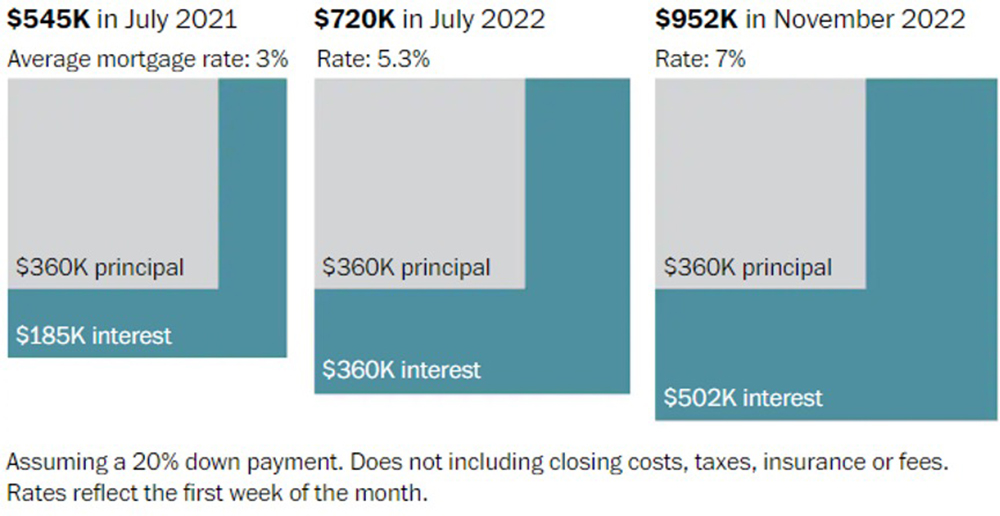

What a whirlwind 2022 has been for both real estate and equity markets. On the side of residential real estate, we have seen not only the highest prices paid for homes, but perhaps the highest rate of price appreciation seen in decades. (at least for the first few months of the year). The market today is not looking as rosy as the Federal Reserve has contributed to putting the brakes on this market, (so to speak). The precipitous increase in mortgage rates has changed the landscape for would-be buyers, making many a potential purchase not affordable at this time. According to Freddie Mac, mortgages peaked at 7% in early November, nearly twice what they were the year before. An example of how the landscape has changed, assuming a 30-year fixed mortgage for a $450,000 house would cost, Chart 1 shows that the higher mortgage rates translate into playing hundreds of dollars more each month to borrow the same amount of money.

Other Factors in the Real Estate Market: The highest prices on record for building materials, everything from plywood and wood products to toilet seats has put a crimp in would-be buyers and renovators who want to renovate an existing home, or perhaps have a new home built.

Lumber prices peaked in April of this year and are slowly coming down, but not to the levels of pre-COVID-19 prices. Tracking the lumber market via the Producer Price Index (PPI) revealed a decline of 1.49% for lumber and wood products over the past year (October of 2021 to October of 2022). The decline in the PPI is not enough to have a material impact and make building and renovating more feasible. Chart 2 shows the trajectory of the lumber market since the beginning of 2022.

What to Expect for Material Costs? One of the last times we had a spike in material costs was approximately 12 years ago, when petroleum prices were soaring. In fact, between February of 2009 and April of 2011 petroleum prices rose 180%! Price declines ensued between 2012 and 2014 where prices fell nearly 35%.1

When the price of petrol soared, it took the price of many materials along with it. Every building product imaginable including that of fiberglass roof shingles and plumbing equipment such as ABS & PVC piping, all increased dramatically in prices. The question I ask the reader, do you think the price of roof shingles went down when the price of fuel went down? No, of course not! Based upon the past trend in the cost of building materials, don’t expect any big price reductions in the price of materials.

Enough of the Bad News – Now Some Good News! On the positive front, some sectors of the real estate market have continued to benefit, despite the increases in material and borrowing costs. Light industrial, self-storage and flex spaces have seen record demand over the past three years. A poll of self-storage facilities along the shoreline in Eastern Connecticut revealed that occupancy rates increased from the low-to-mid 80% range to the mid-ninety percent range. Light industrial and flex spaces that are generally smaller, say 1,000 to 5,000 s/f have been gobbled up by small contractors and people in the service business. Rental rates for these kinds of spaces have increased substantially, with rental rates formerly being in the $7 to $10 per s/f range and now, the same spaces are leasing for $12 to $14 per s/f.

Residential Sector: The low inventory of homes for sale has propped up the market and should continue to be a stabilizing element, with bidding wars seeming to be a thing of the past.

Higher mortgage rates are certainly here for a little while and can make a potential purchase unaffordable but, lower adjustable rates are still an option, and as many homeowners have done in the past, many purchase their home with a lower adjustable-rate mortgage and then refinance at an affordable fixed rate a couple years down the line.

Time for a Change in Market Pricing – Residential & Equity Markets: Just as we have experienced in the past decade or two (or three), the prices of homes will fall, just as they did in 1990, when the banking industry was overhauled by Congress, in 2000 when the dot-com bubble burst and in 2008 when the financial industry melted down, taking with it several investment banks and major corporations. At the same time, equity markets experienced their biggest decline since the great depression.

A survey of home prices along the shoreline in Eastern Connecticut (the market I predominately work in) reveals that prices are falling. Equity markets have been trending down all year and are going through an adjustment process all their own.

Appraisal Services in this Changing Market

Whether we are talking about residential or commercial property, an appraisal professional can be of great help in navigating a potential purchase, sale, lease, a valuation for gifting or a property tax reassessment. Appraisal professionals can be located through the Connecticut Chapter of the Appraisal Institute or through Appraisal Institute Website at www.appraisalinstiture.org. There, one can utilize the “Find an Appraiser” tool and locate an appraiser and their valuation specialties in their area. To all, Happy Holidays and Merry Christmas! Have a Happy and Safe Holiday!

Marc Nadeau, SRA, is a certified general appraiser and president of the Connecticut Chapter of the Appraisal Institute.

1 U.S. Bureau of Labor Statistics