Executive Summary

The Connecticut hospitality market has demonstrated uneven recovery patterns between 2019 and 2025, with boutique and historic properties achieving $125 RevPAR in 2025, up 8.7% from the 2019 level. Coastal resort properties achieved a $105 RevPAR in 2025, representing 10.5% growth since 2019. Casino corridor properties maintained modest growth with RevPAR improving 4.5% to $92 in 2025. Urban centers struggled with RevPAR; it declined 17% to $78 in 2025, while highway node properties decreased 9.7% to $65 in 2025. Statewide average RevPAR declined 4.4% to $87 in 2025, masking significant submarket variation.

Submarket Performance Analysis

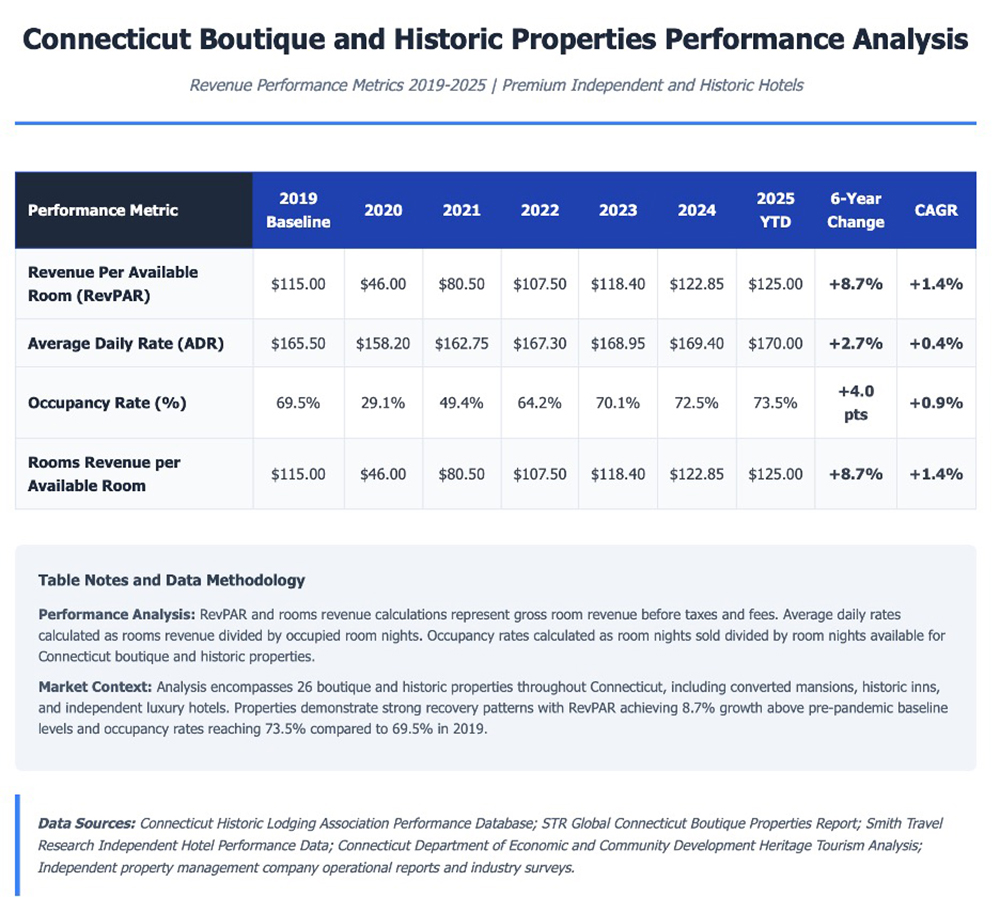

The boutique and historic property submarket of Conn. emerged as the state’s strongest performing hospitality segment from 2019-2025, with revenue per available room increasing 8.7% from $115 to $125. Occupancy rates exceeded pre-pandemic levels, rising from 69.5% to 73.5%, while average daily rates maintained premium positioning at $170, demonstrating sustained pricing power. This performance reflects the submarket’s success at adapting to the post-pandemic shift toward experiential travel while benefiting from limited supply within this specialized market segment.

