Part one appeared in the Feb. 11th edition of NEREJ.

Every inventory completed by business owners, assessors, and revaluation appraisers, should include a model number and serial number whenever possible. Typically it is the more expensive items that carry a nameplate. Several "serial number" databases are available for a fee, allowing owners to check the year of manufacture by serial number and date ranges, for model numbers depending on the industry the equipment serves. The type of equipment being researched makes a difference, as it is easier to research the age of a backhoe than a dough mixer.

The internet is a useful tool, more for researching prices of new equipment than used equipment, as many equipment sellers offer their wares online. Some suppliers offer prices through online queries and others who appraise equipment under the guise of "fishing for inventory" are not cooperative in providing prices. While finding a used equipment price may present one of a number of barriers, finding a new price is typically easy.

Once a new price is known, and the year of purchase is known, (or estimated) then the United States Bureau of Labor and Statistics has an online inflation calculator which can be used to calculate the cost new, of an old piece of equipment, adjusted for CPI.

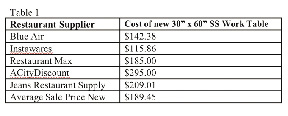

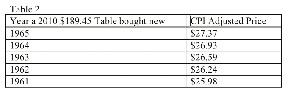

Here is an example. A restaurant owner takes over the restaurant from his father who inherited it from his father. In the kitchen sits a 6' wide stainless steel table which looks as if it has been there since the beginning of the business, and next to it is one which is obviously a later manufacture. The third generation owner has no idea when either table was originally purchased. On the internet we find five restaurant suppliers (detailed in Table 1) offering a brand new six foot stainless steel work table for a range of $115.86 to $295.00, with an average price new of $189.45. Knowing the restaurant was founded in 1965 the first table is placed at that date even though the original owner may have purchased the table used. The impact on taxes of the purchase price in 1965, versus five years earlier (if it was purchased used), is minimal as demonstrated in Table 2.

The six foot work table has an inflation adjusted original purchase price range, in value, of $1.39 between the 1965 adjusted value of $27.37, and the adjusted value in 1961 of $25.98. ($27.37 - $25.98 = $1.39). Thus if the age is estimated, there is little impact on taxes. In this same example, because the table is a long life equipment purchase before 2005, the depreciation is 70% and the taxable amount is $8.21 based on 1965. If the age estimate is five years off and the table was originally sold in 1961, the taxable amount would have been $7.79, a minimal difference.

The second table in our example is also old and is estimated to have been manufactured in 2004 when the restaurant underwent an expansion into the banquet business. In reality no one knows when the second table was purchased but the expansion is a good guess. Again the table could have been purchased as used and may have a five year spread in estimated age. A $189.45 work table purchased in 2010 would have cost $164.12 in 2004 and the taxable amount on it is $49.23. The same methodology used above for the 1965 table could be used here for the 2004 table to show again, the difference over five years on the taxable amount is small.

While this procedure bases the taxable value on facts, there are additional factors which could cause minor errors. (1) Some equipment manufactures suggested list prices have not kept pace with the Consumer Price Index, some have exceeded it. (2) If a business owner purchased many pieces of equipment at the same time there would be a volume discount. (3) Some equipment has been discontinued and there is no comparable new sales price available. In the case of discontinued equipment, the newer replacements may be significantly enhanced thus much more expensive than older models. (4) Newer government regulations may have imposed costly enhancements to new equipment that were not on older equipment grandfathered in the industry.

Nonetheless the procedure offers Assessors and business owners a broadly applicable methodology of basing taxes of tangible property on the original price, adjusted on fact and evidence, meeting the spirit and intent of tax laws. The method is readily discoverable by others for verification eliminating subjectivity. The results of the method deliver a small range of error provided there is a broad selection of new product available. The amount taxed is most likely to be equitable across the businesses in a city or town and if widely adopted, throughout the state.

Richard Conti, GPPA, SPA, ASA, is president of Conti Appraisal Service, Attleboro, Mass.

Tags:

Business tangible property taxation values in southeastern N.E. Pt. 2

March 10, 2011 - Financial Digest