Many investors realize they need to invest a portion of their investments into the stock market. After all the stock market and the companies that make up the stock market have historically been a very good investment. According to historical records, the average annual return for the S&P 500 (1) since its inception in 1928 through 2014 is approximately 10% (2). This total return consists of income in the way of dividends and growth of the investment.

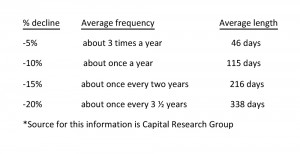

To help achieve this long term return investors have to stay the course during the inevitable declines in the stock market. I think if investors can expect these temporary declines as part of the normal investing process then they will be better able to stay invested. Unfortunately the research (3) shows the average investor has a much lower return than the historical average since they tend to sell at the very time prices are getting cheaper…when the news is bad. As an investor, you may expect the declines in the stock market as shown in Chart 1.

The above declines are the historical declines in the Dow Jones Industrial Average (4) since 1900. In some years the declines can be significant. From March 2000 to October 2002 the S&P 500 (a similar measure of stock market performance) declined 49% and from October 2007 to March 2009 the decline was 57%. Even with these unusually large declines the investor who stayed the course had positive returns over a 15 year time frame (5).

One of the best ways to stay fully invested during these declines is to have the appropriate amount of stocks based on your specific situation. For example, if you are retired you may only want to have 50% on the stock side due to the

volatility. You could diversify the other 50% with treasury bonds, high yield bonds, investment grade bonds, global bonds, immediate income annuities and cash (6). These investments tend to provide steady income and may hold up better or potentially even rise in value during stock market declines. A younger retirement investor may want to have a higher allocation in stocks since they usually will not be using the funds for years and they – and the dividends - can continue to add to stock funds as they are declining in price…buying lower priced shares.

Once an investor can be prepared as to what to expect in terms of declines, he or she can then decide how much or how little to allocate to stocks. As you can see, the long term returns of the S&P 500 Index are very good, yet the short term fluctuations can make it very very difficult to stay the course. As an investor, if you can expect these declines as a normal part of the investing process, you will be more likely to stay invested long-term. If you are among the few individuals who can buy in times like this, you may have a higher probability of outperforming the market averages.

Brian Hill, ChFC, CFS, is a financial advisor at Capital Analysts of New England, Inc., Quincy, Mass

Advisory services offered through Capital Analysts or Lincoln Investment, Registered Investment Advisors - Securities offered through Lincoln Investment Broker/Dealer, Member FINRA/SIPC - www.lincolninvestment.com - Capital Analysts of New England and the above firms are independent non-affiliated entities.

1. 500 of the largest exchange traded stocks in the US from a broad range of industries whose collective performance mirrors the overall stock market.

2. Source- Investopedia; “What is the Average Return of the S&P 500? By JP Maverick

3. US New and World Report: “Are you Guilty of these Mistakes?” By Aleks Todorova 4/28/2015

4. The Dow Jones Industrial Average is a widely watched index of 30 US Stock thought to represent the pulse of the American economy and markets. Investors cannot invest in an index. Past performance is no guarantee of future results. There can be no guarantee that any particular yield or return will be achieved from any investment. Please note that volatility including fluctuating prices and the uncertainty of rates of return inherent in investing in stocks and bonds over extended periods of time will affect the actual return received. In general, the bond market is volatile, and fixed income securities carry interest rate risk. (AS interest rates rise, bond prices usually fall, and vice versa. The effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Any fixed-income security sold or redeemed prior to maturity may be subject to loss. International l investing involves special risks, including, but not limited to, the possibility of substantial volatility due to currency fluctuation and political uncertainties.

5. T. Rowe Price: “Staying the Course” Summer 2015

6. In general, the bond market is volatile, and fixed income securities carry interest rate risk. (AS interest rates rise, bond prices usually fall, and vice versa. The effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Any fixed-income security sold or redeemed prior to maturity may be subject to loss. International l investing involves special risks, including, but not limited to, the possibility of substantial volatility due to currency fluctuation and political uncertainties. In reference to general account obligations and guarantees, such as is present with fixed annuities, the ability for the insurance company to meet these obligations to policyholders are subject to sufficient capital, liquidity, cash flow and other resources of the insurance company.