Boston City Group, Inc. sells 198 unit development site for $4.6 million - sold to to Wood Partners

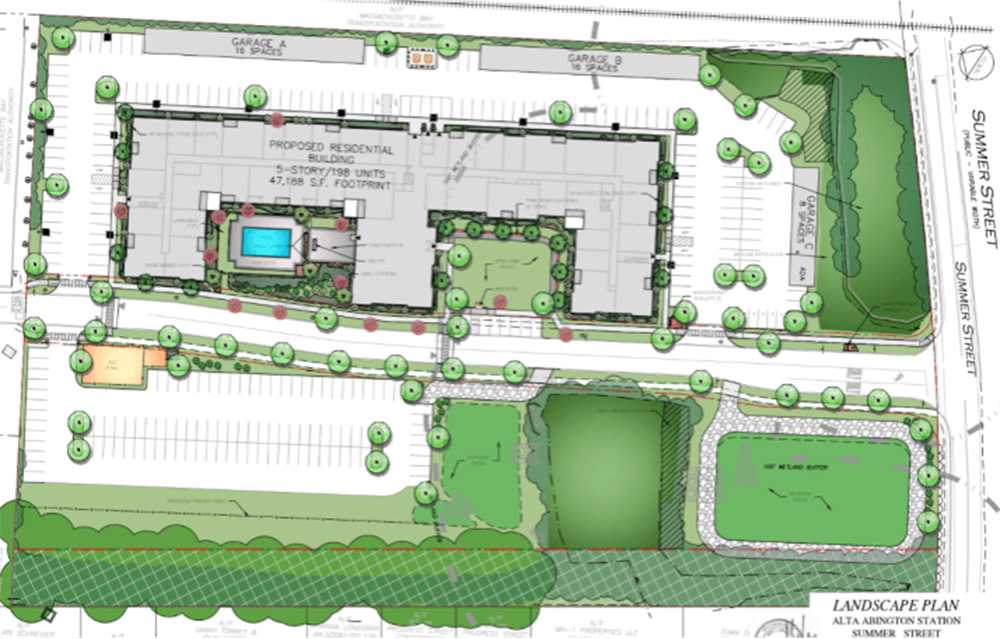

Abington, MA A nine-acre multifamily development site located at 0 Summer St., fully permitted for 198 units comprising 277,186 s/f, was sold to Wood Partners for $4.6 million.

Caroline Ligotti, Linda Redeker and Emily McGranaghan of Boston City Group, Inc. at Coldwell Banker Commercial, worked with the seller and procured the buyer.

Wood Partners, a leading national multifamily developer based in Atlanta, has established a strong and prolific presence in the Greater Boston market in the last 10 years.

The firm received final approvals from Abington ZBA and Conservation Commission earlier this year to construct a single five-story building to be named, Alta Abington Station.

A Transit-Oriented Development (TOD) strategically located adjacent to an MBTA Commuter Rail Station; the project is being built under Chapter 40B with 25% of the units designated as affordable.

Planned amenities include a swimming pool, fitness center, courtyard, and a dog park for residents.

This project is among the largest multifamily developments approved in Boston’s South Shore Rte. 3 Corridor in recent years.

Boston City Group, Inc. at Coldwell Banker Commercial, specializes in sourcing and brokering multi-family investments and development sites, commercial retail, office, industrial assets throughout Greater Boston and the New England, New York and Washington DC metro areas.

Life Time opens 60,000 s/f athletic club at BXP’s Prudential Center in the Back Bay

Connecticut’s Transfer Act will expire in 2026. What should property owners do now? - by Samuel Haydock

Tenant Estoppel certificates: Navigating risks, responses and leverage - by Laura Kaplan

New Quonset pier supports small businesses and economic growth - by Steven J. King

(1).png)

(1).png)