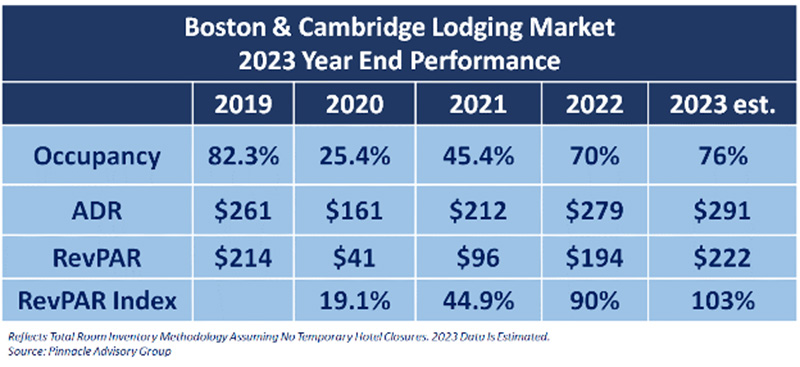

The Boston & Cambridge (“City”) lodging market recorded an occupancy of 45% in 2021, only 55% of its performance in 2019. Last year, occupancy increased to 70%, representing an 85% index to 2019. The City’s year-end 2023 occupancy is estimated to be 76%, a 92% index. It’s clear that lodging demand continues to gain strength. More importantly, if we account for actual demand, by the end 2023, the Boston market will accommodate 8% more room-nights than in 2022 and slightly more room nights as compared to 2019.

The City’s ADR has recovered from the pandemic at a faster pace than its occupancy, climbing to $291 in 2023, a 4.5% increase over 2022 and a 12% premium to 2019 levels. However, it’s worth noting that ADR improvements in 2023 have moderated throughout the year, while occupancy continued to climb month over month. For example, for the first 6 months of 2023, ADR increased an average of 11% for the same time period in 2022, as compared to 3.7% (est.) for the last 6 months of 2023.

The market’s revenue per available room (RevPAR) in 2022 and 2023 was at 90% and 103%(est.), respectively, index relative to its RevPAR in 2019. By comparison, the U.S. lodging market’s RevPAR in 2022 and 2023 was 107% and 112% (est.) when indexed to 2019. While still below the recovery of the entire U.S. lodging market, the city continues its upward trend. The expectation is that 2024 will feel more like 2019 in terms of overall travel in the Boston market.

Presented in Chart 1 is our 2023 forecast for the Boston/Cambridge lodging market compared to the annual performance pre-COVID (2019).

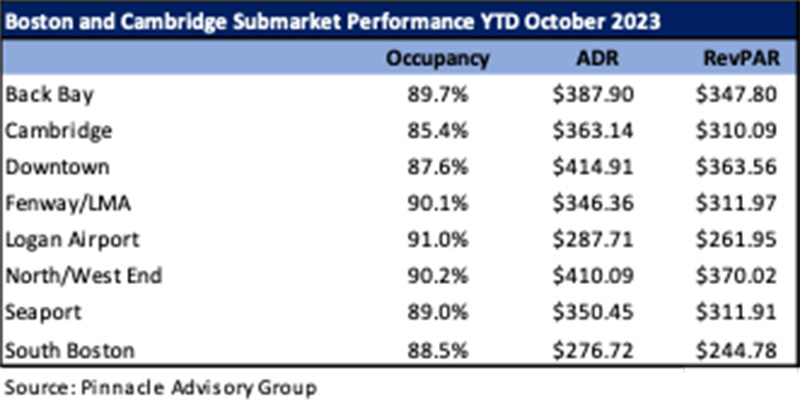

Pinnacle Advisory Group tracks market statistics by submarkets. Presented in Chart 2 is a table showing the October YTD 2023 occupancy, room rate, and RevPAR by submarket.

For the first 10 months of 2023, both occupancy and ADR in all submarkets have shown strong growth over 2022. Occupancy for the Boston/Cambridge market increased from 71% in 2022 to 78% for October YTD 2023. The Logan (airport) and Fenway/LMA submarkets continue to lead in occupancy. The higher occupancy at the airport corresponds to the significant improvement in air traffic at Logan. The Fenway submarket benefits from the strength of the City’s medical industry. While Cambridge occupancy increased 9% this year, this submarket recorded the lowest submarket occupancy. University demand is strong, but lab space and associated biotech industry is still recovering.

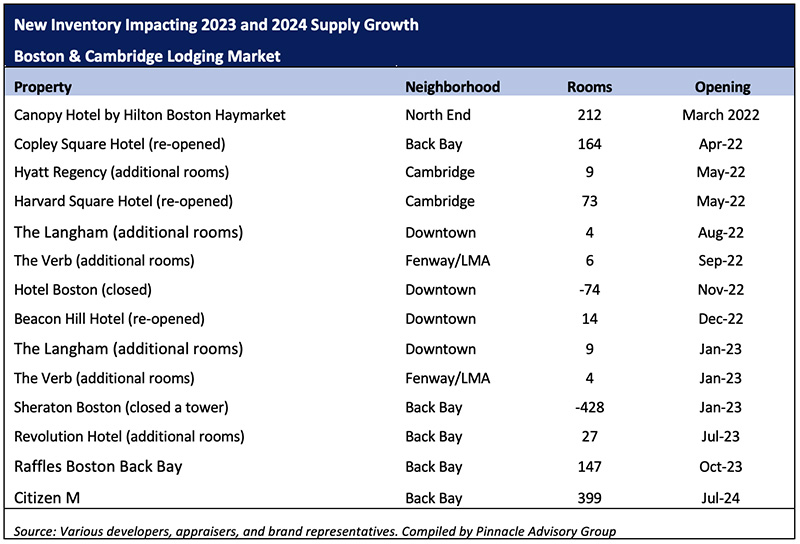

New Supply: Between 2015 and 2022, the lodging supply in Boston/Cambridge increased 3%, compounded annually. Even with strong supply growth, and without taking into consideration market occupancy in 2020 and 2021, the City’s occupancy averaged 80% exemplifying the strength of the lodging market. New supply growth for 2023 and 2024 will be minimal. In 2023 supply will decline 1.1%; in 2024 it will increase 1.1%. The lack of new supply will continue to aid in the recovery of the market from the impact that the pandemic had on travel. (see Chart 3)

