Borrowers are often fearful of defeasance, but why? With the recent low interest-rate environment fresh in everyone's minds, defeasance has built up a negative connotation among owners and brokers, with many loans being assumed rather than defeased over the last few years. However, as loans originated from 2005 to 2007 approach maturity, defeasance can actually be cost beneficial for many commercial property owners.

Most often used in commercial real estate as the prepayment requirement on conduit/CMBS loans, defeasance is the process of releasing a commercial property from the lien of the mortgage and replacing it with a portfolio of U.S. government securities. Once a loan is defeased, the securities portfolio effectively replaces the borrower's payment stream and makes the remaining mortgage payments on the loan, allowing the borrower to simultaneously either refinance or sell their property free and clear.

With the cost to defease tied directly to the cost of U.S. Treasuries (i.e. the higher the cost of Treasuries, the higher the cost to defease), many owners have dismissed defeasance as impractical, especially those with several years remaining until loan maturity. Since 2008, the cost to defease has ranged from 4-6 points per year remaining on the loan, leading many borrowers to 'sit' on their loans rather than sell or refinance. However, Moody's reported a significant rise in US CMBS defeasances in 2013, increasing 123% from 2012; and what's more, 2013 data shows borrowers are defeasing loans with longer remaining terms than in 2012.

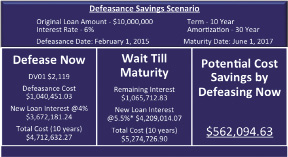

While penalties still range from tens of thousands to tens of millions of dollars, many borrowers can actually save considerable amounts by defeasing today (See Table 1 below for sample analysis). For borrowers looking to take advantage of today's lending market, defeasance presents the opportunity to move from 5.5-7.5% rates into 3.5-4.5% rates, while protecting themselves against probable interest rate increases over the next few years. In many cases, defeasing today means negating interest rate risk at a minimal cost.

For example (per Table 1 below) for a borrower with a loan with an original principal balance of $10,000,000 originated in June of 2007 at a 6% interest rate, the potential cost savings from defeasing now will be approximately $562,000, based on current interest rate forecasts. As illustrated in the table below, the total cost to defease today will be approximately $1.040mm, while total interest payment savings recognized by locking-in a new 10-year loan at 4% interest rather than 5.5% interest would be approximately $1.6mm, resulting in a net profit of $562,094.63. Should interest rates move above 5.5%, these costs will be even more substantial.

Moreover, for borrowers looking to lower their defeasance costs by waiting for yields on Treasuries to rise, it should be noted that this strategy will most often have only a minimal impact on costs.

For example, should the borrower on the loan in Table 1 choose to delay their defeasance until the relevant Treasury rates have raised 10 basis points, their defeasance savings will be only approximately $21,000. Obviously, while these savings are certainly helpful, they pale in comparison to the potentially hundreds of thousands of dollars in increased interest costs that borrowers risk incurring by delaying their refinance.

Indeed, most borrowers view defeasance as a Treasury-rate game, believing that they should delay their defeasance as long as possible to lower their costs. However, as Table 1 demonstrates, the rewards associated with defeasing today can often outweigh the rewards of delay.

Eitan Weinstock is the senior defeasance analyst at AST Defeasance, Los Angeles, CA.

Tags: