After an unprecedented ten years of growth, by February 2020, global markets including real estate are now in flux as a result of the COVID-19 Pandemic. The COVID-19 outbreak resulted in tremendous uncertainty regarding the duration and depth of the crisis. Market participants are beginning to apply price premiums to underwriting and deal structuring. Here, we consider the impacts of multifamily rent changes in the current economic climate.

Rent - Collections, Growth and Enhanced Public Benefits

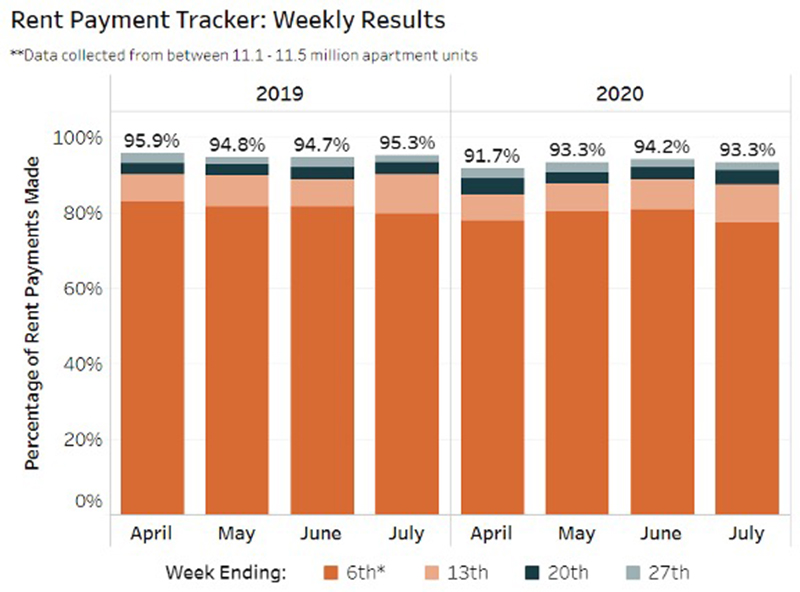

The National Multifamily Housing Council’s (NMHC) Rent Payment Tracker covers 11.4-million occupied units of professionally managed apartments across the nation. The most recent information available (through Week Four of July) indicates that 93.3% of apartments have at least made a partial rent payment. This corresponds with 95.3% in the same period in 2019, and a slight decline from the June 2020 Week Three collection point of 94.2%. The chart below from NMHC reflects collections through the fourth week of the month of all the noted periods.

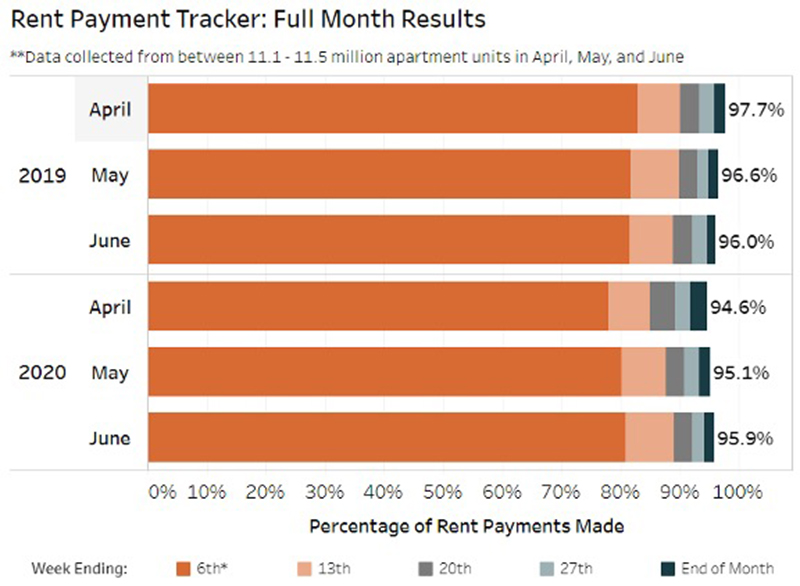

Of significant concern, and a point surely impacting 2020 collections has been the fiscal stimulus passed this year in response to the COVID-19 crisis as discussed below. Looking at the most recent month-end reports from NMHC, rent collections strangely rebounded from April through July of this year – surely an impact of that stimulus in the face of lightning fast unemployment trends March through May of this year. Logically, if fewer people are employed in a market area rent collections come at greater risk. However, the stimulus has mitigated these concerns in the short-term. The risk of such collections will surely vary not only market-by-market but at the neighborhood and asset level. Areas and assets more exposed to service-industry and non-essential employees (according by State governments) will be impacted variably.

