An incredible year for the Boston commercial real estate market - by Webster Collins

When I called CBRE’s New England research director to ask about events that I could “Zoom into” to gather data for a 2022 kick-off story, I was told that we would receive the following market summaries:

• Downtown Boston office market rebounds in Q4

• Cambridge office ends 2021 better than it began

• Suburban office gaining momentum

• Boston industrial market surges to record-breaking highs… again

• Lab market finishes 2021 with record high rents, record low vacancies

This article summarizes CBRE’s findings.

Downtown Boston Office Market

Downtown Boston Office Market

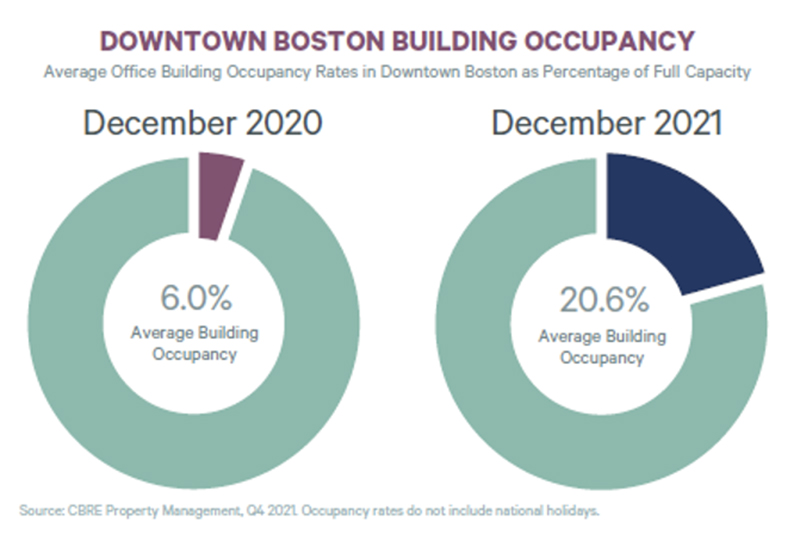

CBRE highlighted the remote “work from home” issues and their impact in the market in Q1 2021. Over the year, occupancies dramatically increased.

Office space usage is three times that of a year ago. The Boston office market has reported the second consecutive growth quarter since 2019 with 426,000 s/f of office absorption. The trend reported last year of large office tenants (occupiers over 20,000 s/f) moving into newer space has continued. 79% of these tenants have relocated to new Class A buildings with Class B buildings being left behind.

At the same time, looking at 2022, uncertainty looms over the downtown office market, in particular, Class B space.

The Seaport, with 280,000 s/f of Q4 2021 office absorption, continues to be a magnet and represents 66% of downtown quarterly absorption. The city ended the year with a 10.9% vacancy rate which is still a lot of space – over 9,000,000 s/f.

Cambridge Office Market

Cambridge office vacancy, at 5.2%, is half that of Boston and with 509,141 s/f of positive absorption, is close to Boston’s 621,285 s/f. Office rents are at record highs with an average of $85.83 per s/f (gross).

Major corporate leases have been signed. Facebook has leased 290,000 s/f with a 267,000 s/f sublease at 50 Binney St. and a 22,400 s/f direct deal at 100 Binney St.

40 Thorndike has come back to life with Leggat McCall Properties and Granite Properties joint-venturing with CBRE Investment Management to finance and fully redevelop its 422,000 s/f tower with delivery planned for mid-to-late 2023.

This is a strong indicator that once concerns of the pandemic are contained, companies and employees will feel comfortable making a return to the office.

Suburban Office Market

The suburban office market, which was hard hit during the first two quarters of 2021 with negative 617,077 s/f absorption, rallied during Q4 2021 with positive absorption of 305,061 s/f.

While leasing activity paints a picture of recovery, the sublease market shows little. Clarks’ 120,000 s/f building is a prime example of sublease space being pulled back in the market, although sublease rates have stayed consistent throughout the year.

With the shrinking of office space demand, many owners are investigating the option of converting their office buildings to life science use. The process is far from automatic due to the high ceiling requirements (16’-17’), mechanical systems, and hospital finish equivalent costs eliminating many properties.

In terms of market rents, the suburban market office average rent is $25.42 per s/f (gross), 36% below the city of Boston and 30% less than the city of Cambridge. This rent spread has propelled momentum in the suburban market.

The Boston Industrial Market

The current level of industrial demand for robotics manufacturers, biomanufacturers, logistics, wholesalers, retailers, and transportation use have driven vacancy rates to record lows and asking rents to record highs. Vacancy rates are 1.5% and average asking rents are $12.55 per s/f, NNN.

Industrial absorption for Q4 2021 totaled 7,547,590 s/f, a record high for any single year.

The current level of industrial demand will exceed supply for the next 18 to 24 months. The speculative development pipeline of space totals only 2.9 million s/f, due to significant barriers to entry and a lack of developable industrial land.

The Boston market, which at one time was classified as Tier II, has shifted to the top in terms of its classification. The quality of property overrides all issues. Junky old buildings with low ceiling heights and obsolete designs do not fit into this framework.

The Greater Boston industrial market now has top tier fundamentals with worldwide capital seeking properties in this market.

The Lab Market

Since its start-up years, pre-2000, the lab market has developed into the top sector within Greater Boston.

The lab market is location-centric. Kendall Sq., Harvard/Allston, the Seaport/Fort Point Channel continue to shine. There is a steep drop in second-tier locations driven by venture capital money that will only be placed in locations with the highest potential and lowest risk. Somerville has been added to the list of key locations.

There is 11,300,000 s/f of space under construction. Leasing is setting record highs, driven largely by venture capital.

Conclusion

These are extraordinary times in a city that is rebounding from the pandemic faster than any other within its competitive set. Boston is one of the best places in which to live, play and work. I have not missed a day out of the office which is my library of information to properly represent my growing list of clients.

Webster Collins, MAI, CRE, FRICS is an executive vice president within the Valuation and Advisory Services Leadership Team at CBRE, Boston, Mass.

Check out the New England Real Estate Journal's 2025 Fall Preview Spotlight

Explore our Fall Preview Spotlight, featuring exclusive Q&As with leading commercial real estate professionals and in-depth byline articles on today’s most relevant market topics. Gain insight into the trends, challenges, and opportunities shaping New England’s commercial real estate landscape this fall.

30 years on South Coast Rail: A journey to connect Southeastern Mass. with commuter rail - by Rick Carey

Shallow-bay wins on 495/128: A renewal-driven market with a thin pipeline - by Nate Nickerson

How long should I hold a property for it to qualify as an investment property in connection with a 1031 tax-deferred exchange? - by Brendan Greene and Mark McCue

.png)