The economy in Boston and Cambridge is driven by a diverse set of growth engines which have provided it with a level of stability through multiple recessions. While the city remains reliant on its traditional industries such as financial services, education and healthcare, it has also become a hub for innovation, technology, and life sciences, all of which drive corporate travel throughout the calendar year. The city’s rich history, convention centers, amenities, and ease of access contribute to its ability to attract group and leisure travel. The Boston/Cambridge lodging market has now experienced six consecutive years of revenue per available room (RevPAR) growth with very few additions to supply since the most recent recession. As a result, the area has become one of the most sought after and desirable markets in the country for investment in both new projects and acquisitions.

Demand Outpacing Supply

The Boston/Cambridge lodging market supply is made up of 101 hotel properties combined for approximately 23,000 rooms. Similar to many markets throughout the country, the economic environment following the 2008/2009 recession led to very little growth in supply. Between 2010 and 2015, the market welcomed seven new hotel properties of approximately 801 rooms, of which over 70% opened in 2015. When accounting for minor room count changes and expansions, the local market’s room supply has increased 0.7% on a compound annual basis the last six years. During this same six year period, accommodated demand has increased year after year at a compound annual growth rate of 2.4%. (See Chart 1)

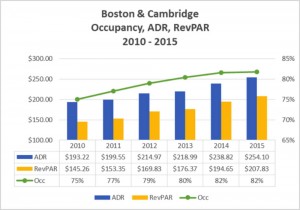

Driven by the city’s continued demand growth across all three primary demand segments, corporate, group and leisure, and its lack of new supply, operators have been able to increase rates considerably. In 2015, occupancy in the Boston and Cambridge market increased 0.2 points to 81.8% with average daily rate (ADR) increasing 6.4% to $254.10. The resulting RevPAR in 2015 increased 6.7% from the prior year to $207.83, a historic high for the market. (See Chart 2)

Future Changes to Supply

Historically, Boston has not seen significant increases to its supply in the form of a “boom” but rather small increases over time. This was primarily due to the area’s high labor costs, lack of available land, and an ADR that, in most cases could not justify the cost to build. Some of these factors still exist today however the recent growth across all demand segments has enabled developers to once again underwrite feasible projects.

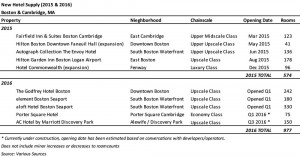

In 2015, new supply in Boston and Cambridge was limited to three new hotel properties and two guestroom expansions, combining for a total of 574 rooms. The Boston and Cambridge market is expected to welcome five new hotels (977 rooms) this year, a four% increase to existing supply. The market has not seen a one year increase this large since 2006 when the InterContinental and the Westin Waterfront opened adding 1,217 rooms. (See Chart 3)

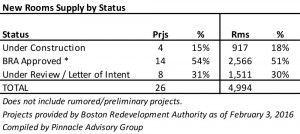

There are proposed hotels, both select-service and full-service, throughout the City with projected opening dates in 2017 and beyond, many of which cannot be confirmed as moving forward at this time. As of February 3, 2016 there were 26 hotel projects, representing approximately 5,000 rooms, in the Boston Redevelopment Authority’s (BRA) pipeline – this does not include the three hotels which have already opened this year. It is highliy unlikely that all of these hotel projects will move forward, however it is a good indication of the level of interest investors and developers have in the immediate area. (See Chart 4)

The lodging market, while volatile at times, is cyclical in nature. As evidenced by the Boston/Cambridge market’s historic peaks and valleys in both occupancy and rate over the last twenty years, the local area is of no exception. While it is difficult to predict a lodging market’s exact peak, one can apply the basic stages of a real estate cycle which would indicate the Greater Boston lodging market has been in the recovery stage since 2010 and has recently begun its expansionary stage as new hotels are approved, completed and opened. It is between this stage and the oversupply stage where investors benefit most from their property’s peak real estate value. Although we are forecasting a slight decline in market occupancy, oversupply is not expected to be an issue in the immediate future given trends in demand growth.

Looking Ahead

Statistics for the overall Boston and Cambridge lodging market are positive indicators for the City’s future prospects and illustrate the underlying strength of the broader market. Pinnacle Advisory Group has projected a seventh year of increased market demand in 2016 with the City projected to maintain an occupancy level above 80%. Current demand trends throughout Boston and Cambridge and the market’s capacity constraints through much of the year will allow operators to continue increasing average daily rates, which are projected to be, once again, the driver behind RevPAR growth in 2016.

Despite the risk of new supply, the positive fundamentals outlined above are expected to continue as the basis for underwriting new hotel projects and maintaining a high level of investor interest. Macroeconomic issues facing the nation’s economy today such as oil prices, the US Dollar, China’s recent economic slump, the spread of the Zika Virus among others, should be monitored as they may have an impact to lodging markets across the country. In spite of these uncertainties, long term prospects for the Boston and Cambridge market are encouraging.