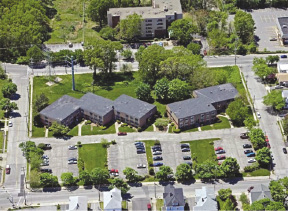

Cornerstone Realty Capital arranged a total of $2,432,500 in financing for its client, Blackstone Valley Portfolio Fund I, LLC, allowing for the acquisition of a 71 unit apartment portfolio made up of five buildings. The apartments are located at 325-333 Prospect St., 5 Chestnut St., 330 School St., and 10 Beechwood Ave. The Prospect St. complex, which is made up of 2 three-story buildings, has 55 total units, 330 School St. contains six units, and 5 Chestnut St. and 10 Beechwood Ave.each contain five units.

Less than two miles from I-95, these properties have access to other areas of New England, primarily Mass. and Conn. The properties are also located within one mile of Memorial Hospital of Rhode Island, a 294-bed community hospital. As a teaching affiliate to Brown University's Alpert Medical School, the hospital serves as one of the most prominent medical centers in the country and one of the largest employers in the area.

A representative of Blackstone Valley Portfolio Fund I said, "Having dealt with Cornerstone in the past, our confidence in their ability to satisfy our financing needs for this acquisition was unmatched. Their efficiency and effectiveness in connecting us with a suitable lender, getting us the terms we needed, and doing it all in a timely manner provided us with an ideal loan structure."

Cornerstone was able to deliver a 10 year loan term at an aggressive rate with a 30 year amortization.

Also, Cornerstone arranged $2.15 million in financing for its client, Oasis Properties, allowing for the refinance of a 12 unit apartment building in Somerville, Mass. The unit mix in the property is comprised of 1 one-bedroom unit and 11 two-bedroom units.

Located near Porter Square, the property features access to several MBTA subway and bus stations, multiple state routes, and close proximity to downtown Boston.

Brett Pagani, vice president at Cornerstone said, "Having secured the financing for the original acquisition of the property we were confident in our ability to deliver a very strong deal to our client. There have been some tremendous upgrades at the property and we were able to help our client capitalize on those improvements."

Cornerstone was able to deliver a 10 year loan term at an aggressive rate with a 30 year amortization.

Cornerstone specializes in structuring and sourcing innovative financing for all property types.

Tags: