Are we in the midst of a "refi boom?" Well, that depends on how you look at it.

This summer, my appraiser colleagues were cheerfully reporting how busy they were. Appraisal requests were flowing in with seemingly no end in sight. This trend was a stark contrast to the slow pace of the past few years. Many appraisers had cut back due to the dramatic decline in mortgage related appraisal assignments. Some who used to have administrators and review appraisers are now functioning in solo-shops with limited to no support staff. Others left the profession entirely, even letting their licenses expire. Then came the Home Buyer Tax Credit, followed quickly by this summer's drastically reduced interest rates, attractive enough to bring even the most conservative of borrowers back to the table. Suddenly, for those who stuck with it, appraisal orders wer coming in rapid-fire and have yet to slow down. This is welcome news for appraisers and other professionals involved in the business of mortgage origination. But, will it last? Is this really a 'refi-boom' or does it just feel like one?

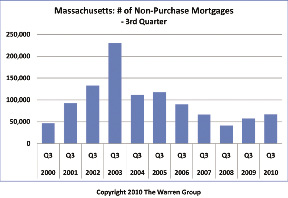

Let's look at the numbers and find out. According to The Warren Group, more non-purchase mortgages were recorded in Massachusetts in the third quarter of this year than any quarter since the second quarter of 2009 - the last time interest rates dropped. In Q3 2010 lenders originated over 66,000 MA non-purchase mortgages in Massachusetts. That's 16% more than Q3 2009, and 80% more than Q3 2008. With over 26,000 refinance and home equity loans recorded, September 2010 was the busiest September we've seen since 2006. However, year to date in 2010 there have been just 157,623 non-purchase mortgages recorded in the state. That's the lowest year to date figure in The Warren Group's database for the last ten years.

To put these figures in perspective, we must look at a larger data sample. By far, the peak year for mortgage activity in Massachusetts for the past 20 years was 2003 with an astonishing 845,570 mortgages recorded (purchase and non-purchase). 2003 was of course an anomaly. Loan originations that year more than doubled the state 20-year average. For the past two decades, the average number of mortgages originated annually in the state is roughly 378,000. Even with the increased activity of the past few months, it appears as though 2010 will fall 30% below the 20 year average for mortgage production.

What does the future hold? I don't have a crystal ball, but analysts seem to think that interest rates will remain low for the near term. If that is the case, then refinance activity could continue at this pace for a while. However, two key elements for real estate market stability are still missing: employment and sales activity. Sales transactions are 20% below the 20-year statewide average, and un-employment remains uncomfortably high. Let's hope 2011 brings marked improvement in both categories. In the meantime, get out there and make hay while the sun is shining!

Marie Wentling is the Director of Data Solutions for The Warren Group, Boston, Mass.

Tags:

.png)