2024 – Momentum Continues

Here’s our perspective on the City’s lodging market for 2024:

• Convention and Group Demand – This segment of demand comprises approximately 23% of total demand in the City. According to Signature Boston, the Boston Convention and Exhibition Center will generate approximately 500,000 room nights in 2024, which will be a record year for this venue. However, the Hynes Convention Center may only generate around 120,000 room nights, potentially only ½ of the room nights generated in 2023. This anticipated poor performance is due to the combination of a stop-sell order that was in place for 5 years, coupled with extensive, on-going renovation plans which will keep this Center dark during certain periods of the year.

• Corporate Transient Demand - We believe that corporate transient demand will continue its slow and steady recovery from the pandemic, based on our research into local demand trends. The local office brokerage community believes that moderately increasing demand for office space in the city provides a reason for cautious optimism for 2024, although nearly 1.5 million s/f of occupancy losses in Q3 2023 drove vacancy rates to 20-year highs. However, although employment in traditional office jobs increased over the last twelve months across all sectors in Greater Boston, we don’t yet know what specific companies will do in 2024 as it relates to their in-office attendance policies and/or their travel budgets.

• Leisure Demand - Leisure demand is softening as the pent-up travel demand that resulted from the pandemic has waned, and as leisure travelers opt to visit new locations or travel abroad. We believe that 2022/2023 was the time frame when leisure demand peaked in the City following the recovery from the pandemic.

• Average Daily Room Rate (ADR) - We know that the pace of room-rate growth is slowing as compared to the significant ADR rate growth experienced in 2021 (up 32% from prior year), 2022 (up 31% from prior year) and 2023 (up an estimated 4.5% from 2022). For example, for the five months of 2023, ADR increased an average of 12.7% over 2022, while during the five-month period of July through October of 2023, the ADR increased 3.7% compared to the same five months of 2022.

• New Supply – We know that new supply growth in Boston/Cambridge will remain low in 2024 with supply increasing 1% over 2023; and that in 2023 the city’s supply of hotel rooms declined from 2022.

Of course, no one can be 100% certain of all the factors that will influence the Boston lodging market’s ultimate performance. Providing projections is a risky business.

Risks – A number of national and global issues will impact the lodging market, including the local Boston market. Examples of issues that present risk to the 2024 projections include rising global geopolitical concerns, inflation, a persistent skittish economic environment, challenging consumer confidence, labor shortages, and continued supply chain constraints.

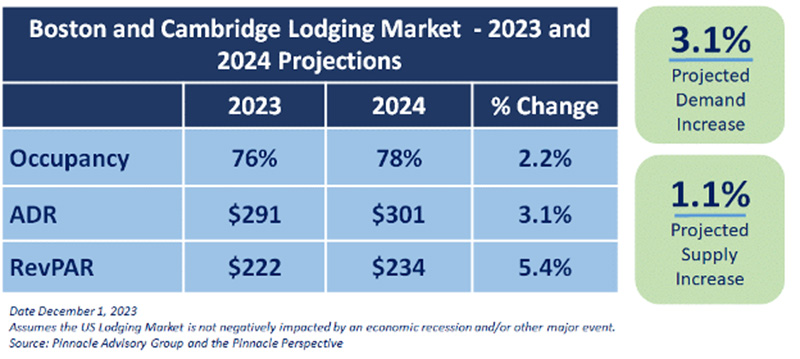

With these factors in mind, Pinnacle believes that demand will improve in the Boston/Cambridge lodging market, and room rates will increase. Our expectations for demand growth, coupled with limited new supply in 2024, results in a projection of 78% for year end 2024 occupancy.

Presented in Chart 4 is Pinnacle’s 2024 forecast for Boston/Cambridge:

There is much to be optimistic about as we move into 2024 although the hospitality industry has become accustomed to surprises. In addition to projections that have risk, local hotel owners and operators will continue to operate in a challenging labor market which has created wage pressures and increased operating costs. Nevertheless, all signs point to a healthier lodging market in 2024.

Rachel Roginsky, ISHC, is the owner and founder of Pinnacle Advisory Group. She is based in the firm’s Boston office. Roginsky has more than 40 years of experience in hospitality consulting. Roginsky is an appointed board member of The Cornell Center for Real Estate and Finance (CREF) and is the current chair for Boston University School of Hospitality Administration’s Real Estate Advisory Council (REAC). She also serves as a board member to numerous hospitality-related organizations and societies and is a regular guest lecturer at prestigious institutes of higher education. Additionally, Roginsky is an adjunct professor at Boston University. She is widely published and quoted and is the co-editor and author for Hotel Investments: Issues and Perspectives, a well-regarded book (5 editions) published by the Educational Institute of the American Hotel and Lodging Institute.