Background As is known by many in Boston, the Seaport District is the conversion of former rail yards, warehouse buildings, the former Boston Army Base, U.S. Navy Shipyard Annex and filled lands to create a new ‘city within a city.’ The cause of the redevelopment of this section of Boston was the infrastructure created by the completion of the Big Dig in 2005; this includes Seaport Blvd. and wide sidewalks, which opened up very large remnant parcels of land for development. What has happened these past 10 years is beyond anyone’s imagination.

Baseline Analysis The construction of the Boston Convention & Exhibition Center on Summer St. triggered new hotel construction, but the full extent was unclear. Construction of rental apartments started to take place and, clearly, the PricewaterhouseCoopers, Goodwin Procter and Vertex buildings were significant improvements and signs the Seaport was a viable option for major office users.

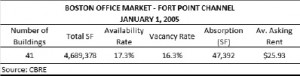

I went back to my appraisal on Fan Pier and what is now Seaport Sq. and looked at 2005-2006 projections. In 2005-2006 there was no Seaport District—the reference was the Fort Point Channel South Boston area. CBRE’s Fort Point Channel market statistics were as follows:

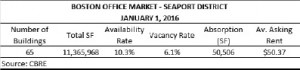

Boston Office Market -Seaport District

Boston Office Market -Seaport District2016 Space Inventory – Seaport District The inventory of space within this one square mile area includes five types of uses: apartments, condominiums, hotels, office buildings and retail.

In terms of new apartment construction, within Central City/Back Bay Boston from 2005-2015, 6,507 units were completed. Of that number, 1,896 units, or 29%, were within the Seaport District alone. An additional 2,246 units are in the construction phase as we speak.

In 2005 the number of new condominiums was close to zero; 1,154 units in 21 properties have since been or are nearing completion.

Boston Office Market - For Point Channel

Boston Office Market - For Point ChannelHotels and the Boston Convention & Exhibition Center have been a major magnet. Between 2005 and 2015, six hotels with 2,030 room keys were built in the Seaport. Prior to 2005, the area only had the Seaport Hotel with 428 room keys.

In terms of amenities, currently there is approximately 450,000 s/f of existing or to be delivered retail space in Seaport. 450,000 s/f of new retail is currently under construction in Phase I of WS Development’s Seaport Sq. WS Development plans to add another 850,000 s/f during later phases. Overall, WS Development projects 1.3 million s/f of retail to be delivered at the completion of Seaport Sq.

The Seaport/Fort Point area has been dubbed Boston’s Innovation District. Former brick and beam warehouses have been converted to trendy tech offices. By far the largest conversion project is Jamestown’s Innovation and Design Building, a 1.4 million s/f former army base building located at 21-25 Drydock Ave. The days of sprawling parking lots are now forgotten and are being replaced by Class A buildings stretching across Seaport Blvd. The Q4 2015 office market statistics in the Seaport District were:

Conclusion The Seaport District by far has the largest and strongest market capture of any section or district within the city. In a short ±10-year timeframe, the office market has more than doubled. Vacancy rates, which at one time were 16.3%, are down to 10.3%. Average asking rents have doubled. In all of Greater Boston between 2005 and 2015, 4,374 hotel room keys were delivered—nearly 50% of the new inventory delivered was located in Seaport. 29% of new rental apartments are located in the Seaport District and, with its waterfront location, a separate condominium market has evolved. The Seaport has supplied the surging demand for ultra-high-end luxury condos. Condos at 22 Liberty at Fan Pier sold out quickly with a median sale price of $2.9 million, however owners are already flipping units and achieving record-high prices of $2,000 or more per s/f.

To knit it all together, 10 years ago the Seaport had a projected office market cap of 10 million s/f. Currently there is significantly more inventory than the projections, with more to be delivered over the next several years. The Seaport has evolved into a world-class neighborhood with top office occupiers, restaurants, hotels and apartments. WS Development’s retail master plan of Seaport Sq. will once again reshape the neighborhood into a cutting-edge live-play-work urban environment.

The WS Development Seaport Sq. plan including three levels of retail is mind boggling. When one looks up another 10 years from now, projections are for 2 million s/f of retail, 12,000 residential units, 5,600 hotel room keys and millions of s/f of office. The Seaport will become Boston’s new Newbury St. and totally shift the direction of growth within the city.

Webster Collins, MAI, CRE, FRICS is an executive vice president within CBRE’s Valuation and Advisory Group. Peter Mugford Jr. is a research analyst within CBRE’s Research and Consulting Group, Boston.