Market bounces are truly rare. They occurred once in the 1980', once in the late 1990s, and now Q3 2011.

Market bounces start at very low points. They typically follow long periods of negative absorption and then in one sharp, sudden move, they spike up. In the past two such instances, they have been across broad market lines. They have included most of the 12 to 14 sectors that make up CBD, Cambridge and metro's north, west and south, outside of Boston's urban core.

Their market life varies. In 1999 to 2000, the life span was short, interrupted by the dot com bubble burst. In the mid-1980s, they lasted for multiple years until 1987 due to a basic undersupply of space as caused by long-term employment growth.

What must be kept in mind is that in 1979, Boston's suburban office market had only 5 million s/f of space! By 1999, that number had grown to 88.255 million s/f and Q4 vacancy was 6.51%.

This article will start with the most astonishing market, industrial space, shift to office space and conclude with market observations.

Industrial Market Bounce

The industrial market has a history of negative absorption:

The Delta alone between 2010 and 9 months 2011 is 4,480,000 s/f which is huge. The absorption bounce occurred in 9 of the 11 industrial markets of Boston. Half of the absorption bounce was in Q3 alone. What caused it? Discussion with brokers indicates:

* A desire to upgrade to Class A industrial space.

* A significant number of out-of-market industrial expansion deals in Boston.

The Office Market Bounce

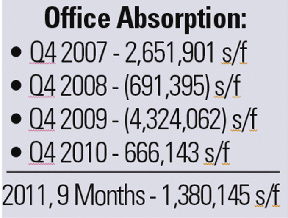

The office market bounce, while still there, is far more tepid:

The office market had followed predictions of a slow recovery in 2010 and did not bounce until 2011. If the Vertex deal of over 1 million s/f, in the works for 5 years, were excluded, the bounce would have been far less.What caused it? Discussion with brokers indicates:

*Significant build-to-suit construction.

* The uptick in the Cambridge lab market.

Conclusion

Why would these bounces occur at all under unemployment numbers in Greater Boston close to double historic averages? Please keep in mind the prediction by CBRE's Global Chief Economist of not gaining all jobs lost in the Greater Boston area since 2007 for another two to three years.

The answer is found in a chart not seen before:

Corporations, while not growing jobs, are investing in their businesses. This investment is having a direct one-on-one relationship to their real estate needs.

While we may not be able to trend-line this bounce, it is significant and adds breathing room for our economy.

Basic economics still show that we have considerable vacant space to lease. For every strong pocket like Back Bay, Cambridge, and parts of Route 128/95, there are market voids. There was negative absorption Q3 2010 in the suburban office Metro West and Metro South sectors.

Overall, the brightest spot has been the often overlooked industrial market. This market provides proof of the very important phenomenon taking place; out-of-market requirements providing a jump start.

Webster Collins, MAI, CRE, FRICS is executive vice president/partner with the valuation & advisory group of CB Richard Ellis, Boston.

Tags: