Defeasance, LLC

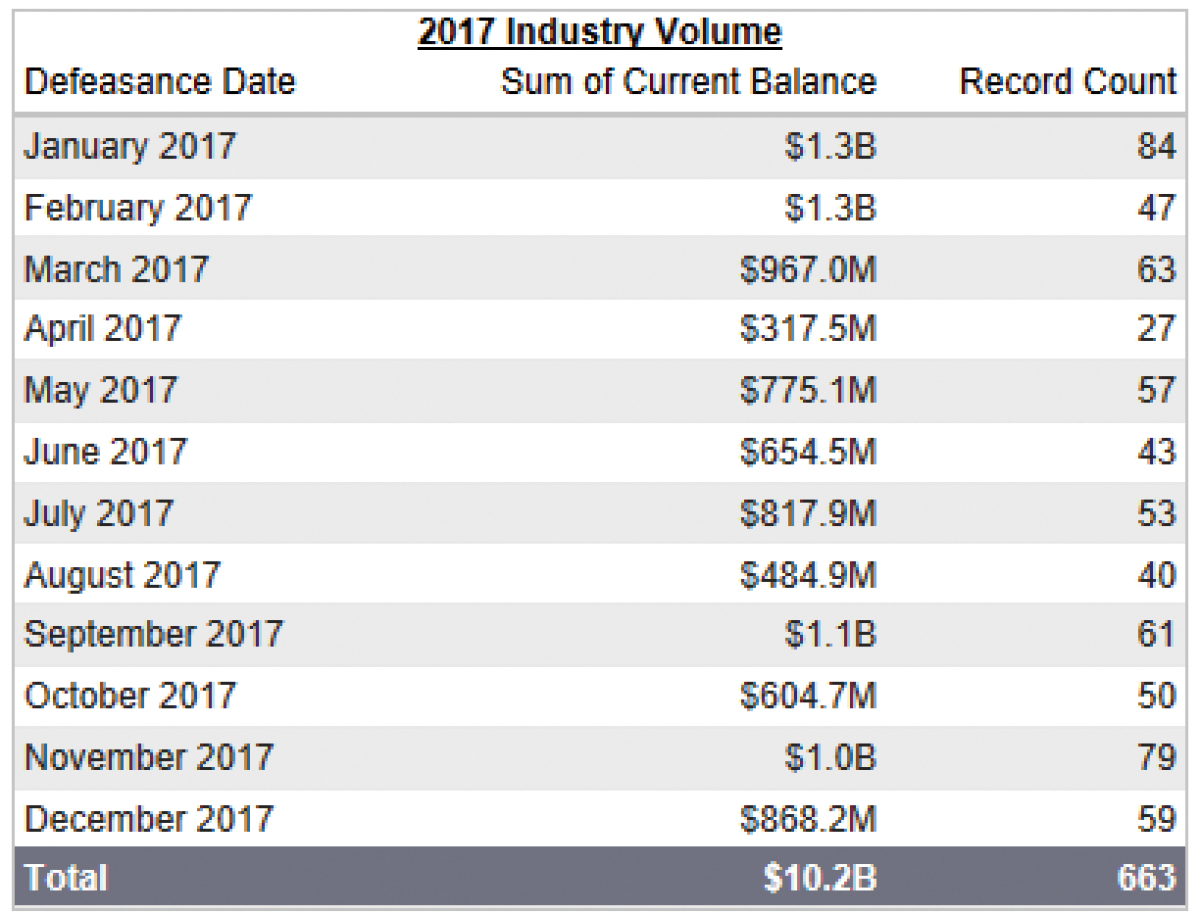

The final numbers are in for 2018; defeasance activities were up 11.9% from 2017 totals of 742, compared to 663 transacted in 2017.

For the past several years borrowers have been moving to exit real estate debt in order to cut down on interest rate expense, as well as take advantage of other opportunities in the market. Significant appreciation in almost every asset class especially; multifamily, industrial, self-storage, hospitality, etc...has driven the desire to unlock equity in existing assets and move to take advantage of new opportunities.

The climate for new opportunities has become increasingly more challenging as real estate prices continue to rise and increasing materials costs and rising interest rates make projects more expensive. So, what’s next? What does this mean for the real estate market and defeasing existing notes for 2019? With a flat yield curve, historically low interest rates, and real estate owner’s ability to find value, there continues to be a steady flow of notes being defeased.

New origination momentum of CMBS notes continued from 2017 into 2018, with $40.4 billion being issued for the first 6 months of 2018. Things lightened a bit as 2018 wore on as the total for 2018 was down approximately 13.7%. The total for 2018 came in at an estimated $75 billion. New private capital continues to enter the markets along with bank and agency lenders as we are still experiencing both relatively historical low interest rates and cap rates, which continue to create both sales and financing activity in the market place.

Defeasance comes into play when a borrower wishes to pay off a conduit loan prior to its maturity date. In these cases, the borrower must provide the original lender substitute collateral (almost always in the form of U.S. Treasuries). The new collateral must produce an income stream sufficient to pay all the remaining loan payments and pay off the balance in full at the maturity date. The cost of completing a defeasance transaction depends on a number of factors, including the number of months left on the loan term at the time of prepayment, the current U.S. Treasury yield on securities sufficient to meet that goal. In addition, there are various third parties involved, all of  whom play different roles in the entire process. The collective costs of the treasuries and third-party expenses determine the total cost. The defeasance transaction then releases the property as collateral, allowing either a sale or new loan be put in place.

whom play different roles in the entire process. The collective costs of the treasuries and third-party expenses determine the total cost. The defeasance transaction then releases the property as collateral, allowing either a sale or new loan be put in place.

According to Bloomberg during 2018, approximately 489 multifamily loans that were defeased totaling $8.5 billion, 68 loans totaling $1.9 billion were retail property types, and 55 loans totaling $1.7 billion were office property type.

With the federal reserve continuing to raise short-term interest rates, U.S. Treasury rates have increased on the short end (1 to 6 months), closing in on 2.5%, while the 10-year rate continues to stay close to 2.75% creating a flattening of the yield curve. Federal policymakers expect two possible rate hikes this year. It is reasonable to anticipate rising rates may compel borrowers to pay off existing loans sooner for those loans that are due to mature in the next couple of years. This is to take advantage of the current low interest rates available in the marketplace today and deals that were “bought right” during the downturn and have a positive equity position. In the meantime, it would certainly seem that keeping interest rates low will produce a large amount of economic activity in the commercial real estate market, at least into 2019. Regardless of what interest rates do over this timeframe, it will be a busy time for commercial real estate professionals as owners decide whether to refinance or sell ahead of their pending loan maturities.

John Felter is a managing director with Waterstone Defeasance, LLC, in New York, a Raleigh, N.C.-based defeasance advisory firm.