Newmark Knight Frank

Greater Boston has undoubtably risen to global tech hub status in the last several years. World-class universities, a well-established startup scene and top-ranking hospitals and institutions are just a few of the driving forces behind this metro’s standing. Accordingly, high-tech employment accounts for 11% of total jobs across the metro area. Drilling down further, two of the market’s key economic engines — Boston and Cambridge — rise to the top of the list of hottest tech clusters. Let’s see how they stack up against each other.

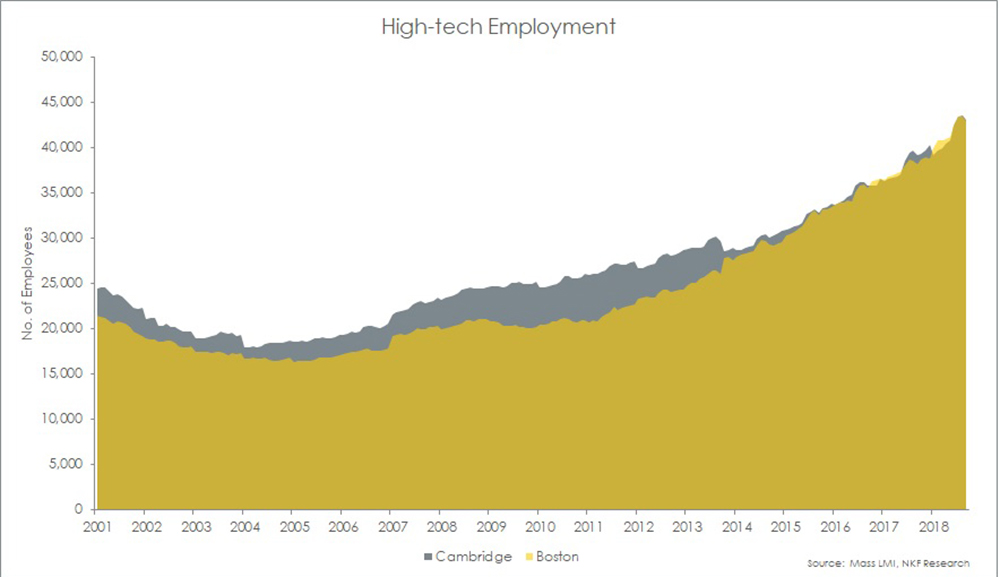

Given the city’s roots in higher-education and life sciences, it’s no surprise that Cambridge has traditionally ruled the roost in terms of high-tech jobs. From 2001-13, monthly high-tech employment averaged roughly 23,000 or 21% of total employment here. During this time, the number of jobs in Cambridge far outpaced those in neighboring Boston as well, with the delta reaching a peak in early 2011. The last five years proved to be a turning point for both markets, as growth in tech and biotech expanded exponentially. In Cambridge, high-tech employment increased by roughly 45% from 2013-18 and, with more than 43,000 jobs, now accounts for a third of total employment. While the life science and biotech sectors have been a catalyst for this growth, major tech firms like Facebook, IBM and Akamai have been expanding their presence in Cambridge as well.

While high-tech has done well in Cambridge, Boston’s story is even more compelling. Major employment nodes in the Financial District and the Back Bay have historically been anchored by traditional office-using industries like finance, legal services and insurance. However, market conditions have shifted over the last several years. Though banking and finance had been moving back-office operations to lower-cost locations for some time, right-sizing and efficiencies have since come to the forefront of real estate decision making. Simply put, these types of tenants needed fewer s/f per worker than in the past. Moreover, market fundamentals in Cambridge began heating up. As a result, price-sensitive tech companies and startups have been facing rapidly rising rents and shrinking availabilities for several years now. More space options, comparatively cheaper rents and a swath of developable land in the Seaport ignited tenant migration from Cambridge to Boston.

Vertex Pharmaceuticals’ relocation to Boston’s Seaport submarket in 2013 was among the most notable. This pivotal move allowed the biotech giant to consolidate its 1,300-employee operation from multiple Cambridge locations into two new buildings totaling 1.1 million s/f. From 2013-18, roughly 2.5 million s/f of tenants crossed the bridge into Boston. Amazon, Foundation Medicine, Sonos, Fuze and Cambridge Innovation Center represent just a few of the companies that joined Vertex. Coupled with homegrown tech growth, from companies like Wayfair, and in-migration from Suburban tenants like Autodesk and Continuum, high-tech employment expanded by 65% during this time. Employment levels are now on a par with those in Cambridge. See Chart 1.

Cambridge and innovation remain synonymous. That said, activity has been spreading throughout the metro area. With Boston being the largest benefactor, it’s not surprising that high-tech employment has expanded more rapidly here than in Cambridge. Looking ahead, expect growth in these industries to continue to drive the local economies and commercial market fundamentals in both cities.

Elizabeth Berthelette is research director at Newmark Knight Frank, Boston, Mass.