Webster Collins, CBRE/New England

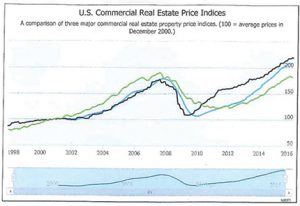

Webster Collins, CBRE/New EnglandIt has been a long climb back since the Great Recession. We spent two years on the downside when the market fell out of bedŌĆöDecember 2007 through 2009ŌĆöand it took 3.5 years to recover on the upside. We have had three very good years since as illustrated in the graph below:

The market has now peaked in Boston. This article will address three market observations and conclude as to the likely patterns ahead.

Signals of a Market Peak If one studies the actions of Boston properties, the last thing you will see is the start of construction in BostonŌĆÖs urban core without a lead tenant. That said, three major players have announced ground up construction on speculatively built new office buildings to total ┬▒1 million s/f.

At the time of their announcement, Q1 2016 market statistics suggest 883,000 s/f of negative absorption for the market as a whole. It is a sure sign of market peaking when speculative construction takes place. This is evident in the apartment market with Class A product. 2015 saw 6,767 units of new construction; that market is now taking a breather with a 33% pullback in new construction projected for 2016.

Price Change When markets peak, changes in pricing typically occur. National statistics published by MoodyŌĆÖs, Real Capital Analytics and Green Street Advisors show mixed trends from a -1.1% decline Q1 2016 to as little as -0.5% decline for Q1 2016.

Price change is primarily attributed to changes in interest rates from the Federal ReserveŌĆÖs rate adjustments from last fall. Real estate pricing is clearly impacted by the volatility being experienced in the capital markets.

What brought this into my mind is my recent email exchange with Fantini & Gorga on financing spreads. There is a lot of confusion ŌĆśwhen trying to compare pricing across industry lenders.ŌĆÖ Just because markets are at their peak and prices change, this does not mean that Great Recession signs are again on the horizon. They are not.

What brought this into my mind is my recent email exchange with Fantini & Gorga on financing spreads. There is a lot of confusion ŌĆśwhen trying to compare pricing across industry lenders.ŌĆÖ Just because markets are at their peak and prices change, this does not mean that Great Recession signs are again on the horizon. They are not.

On May 12, 2016, I attended a program where CBREŌĆÖs chief economist, Jeff Havsy was a featured speaker. His views are that we may see a mild pullback in 2018, as a result of a slowdown in job growth due skill/personnel mismatch, a strong dollar, and an environment with raising interest rates. At most, we are looking at three quarters of job loss and two quarters of negative GDP.

Basel III Rules Likely to Affect Commercial Real Estate This is the title of a recent ULI publication. It is banks ŌĆśrisk-weightingŌĆÖ for what are called ŌĆ£high-volatility commercial real estate loans.ŌĆØ Under new regulations, LTV ratios must be 80% or less, but more importantly, actual cash of at least 15% must be contributed before bank funding can take place. The required equity is based on actual cost rather than as-completed value.

Banks are the traditional source for construction loans. Construction loans from banks clearly will be harder to come by, which will take off the froth that existed in the market in 2015.

Conclusion Boston continues to be a magnet for acquisition of prime properties. That said, CBRE suggests a two-quarter mild recession in the 2018 timeframe. While adjustments in market pricing are expected to take place and the economies of new construction may shrink, I believe that BostonŌĆÖs top city rating in the world of real estate will continue to carry our markets into the third decade of the 21st century.

Webster Collins, MAI, CRE, FRICS is an executive vice president and partner within CBREŌĆÖs Valuation and Advisory Group, Boston.