The Boulos Co.

For the first time in 10 years, the Greater Portland office market vacancy rate increased after steadily declining year after year. The Boulos Company conducted its annual survey of over 12 million s/f in almost 350 Class A and Class B office buildings across seven submarkets. The 2019 overall vacancy rate, including sublease space, increased to 6.66%. While still well below the height of the recession, this is a dramatic increase from 4.61% in 2017 and 4.18% in 2018. The increase is primarily due to activity in the suburban market as vacancy rates in all five of its submarkets increased in 2019. Due to the relatively small market size, this significant increase is mainly due to just a few buildings and speaks to the demand being unable to keep pace with new vacancies.

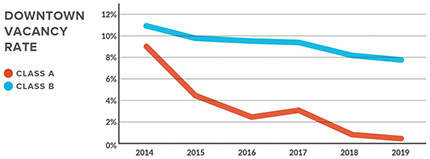

Downtown

The only submarket that continued to improve is downtown Portland. Vacancy rates for both Class A and Class B buildings fell slightly to 4.18%, with a total of less than 10,000 s/f of Class A space available across 25 buildings. With a vacancy rate of just 0.4%, this is the tightest Class A market since 2001, down from 1.04% in 2018. Supply in the downtown towers continues to be a significant issue in Portland, which has sparked new construction over the last couple of years and is even causing some longtime downtown tenants to seek space in the suburban markets. Class B properties fell for the fifth consecutive year to 7.72%, down from 8.59% in 2018. Unlike 2018, this decrease in vacancy was a result of numerous smaller deals under 5,000 s/f, rather than one large transaction or conversion to residential. Downtown tenants seeking higher-end Class B product have very few options with less than one-third of the availabilities located in recently renovated or modern buildings. Once again, there was a lack of substantial urban transactions due to a limited number of large availabilities. SMRT Architects and Engineers signed a lease for 18,559 s/f at 75 Washington Ave. In late 2019, Certify, which occupies multiple smaller spaces throughout the city, leased 38,072 s/f at 21-39 Commercial St. The largest lease signed on Portland’s peninsula in 2019 was Sun Life U.S., which leased 77,000 s/f in a to-be-built office building at the Portland Foreside development, continuing the downtown building boom. While this building will not break ground until 2021, this will mainly impact the suburban market as Sun Life will vacate its two locations near the Maine Mall.

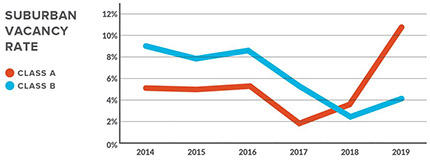

Suburbs

Vacancies in all five suburban submarkets increased in 2019. The direct vacancy rate for these submarkets, which includes suburban Portland, South Portland/Scarborough, Maine Mall area, Westbrook, and the Falmouth/Cumberland/Yarmouth areas, increased sharply from 3.76% in 2018 up to 8.75% in 2019. This is the highest vacancy rate since 2012 as the suburban market is starting to experience the effects of new construction coupled with a substantial consolidation. These are the principal culprits for the spike in vacancy over the last 12 months. The limited number of large transactions in the suburban market did not provide enough absorption to counteract UNUM consolidating into two of their three buildings on outer Congress St. in Portland, resulting in a 200,000 s/f vacancy. Though, to be fair, this will be a short term vacancy as the building is recently vacated, under construction, and significant portions of the building are under contract. In addition, WEX completed its move in early 2019 from the Maine Mall area to a new building in downtown Portland resulting in 72,000 s/f of vacancy in the suburban market. These two vacancies represented almost 80% of the added square footage in 2019. The only significant new lease in the suburban market was Stantec, which relocated from 482 Payne Rd. to 20,820 s/f at 2211 Congress St. (the previously mentioned UNUM building). Stantec downsized by approximately 18,000 s/f in this planned relocation.

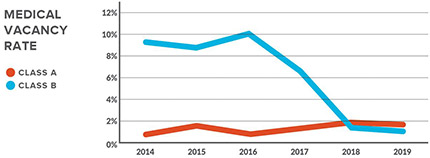

Medical

The medical office market vacancy rate throughout Greater Portland steadily declined over the last six years, and that was no different in 2019 as the vacancy rate dropped slightly from 1.82% in 2018 to 1.42% in 2019 for both Class A and Class B medical buildings. There are limited availabilities throughout the market, with only three small vacancies across 56 medical buildings throughout Greater Portland. Medical office tenants must renovate existing office space, which, with current construction costs, is extremely difficult and expensive. Like the downtown Class A market, many medical tenants are contemplating new construction despite the high costs associated with ground-up development.

Office Market Forecast for 2020

The 2019 numbers show a possible shift in the overall market moving into 2020, and this should continue for the next 12-24 months. New office buildings that are currently under construction, such as the 172,000 s/f Covetrus building downtown as well as Certify’s consolidation and relocation, are creating a spike in the amount of “shadow space” downtown—space currently occupied by tenants who have signed a lease elsewhere and will be moving out, in this case, sometime in 2020. These moves should create an increase in the downtown Class A and Class B vacancy rates, which will provide a much-needed supply of larger office suites downtown and put an end to the extremely tight submarket. The suburban market shouldn’t experience another increase as it did in 2019, pending any surprises, and even a possible decrease based on what we know moving into the New Year. Larger options in the suburban market are creating opportunities for companies seeking over 20,000 s/f, and unlike 2019 there will likely be a few substantial transactions to report next year.

Nate Stevens is a partner, broker with The Boulos Co., Portland, ME.