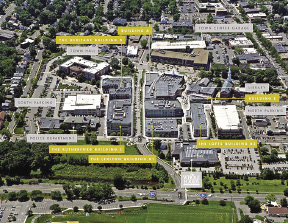

CBRE/New England's capital markets team completed the sale of Blue Back Sq., a mixed-use property offering a street retail, working and living community unique to central Conn. The asset is comprised of six buildings totaling 448,877 s/f over 6.4 acres with a mix of office, medical office, retail and residential space. Ronus Properties sold the asset to Starwood Capital.

CBRE/New England's Chris Angelone, Bill Moylan, Nat Heald and Bruce Lusa of the Boston office, in conjunction with Jeff Dunne and David Gavin of CBRE's New York institutional group and John McCormick, Pat Mulready and Mike Stone of the Hartford office, represented the seller and procured the buyer. Blue Back Sq., which is 97% occupied, traded hands for $106.3 million.

"We are very pleased to have facilitated this transaction on behalf of Ronus Properties," said Angelone. "Starwood Capital jumped on a great opportunity to acquire an institutional-quality asset that is both diversified and possesses an intrinsic competitive advantage—which together ensure the long-term success of the project."

Completed in 2008, Blue Back Sq. has large retail footprints and efficient office floor plates, and contemporary design. The first floor of each of the six buildings is retail and restaurant space (totaling 210,557 s/f) with the floors above containing residential apartments (48 units), condominiums (59 units; owned separately), medical office and professional office. The property is shadow-anchored by Whole Foods and several municipal buildings, including the town library, police station and town hall. In addition, two municipal-owned parking garages (1,011 public spaces) are integrated into the master-planned site.

The CBRE investment sales teams specialize in the sale of retail properties in suburban New York, Boston and New England. The teams service a client base of institutions, corporations, private investors, developers and REITs and have a number of attractive investment opportunities on the market including: Riverside Center, a 722,084 s/f Walmart, Lowe's and BJ's anchored power center in Utica, NY; Pelham Manor Shopping Plaza, a 228,493 s/f BJ's Wholesale Club, PetSmart and Michaels anchored center in Pelham Manor, NY; and Big Y Shopping Center, a 101,100 s/f Big Y anchored neighborhood center in Bethel, Conn.

About CBRE/New England

CB Richard Ellis - N.E. Partners, LP, a joint venture with CBRE Group, Inc. has offices in Massachusetts, Connecticut, Rhode Island, Maine and New Hampshire. Please visit our website at www.cbre-ne.com. CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world's largest commercial real estate services firm (in terms of 2012 revenue). The company has approximately 37,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through more than 300 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting.