Forget the old adage that people need to live somewhere. That never crosses the mind of an apartment investor in the market today. It doesn't have a check-box on the spreadsheet of the mortgage lender, and it will never find its way into an Offering Memorandum for debt or equity in an apartment deal.

In the midst of this credit crunch and apparent economic downturn, generalities and slogans are irrelevant in commercial real estate. Theoretical reasons to invest in commercial real estate are often overshadowed by many real reasons not to. Luckily, the apartment industry in Connecticut doesn't need to rely on generalities and slogans. It has the government and demographics on its side.

Apartment operators in Connecticut have two aces in the hole, which will undoubtedly get them through the storm. The first is a changing demographic environment that supports rental demand growth. Coupled with central Connecticut's stable inventory of apartments, are strong forecasts of rental demand growth that we have not seen since the early 1980s. These factors will shift the supply/demand equilibrium ever so slightly from one of historic stability to one that leans toward opportunity to grow operating profits.

In the past, increasing household formations was the driver behind rental demand growth, which was minimal. In the coming years however, rental demand growth will be additionally spurred by a confluence of factors, including a declining homeownership rate and demographic changes that support renter-occupied housing even without net job growth or population growth.

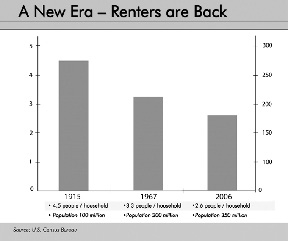

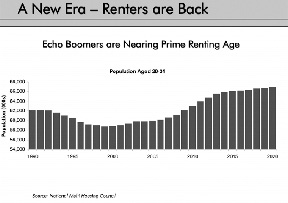

Renters will come. Baby boomers will become lifestyle renters and choose to rent rather than own. Echo boomers are approaching prime rental ages and will rent out of necessity in numbers not seen in a generation. The sub-prime mess has forced many into renting as they can no longer qualify for a mortgage. And, household sizes have shrunk from 3.3 people per household in 1967 to 2.6 people per household in 2006. With these factors supporting rental demand, who needs job growth?

Not only are demographics helping apartment operators improve their bottom line, but apartment owners will enjoy more capital liquidity than owners of virtually all other property types. Thanks to quasi-governmental agencies Fannie Mae and Freddie Mac, which are chartered by the federal government to provide liquidity to the apartment marketplace, mortgage capital is still readily available to apartment owners, and at very attractive rates and terms.

In the recent past, apartment operators enjoyed significant asset value enhancements due to capital market liquidity and plunging capitalization rates. Now that debt and equity capital is tighter, apartment owners will actually have to show improving net income in order to enhance value. It will no longer happen on its own.

Michael Stone is first vice president at CB Richard Ellis, Hartford, Conn.

Tags:

Changing demographics and stable apt. inventory are strong forecasts for rental growth in Conn.

March 20, 2008 - Connecticut