Clear nights, crisp air and back to work. That is fall in New Hampshire. Vacations are happy memories, schools are in session and decision makers are back at their desks. So what will that mean for the New Hampshire commercial real estate market? If the past two quarters are an indication, there will be plenty of activity but little positive direction. Office market vacancy rates will remain uncomfortably high until (apologies for sounding like a campaign ad) a steady number of jobs are created over a sustained period of time. Aside from older, functionally obsolete product, the industrial market appears to be on more solid footing than the office market. While current economic conditions and the cautious lender environment make it very unlikely developers will be rushing to put up "spec" buildings, there is a lack of high bay (22' clear or higher) warehouse/flex space in many of the State's submarkets. Still, as with the office market, in order to support meaningful and sustained improvement in the industrial real estate market, the current economic and political uncertainties must be replaced with a clear path that provides a reliable atmosphere which encourages companies to grow.

The office market in New Hampshire showed a slight increase in the overall vacancy rate in the second quarter of 2011. The vacancy rate increased from 19.8% in the first quarter of 2011 to 20.3% in the second quarter of 2011. While there is plenty of interest in "touring" spaces throughout the six New Hampshire submarkets, and there is a reasonably high level of lease transactions occurring (for instance, Grubb & Ellis|Northern New England's Manchester/Concord team has completed more than thirty lease transactions to date), there has not been an abundance of new tenants entering the market place. For the most part, existing office tenants continue to move from one location to another within their existing submarkets. Some of these tenants are contracting into smaller spaces, while other office tenants are looking for a higher quality space than they currently occupy. Overall, this has had little or no significant change to the total absorption rate.

A positive sign in the Manchester submarket can be found with incubator tenants. The number of tenants emerging from an incubator setting and moving to their own space has increased during the first two quarters of 2011 in this submarket.

The Salem submarket has seen some recent interest in office space from several Massachusetts-based companies. The results of this interest may be seen in the submarket's reduced vacancy rates which began to fall in the fourth quarter of 2011. Likewise, there has been increased interest in leasing in the Manchester market. It will take more than this limited activity to produce sustained improvement in the state's office vacancy rates.

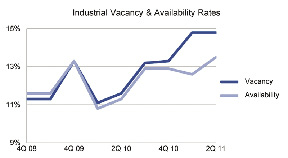

The overall industrial vacancy rate in New Hampshire held at 14.8% from the first quarter of 2011 through the end of the second quarter 2011. Although the overall vacancy rate has been consistent in 2011, there were changes throughout all six submarkets. The Salem, Portsmouth and Nashua submarkets showed positive absorption, while the Manchester, Concord and Rochester submarkets experienced negative absorption.

The New Hampshire industrial market remained active with tenants continuing to explore bettering their real estate positions. Also, several larger (20,000 s/f) buildings that had been sitting empty for several years, were purchased by end users. Additionally, there are several large users (50,000 s/f) active in the southern New Hampshire market. The challenge is finding an existing facility that meets the end user's requirements (clean, high bay, energy efficient facilities that are well located) or risk losing them to other markets (Mass., some southern states or off-shore) where there is a greater existing supply and cheaper land and construction costs.

As this activity demonstrates, there is interest and activity in certain sectors of the industrial market, but older, dated facilities with low clearance (less than 18') are languishing. Tenants and buyers currently in the market are looking for modern facilities that can, among other things, provide them with high-bay space, high-tech data capability, convenient loading and access to highways. We came close in 2010 to seeing this market strengthen enough to foster new construction. Recently, uncertainty has crept back in and the momentum stalled.

The flip side is that owners of industrial buildings remain reluctant to market their assets for sale. The margin between seller expectations (high) and buyer expectations, while narrowing, is still significant. Interestingly, properly priced property remains in demand. There is an increasing amount of investor interest and end user interest in office, industrial and even retail product when it is priced to market (i.e. today's reasonable value, not the relatively high valuations dreamed up last decade). And there will always be "bargain hunters" looking for advantageous opportunities.

Uncertainty is, unfortunately, a very strong contributor to the weak commercial real estate market. Once uncertainty is replaced with confidence, we expect to see vacancy rates drop followed by construction in some markets. Like many, we believe current market conditions will remain for the balance of 2011 and likely into 2012.

Bob Rohrer is the managing director of transaction services and Laura Nesmith is the research manager for Grubb & Ellis|Northern New England, Manchester, N.H.