Each year at the beginning of January of that year, CBRE-New England presents its Boston Market Forecast. This year the forecast was presented on January 5, 2015 at the Intercontinental Hotel in Downtown with 600± people in attendance.

As a preview of what I report in this article, it is important to understand that the Boston market's performance has run counter to traditional techniques for projecting supply and demand. Theoretical economist projections based on past employment trends have been proven to be wrong!

Economists have been replaced by Market Makers. I will briefly highlight the views of these people who are driving the great growth we are seeing in Boston.

City of Boston Office Market

The city of Boston office market is absolutely exploding. 1.72 million s/f of office space was absorbed in 2014, 35% more than in 2013, and 50% more than in 2012.

What statistics do not show is that Boston as a city has $110 billion in total assessed value for all its properties; $4 billion in new construction breaking ground, 4,500 current job openings and 44 tech IPO's in the pipeline. 50% of total absorption in 2014 was urban migration from the suburbs. As of the start of 2015, there are 222,000 s/f of tenants in the market for downtown space alone.

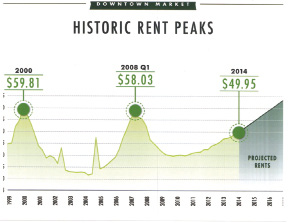

Rent spikes are happening. Downtown Crossing has seen rent at 38 Chauncy go from the high 20's to low-mid 40's per s/f, 500 Washington has moved from the mid 30's to mid 40's per s/f, 101 Arch has moved from the high 30's to high 40's per s/f. CBRE is projecting rents by 2016 to pass 2000 and 2007 peaks.

Cambridge Office/Lab Market

In a 22.5 million s/f market, there are 4.5 million s/f of active tenants in the market. To place in focus, it took 50± years to reach 22.5 million s/f. The city is poised for a 20% growth in demand in one year!

The biggest growth is an entirely new product, the LaBOFFICE. This is a hybrid product with labs inserted into office product. In 2014 there were over 550,000 s/f of LaBOFFICE created.

Relief values are clearly needed as not all tenants can afford the large spike in rents taking place. In East Cambridge for office space, average asking rent is $62.84 per s/f, higher than Downtown Boston.

The Suburban Office Market

There are cranes in the sky in Waltham! What has triggered this event? The answer has multiple parts. It is basic economics. People create value. New multi-housing is under construction. Transportation plans are in place by the 128 Business Council to relieve traffic congestion. Retail is coming alive with 1265 Main in Waltham, University Station in Westwood, and 3rd Ave. in Burlington to mention just a few.

What is happening is that urban is being put back into suburban with major redevelopment by Boston Properties at Bay Colony, the Davis Cos. at the Center at Corporate Drive and Anchor Line Partners at Cross Point. For post 1999 construction, capital investment back into these properties has driven rents up to $25.10 per s/f and vacancy down to 8% in this quality product.

The Multi-Family Market

The multi-family market tells what Boston is all about. Boston has the highest labor force growth (2.8%,) second highest unemployment rate (4.7%), second highest multi-family rent growth (3.4%) and third lowest vacancy (3.7%) of any major city in the United States.

A lot of cranes in the sky in Downtown have caused warnings of overbuilding but look at what our development pipeline study shows in Chart 1.

When placed in perspective of what is going on in Boston as a whole, the units are needed to support the expansive growth taking place. Cap rates have been driven to record lows at 4.1% - 4.5% for urban product and 4.6% - 5.7% in the suburbs. The condo market in Downtown is priced at $1,000 - $1,466 per s/f for typical condominiums with over $2,000 per s/f in special product like the Four Seasons and Mandarin.

Conclusion

The only thing I can say is hold onto your hats. While we all know this market will not last forever, the Federal Reserve's interest rate policy and Boston's vibrant educational base has spawned new companies with a voracious addiction for space in which to live-work-play. The factors outlined in this article are recognized worldwide. The global economy in place is what is making Boston into the city it is today. Traditional economic projections have been set aside. International investors think very long term and are driving this market by investing in Boston.

Webster Collins, MAI, CRE, FRICS is an executive vice president and partner in CBRE's Valuation and Advisory Group, Boston.

Tags:

CBRE's 2015 Boston Market Forecast: Office, lab, suburban office and multi-family markets

January 29, 2015 - Spotlights