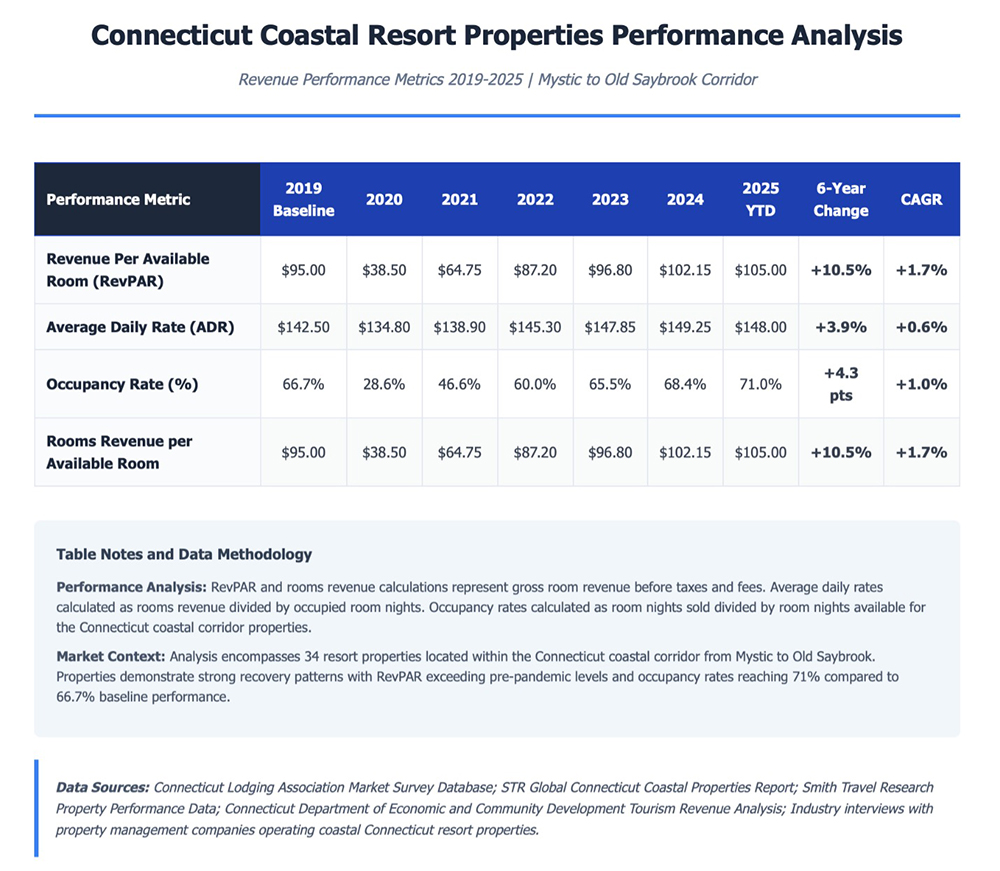

The coastal resort submarket has experienced the highest rate of growth during the 2019-2025 period. Revenue per available room was $105 in 2025, representing a 10.5% improvement over the 2019 level of $95. Meanwhile, occupancy rates reached 71% compared to 66.7% in 2019. Average daily rates remained stable around $148, reflecting pricing discipline during recovery. The coastal corridor’s strength stems from its positioning within Conn.’s maritime heritage and year-round demand from defense and pharmaceutical employers. This submarket’s annual growth rate of 1.7% for revenue per available room significantly outpaces other Conn. hospitality segments and reflects operational strategies that capture business and leisure demand throughout the calendar year.

