorable for borrowers.

Michael Chase, senior vice president, NorthMarq Capital, Boston, Mass.