I recently spoke at the New England Expo on the golf industry, a property type I've studied for the past 20 years. In my preparation for that presentation I combed through data and research I've developed over the years. One of the more interesting facts I uncovered was the correlation between the national unemployment rate and the value of golf properties. Clearly, unemployment is a general sign of the economy, and it makes sense that property values follow its trends. Unlike certain property types that have long term leases, golf values are more fluid and quick to react to changes in the market. Any given market can quickly become over-built with competition; or a club could instantly lose a bunch of members, causing values to fluctuated greatly. And in certain markets such as the southeast, golf is more closely tied to the housing industry.

Golf in particular is driven by disposal income, the more people have the more free time and more money they can spend on hobbies and interests. The less people have, the more they will focus on essentials like rent, food, and transportation. (see chart).

The chart shows how unemployment declined from 1995 through 2000, going from 6% to under 4%. During this time Tiger Woods sprung on the golf stage, his wins brought excitement to the game of golf; people played more golf than ever before. According to the NGF, total rounds played in 2001 approximated 518.1 million. Unfortunately, the effects of 9/11 changed all that, business and leisure travel was down, entertainment spending was cut and consumer confidence fell. Unemployment increased to over 6% from 2001 to 2003.

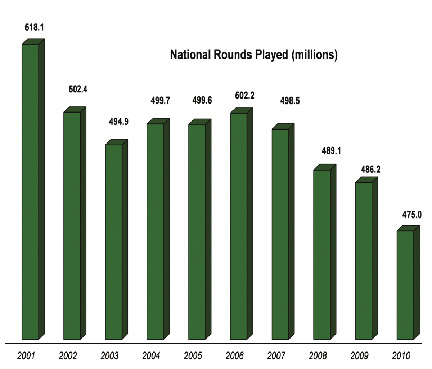

For the next four years we saw a resurgence in the golf market, as the economy improved, unemployment declined and money (debt) was readily available by lenders. Golf saw an uptick in values and transactions. Total golf rounds increased from 495 million in 2003 to 502.2 million in 2006. By 2007 the unemployment rate was back down to around 4% and values seemed to have peaked. Between late 2005 and the end of 2007 my firm facilitated the sale of 4 major transactions of golf properties in the northeast, for a combined sale price of $37.25 million.

Then in late 2008 the national economy fell into a severe recession with the collapse of the housing market and the credit crunch that would ensue. Lehman Brothers filed for bankruptcy in September of 2008 which unofficially marketed the start of the next down cycle. As U.S. companies started shedding jobs, unemployment rates quickly rose, topping 10% by 2009. Golf rounds dropped year after year, totaling only 475 million in 2010. Golf values have fallen precipitously. The same pool of 4 clubs have either re-sold or been re-marketed for sale for a new total price of only $16.2 million. (see bar graph).

Private clubs have been particularly hard hit, golf memberships are the easiest expense to cut when families are looking to trim entertainment/recreation budgets. Public courses have had to discount more to ensure the same level of play. Both course types have lost value over the years, especially since financing is harder to obtain and cap rates have risen.

While it can takes years to permit and construct a golf course, a market can become quickly over-built as operational strategies change. I recently worked on a daily fee golf course on the west coast of Florida. It had little local public course competition when my client purchased it a few years backs. However, there were three private clubs struggling within a mile of the property. Each one had been taken back by their lenders and re-sold to local investors at bargain prices; they have since been converted into public facilities. And, because they were sold at discount prices, the new owners could come out at lower rates and undercut the market. Now, this course has too much local competition and its value has plummeted as a result, at no fault of my client.

Fortunately, we have seen some encouraging signs in unemployment and median home prices. It's important to remember that every market is different. Parts of the northeast have not been over-built or adversely impacted by the housing market as others. Know your market and hire a seasoned professional when valuing a unique property type like golf.

Jeffrey Dugas, MAI, SGA, Wellspeak Dugas & Kane, Cheshire, Conn.

Tags:

By Jeff Dugas -Know your market and hire a professional when valuing a unique property like golf

October 27, 2011 - Spotlights