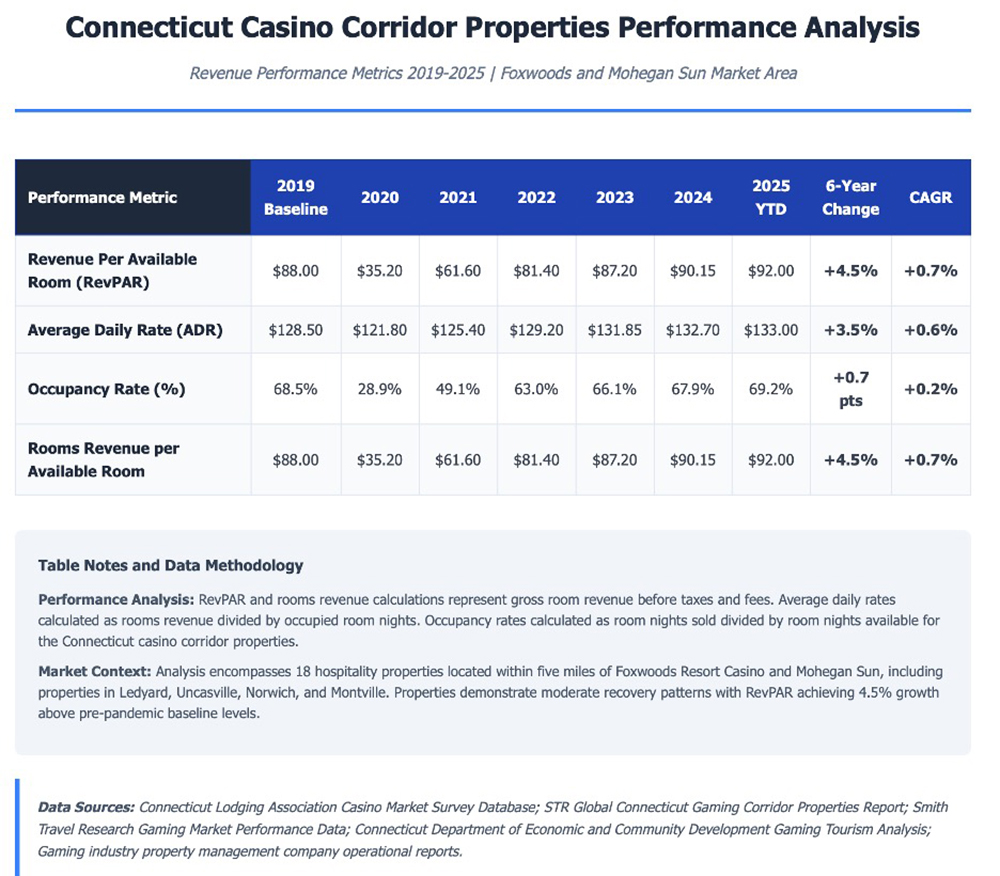

The casino corridor submarket achieved a modest but stable recovery between 2019 and 2025, with revenue per available room growing from $88 to $92, representing a 4.5% increase and 0.7% annual growth rate. Occupancy rates demonstrated resilience throughout the period, improving marginally from 68.5% to 69.2%, while average daily rates increased from $129 to $133. This measured growth pattern suggests that the submarket benefits from gaming-related demand stability and regional entertainment draw, though its performance remains constrained by risks tied to gaming industry changes such as the proliferation of online gaming.