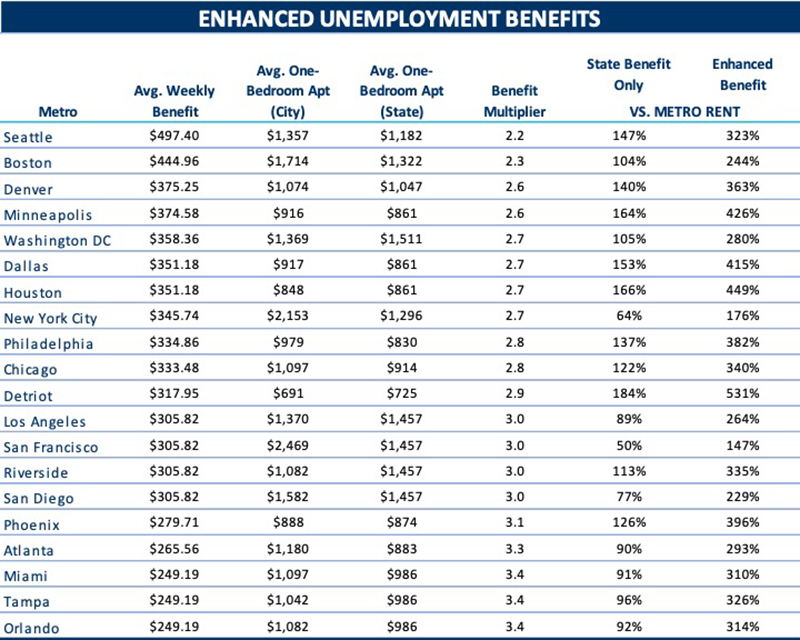

Raising the Social Floor: The COVID-19, Aid, Relief and Economic Security Act (CARES Act), which is a $2.1 trillion fiscal stimulus package, included a variety of stimulus mechanisms but of most direct concern to rent collections is the now expired $600 per week unemployment benefits from the CARES Act. With the expiration of enhanced unemployment benefits, 32.5+ million workers that lost their jobs are limited to the benefits of their state unemployment funds. Without an extension of the CARES Act or similar legislation, the effects would be significant and unevenly distributed around the country because of the uneven level of unemployment benefits by State. Further, the expanded benefits have not solely been monetary but also relating to eligibility. The CARES Act allows eligibility for not only those recently laid off, but also for “gig workers”, freelance workers, the self-employed and for people who can’t work because someone in their household is in school or sick. The removal of these benefits will result in people prioritizing rent payments, car payments, medical payments (during a pandemic), credit card debt and other necessary personal expenses.

As each state funds its unemployment programs differently and at varying levels the impact to the loss of benefits to rent payments is important to understand. The impacts of a full drawdown in enhanced benefits would be significant, representing a removal of $25 Billion a week from the US economy, which is money spent on rent, food education; all of which keeps small businesses alive. However, its impact would be uneven.

Information in the table above was sourced from the US Department of Labor, Apartment List, the APM Research Lab and CoStar. State benefits, considered by the largest US metro areas, vary from an average low of $249.19 per week in Florida to $497.70 in Washington State, and this variation disproportionately effects locations in the country if the enhanced benefits are removed. Major Florida cities, San Diego, San Francisco and Los Angeles are likely to be significantly affected by virtue of the expiration of these benefits. The social floor their governments are providing is at the low-end of the range and does not meet the average rent levels of one-bedroom apartments in the City. From the perspective of social benefits the Boston area appears well positioned, although many other concerns still persist.

Asset pricing is generally holding steady in most markets; based on feedback from market participants, buyers and sellers are keen to understand the underlying fundamentals of each asset and neighborhood as it relates to employment concentration, rent collections and infection rates.

With a suppression of the virus and renewed consumer-focused stimulus, investment dollars will likely continue to flow to the multifamily sector due to its positively perceived risk profile in comparison to other asset classes. Agency lending from Fannie Mae and Freddie Mac have offered liquidity to this asset class that is not available to office, retail and industrial sectors. However, a prolonged legislative battle over ideologies may push a new bill past the August recess period of August 10th to September 7th. Such a delay would worsen the near-term effects of COVID-19 on the multifamily sector and may push impacts out past the current six to 24 months period many investors are considering as the duration.

Corey Gustafson, MAI, is managing director at Apprise by Walker & Dunlop, Boston, Mass.