The CB Richard Ellis Research Group publishes quarterly reviews highlighted with a subtitle of "Quick Stats". This article will start with a brief review of trends over the past three years, present "Quick Stats" for Spring 2011 and conclude with commentary on the market looking ahead.

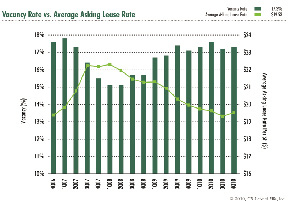

Trends Over the Past Three Years (see bar graph)

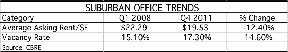

The largest single market is the suburban office market with 106,700,000 s/f. The following summary of the above graph tells only one part of the story: (see Suburban Offic Trends chart)

Looked at by itself, "Quick Stats" on the market are only one indicator of what is going on.

Asking rents suggesting only a -12.4% change does not tell readers the real condition of the market. Achieved rents are off 20% to 30% from their 2007 highs.

Further, landlord concessions are huge. Tenants look for turnkey build-out allowances, moving expenses cabling and furniture.

The market is seriously overbuilt in the greater Boston area but for certain pockets which will be discussed in the section "Looking Ahead".

"Quick Stats"

Quick stats say that the market has reached bottom. Asking rents are rising.

Suburban office asking rents rose from $19.30 per s/f to $19.53 per s/f in Q4 2010. Vacancy was flat at 17.3%.

For the City of Boston office market, vacancy levels are at 10.5% and similar to the suburbs, average asking rents have risen from $40.33 per s/f to $40.63 per s/f.

The biggest spike in rents is in Cambridge where office rents moved from an average of $35.12 per s/f to $36.47 per s/f. Lab rents due to Q4 negative absorption remained basically unchanged at $51.15 per s/f.

What I really want to discuss is where the market is going.

Looking Ahead

It's all about:

* Supply and Demand

* Quality of Space

The best product is like honey for bees. The 3 Com/New/Class A office campus in Marlboro is having a lot of activity. At the same time, because of its location, rents are at $48.75 per s/f, effective with free rent now a big factor in the market. Clearly, the property's value has been severely impacted by market change.

When we move closer to Boston and reach Waltham, the market is far more vibrant. A lot of renewals are underway and rents are solidly in the $30+ s/f range.

By far, the top market is East Cambridge. One Memorial Dr., 4 Cambridge Center and 5 Cambridge Center are 100% leased. Rents have hit the $50 per s/f level, up from the low $40s, one year ago.

Conclusion

Quick stats do not tell the story. There are relatively few true Class A properties in Boston with limited leasing risk and major long term leases in place. These are the well known sales posted during the past year.

As stated at CBRE's last brokerage meeting, "there is Class A and then there is everything else."

The same signs are seen today as in December 2003, January 1994, and September 1983 - three prior bottoms of the market. The problem this time around is that we have to wait until 2014±, when jobs lost since 2007 will have been regained, to be able to wrap our arms around where we are going.

Webster Collins, MAI, CRE, FRICS is executive VP/partner of the Valuation & Advisory Group of CB Richard Ellis/New England, Boston.

Tags:

CB Richard Ellis Research Group's "Quick Stats": Trends over the past 3 years and a look ahead

March 24, 2011 - Spotlights