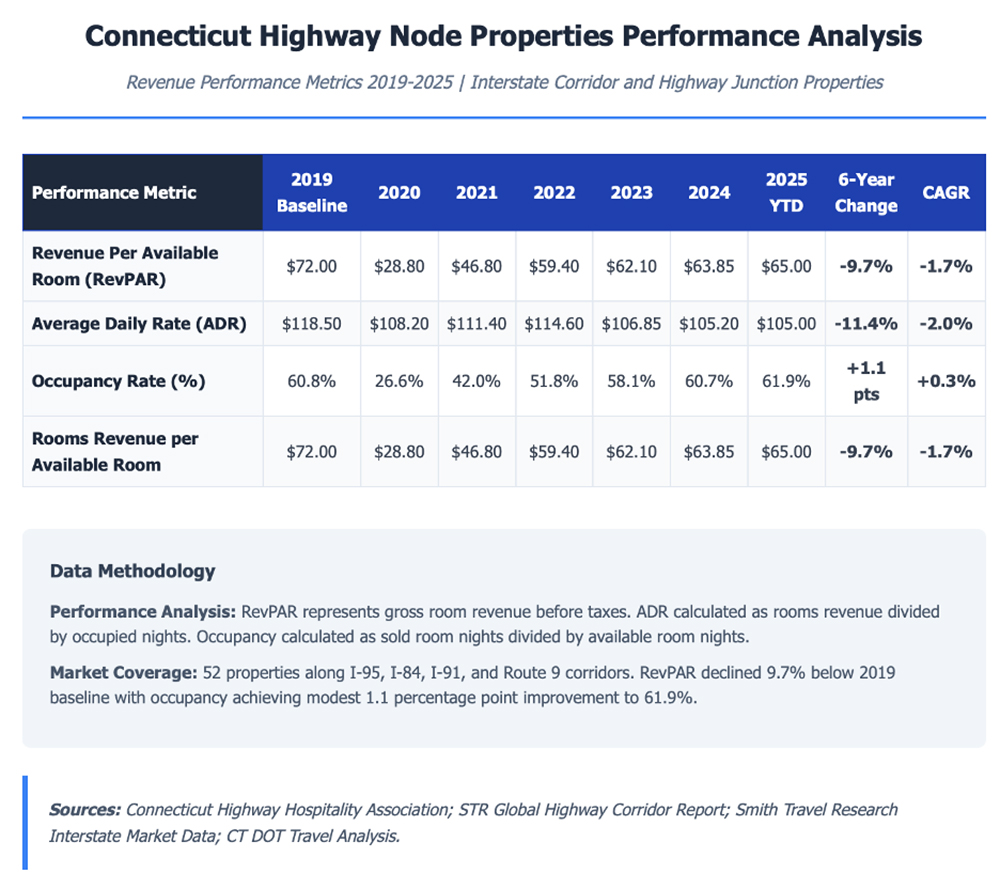

The highway node submarket demonstrated substantial deterioration between 2019 and 2025, with revenue per available room declining 9.7% from $72 to $65 and average daily rates falling 11.4% from $119 to $105. While occupancy rates improved modestly from 60.8% to 61.9%, this marginal gain could not offset severe rate compression that undermined overall performance. The segment’s negative 1.7% annual growth rate reflects structural challenges including reduced corporate travel frequency, competition from extended-stay alternatives, and fundamental shifts in business travel patterns.

