Cost of construction materials and how it’s impacting development - by Nate Nickerson

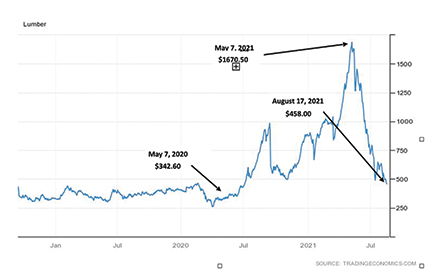

Lumber:

Just over three months ago, on May 7th, 2021, the price of lumber hit an all time high. I remember talking with developers and asking how they were going to navigate the seemingly never ending price increases. On May 7th, the price of lumber per 1,000 board feet* hit $1,670.50. A year prior, before the COVID-19 pandemic had any effect on supply chains and market demand of lumber, the price of lumber on May 7th, 2020 was $342.60 per 1,000 board feet. In the year following, the price of lumber increased 388%, causing some developers to delay, restructure, or abandon their current projects. I was working with a large national multi-family developer at the time and was told that their strategy was to wait it out as long as possible and hope that time would help fix the supply chains and lower the skyrocketing prices, or… they would just eat the cost entirely if they could not delay the project any further; something that smaller developers could not do.

Thankfully, for developers, the price of lumber has tumbled 73% in the last three months and, as I write this, is sitting at $458 per 1,000 board feet, which is right around where it was pre-pandemic. The reason why lumber prices skyrocketed was due to a “perfect storm” of events following the COVID-19 pandemic. Lumber mills cut production and sold off inventory in anticipation of a real estate market crash. That crash did not happen and instead there was a development/building boom, which had an even larger impact on the supply and demand curve. Over time, production resumed, returning prices back to “normal”. This decrease in price is initially impacting wholesalers; there is still a lot of high-priced inventory in the supply chain that could take some time to work itself out in retail prices. (Pollack, GlobeSt.com) However, the price dip is good news for developers as it will certainly sustain the current development boom.

*One board foot of lumber is a piece of wood that is one foot long, one foot wide, and one inch thick (1’x1’x1”)

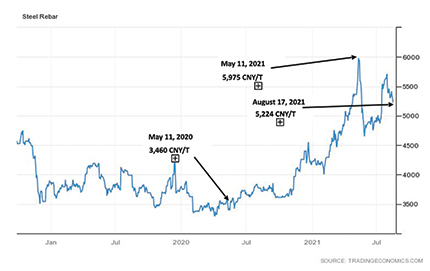

Steel:

Throughout 2020 and 2021, the price of steel seemed to be following the same upward trajectory as lumber, though not as extreme. However, currently the price seems to be still holding at very high levels. Steel (rebar) hit an all-time high of 5,975 CNY/T (yuan per ton) on May 11, 2021. Just a year prior, on May 11, 2020, steel was priced at 3,460 CNY/T. Throughout the next year, the price of steel would increase 73%. As I am writing this, the price of steel is 5,224 CNY/T, which is 13% less than the all time high in May. Many are asking: why isn’t steel seeing a price correction similar to lumber? There seems to be conflicting opinions on the matter. Evraz, one of the largest steel mining companies in the world, stated in early August that the continual increase of stimulus in the global economy in 2021 helped continue recovery from the pandemic. Steel mills continued to increase production to meet demand but demand outstripped supply. As supply continues to meet pre-pandemic levels there is a possibility of a gradual price decline in the coming months (Taboada, MarketWatch.com). The opinion is that steel seems to be lagging behind on production and in turn price due to a backed-up supply chain.

The other opinion is that steel prices will continue to surge into 2022 due to two major acquisitions last year by steelmaking titan Cleveland-Cliffs—AK Steel for $1.1 billion and U.S. steel mills from ArcelorMittal for $1.4 billion—has essentially made the steel industry a duopoly. That firm grip by Cleveland-Cliffs and United States Steel Corp. on the market leaves them with little incentive to increase production. After all, creating more supply would only mean their prices would fall (Lambert, Fortune).

Hopefully, for developers and the real estate market as a whole, we see the steel supply chain work itself out and return back to pre-pandemic prices, further stimulating the development boom we have been seeing.

Nate Nickerson is a vice president with O’Brien Commercial Properties, Concord, Mass.

Check out the New England Real Estate Journal's 2025 Fall Preview Spotlight

Explore our Fall Preview Spotlight, featuring exclusive Q&As with leading commercial real estate professionals and in-depth byline articles on today’s most relevant market topics. Gain insight into the trends, challenges, and opportunities shaping New England’s commercial real estate landscape this fall.

How do we manage our businesses in a climate of uncertainty? - by David O'Sullivan

30 years on South Coast Rail: A journey to connect Southeastern Mass. with commuter rail - by Rick Carey

Shallow-bay wins on 495/128: A renewal-driven market with a thin pipeline - by Nate Nickerson

.png)