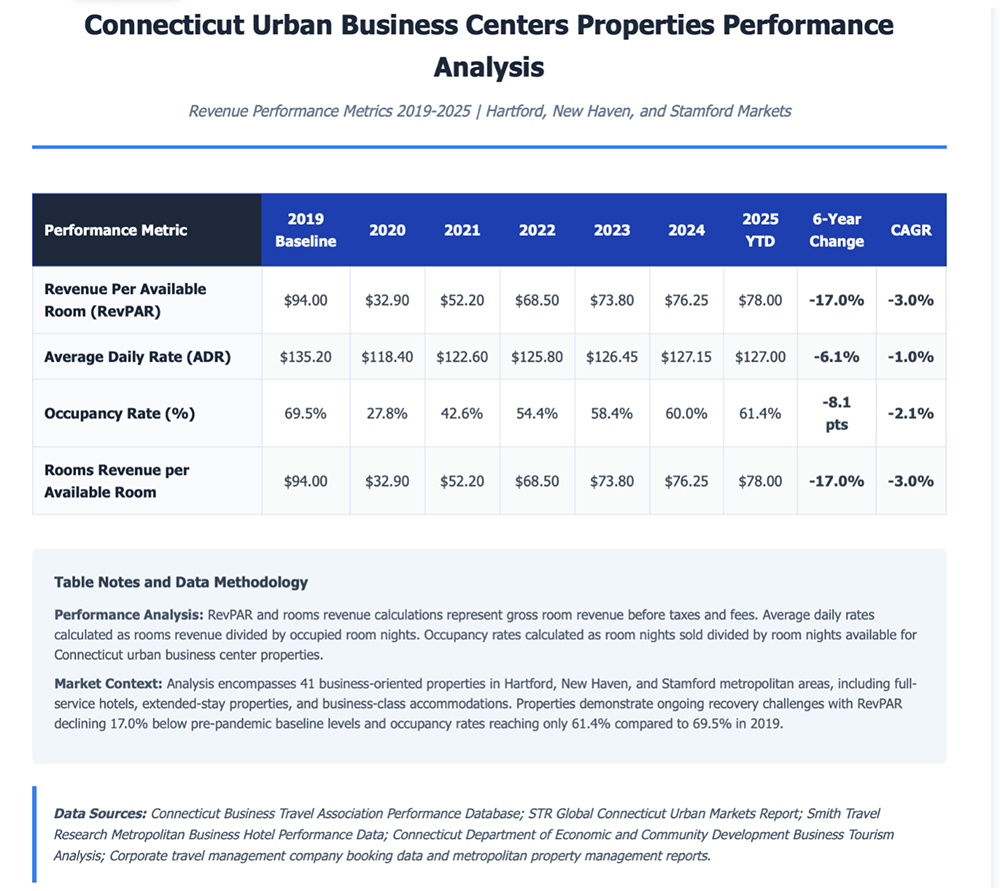

The urban business center submarket experienced the most severe performance deterioration among all hospitality segments during the 2019-2025 period, with RevPAR declining 17.0% from $94 to $78 and occupancy rates falling 8.1 percentage points to 61.4%. This underperformance reflects fundamental structural challenges including reduced corporate travel demand, widespread remote work adoption, and government rate restrictions that limit pricing flexibility. The segment’s negative 3% compound annual growth rate indicates that the submarket has not recovered to pre-pandemic performance levels and continues facing headwinds from permanently altered corporate travel patterns.

Sources: STR Global Connecticut Hospitality Market Performance Database 2019-2025; Connecticut Department of Economic and Community Development Tourism Revenue Analysis 2024; CBRE 2025 Global Hotel Outlook Connecticut Supplement.

Investment Activity and Transaction Trends

Connecticut’s hospitality investment market demonstrated remarkable resilience and selective recovery patterns across the five primary submarkets during the 2019-2025 period. Transaction activity experienced severe contraction during 2020 with only eight recorded sales compared to twenty-three transactions in 2019, before recovering to twenty-four transactions by 2025. Boutique and historic properties emerged as the clear investment favorites, commanding average per-room pricing of $135,600 by 2025, representing an 18.2% increase from 2019 levels as investors recognized the premium pricing power and limited supply characteristics of experiential hospitality assets. Coastal resort properties similarly attracted strong investor interest with per-room pricing reaching $118,900, up 12.5% from pre-pandemic levels, driven by leisure travel recovery and the segment’s demonstrated ability to capture diverse revenue streams beyond traditional room sales.

The investment landscape revealed stark performance divergence across the remaining submarkets, reflecting fundamental shifts in investor risk assessment and return expectations. Urban business centers faced continued investor skepticism with average per-room pricing declining 8.2% to $72,300, as concerns over structural changes in corporate travel patterns and remote work adoption created persistent uncertainty about long-term income stability.

Highway node properties demonstrated the most challenging investment environment with per-room pricing falling 12.8% to $58,700, indicating investor recognition that traditional highway hospitality concepts require significant repositioning to achieve sustainable returns. Casino corridor properties maintained relative stability with per-room pricing of $95,400, up 8.7% from 2019, as investors balanced gaming-related demand consistency against correlation risks with entertainment industry performance. The overall market recovery remains incomplete with statewide average per-room pricing of $82,100 representing a 4.1% decrease from 2019 levels, though improving operational performance in select segments suggests continued investment opportunity for properly positioned assets.

Sources: Commercial Real Estate Transaction Database (CoStar); Real Capital Analytics Hotel Sales Report 2024-2025; CBRE U.S. Cap Rate Survey H1 2024.

Development Pipeline and Supply Outlook

Conn.’s hotel development pipeline includes 22 projects representing 1,850 new rooms scheduled through 2028. This limited supply supports pricing for well-positioned existing properties while constraining overall market growth. The conservative approach reflects financing challenges and ongoing market uncertainty.

Coastal resort markets lead development with six projects totaling 485 new rooms, focusing on boutique and experiential concepts. Urban centers include five projects totaling 620 rooms emphasizing extended-stay and business concepts. Highway node development remains limited with six projects totaling 435 rooms, reflecting ongoing segment challenges.

Sources: Lodging Econometrics Q1 2025 U.S. Hotel Construction Pipeline Report; Connecticut Department of Economic and Community Development Construction Permits Database.

Market Outlook

Conn.’s hospitality market faces a period of measured growth through 2030, with projections indicating modest recovery tempered by structural challenges and evolving competitive dynamics across the state’s five primary submarkets. The statewide outlook is for annual growth of approximately 2.0%, with average revenue per available room projected to increase from $87 in 2025 to $96 by 2030.

The boutique and historic properties segment demonstrate the strongest growth potential with projected annual growth of 2.6% driving revenue per available room from $125 to $142 by 2030. This premium performance reflects continued demand for experiential tourism, cultural events, and authentic accommodations that justify higher pricing despite competitive pressures. Coastal resort properties project similarly strong performance with 2.4% annual growth, increasing revenue per available room from $105 to $118 over the projection period. This growth trajectory assumes continued leisure travel strength and the region’s ability to maintain year-round demand through diversified business sources including defense contractors and pharmaceutical companies.

The casino corridor anticipates moderate growth of 2.1% annually, with revenue per available room projected to reach $102 by 2030 from the current $92 level. This reflects gaming industry recovery expectations and continued entertainment demand, though correlation risks with gaming revenue fluctuations create uncertainty around these projections.

Urban business centers face a challenging outlook with projected annual growth of only 1.7%, increasing revenue per available room from $78 to $85 by 2030. This conservative projection assumes gradual corporate travel recovery and potential benefits from corporate relocations to Conn., though remote work adoption may permanently reduce traditional business travel demand and limit upside potential.

Highway node properties also operate in a difficult operating environment with projected annual growth of 1.8%, increasing revenue per available room from $65 to $71 over the five-year period. This limited growth reflects structural changes in business travel patterns and increased competition from extended-stay alternatives that may permanently alter demand characteristics for traditional highway hospitality properties. The segment’s success will depend heavily on operators’ ability to adapt to changing travel behaviors and competitive pressures.

Market participants should monitor potential modifications to Connecticut’s occupancy tax structure, infrastructure development affecting accessibility and competitiveness, and broader economic conditions affecting both leisure and business travel demand. The state’s fiscal pressures create both risks and opportunities depending on policy responses to budget challenges, making regulatory monitoring essential for successful investment and operational strategies. Properties that achieve differentiation through superior experiences, operational excellence, or strategic market positioning will continue outperforming commodity alternatives that compete primarily on price, with technology integration and sustainability initiatives serving as increasingly important competitive differentiators in attracting both guests and investors throughout the projection period.

Sources: STR Global Connecticut Market Analysis 2025; PwC US Hospitality Directions Report 2025; CBRE 2025 Global Hotel Outlook Connecticut Analysis.

Anastasia Friedman, MAI is principal of Friedman Valuation Services, LLC, Brookfield, Conn.