The 50% Rule refers to the limitation that a homeowner can spend when renovating or repairing a dwelling that is located in a flood zone. More specifically, FEMA allows for repairs, renovations and/or improvements that don’t exceed 50% of the contributory value of the structure and appurtenances. Your appraiser says “appurtenances” as there are elements that are academic to making a building a habitable and usable structure, such as a septic system, well or water and sewer connections. (More on that element later in this article) For renovation or repair projects where the cost to improve and repair exceeds 50% of the contributory value of the structure, it may be required to make the dwelling compliant, which could include elevating the structure so that it is out of the flood plain. This could be a very costly avenue, not to mention that raising a structure, especially an older or antique home could have complications, augmenting the cost of elevating said structure.

Along the Connecticut Shoreline where our office is located, we have long received requests to perform a valuation of the improvements that are located in a flood zone. Such a request is typically preceded by the property owner going to their local town office where they reside to apply for a building permit. The town office that would administer a permit would typically be the engineering or building department. The property owner, if they happen to be located in a flood zone are typically requested to provide a value of the improvements to determine what their limit of spending can be for their construction or renovation project, that limit is intended to cover all “Substantial Improvements.”

In New England, many of the shoreline communities have areas that are located in a Designated Flood Zone. These zones, as designated by FEMA as either AE or VE. By experience of having appraised many a property in a flood zone, many have never experienced any flooding, but still come under the purview of the town to follow the rules as it relates to defining elements of value so that a building permit may be issued. Do note that this writer states “under the purview of the town”, as FEMA makes the rules as it relates to what defines a Substantial Improvement (SI), the town’s role is to interpret and police the guidelines that FEMA establishes.

What is considered to be a Substantial Improvement

Essentially any and all elements that make up the fabric and functionality of the structure. Such elements would include: all structural components, interior finishes, kitchens, baths, flooring, walls, plumbing elements, electrical, exterior doors, siding, windows, roofing, HVAC equipment, any and all mechanical equipment, security and monitoring equipment, as well as attached porches, decks and handicap accessible structure.

Not only are the above listed items regulated by municipalities (cities and towns), they are one and the same that should be included when an appraiser is considering and valuing the Contributory Value of the Improvements.

Recently, I performed a FEMA valuation for a property located on the shoreline in Connecticut. The town administrator questioned whether a septic system should be included in the valuation? My reply was that the septic system is an integral part of the structure, for which the dwelling could not function as a habitable dwelling without it! The administrator then agreed that the septic system was a value component of the structure and included that element in the valuation.

Approaches to Valuing the Contributory Value of the Improvements

The Cost Approach: When the valuation task is to value just the improvement portion of a property, the Cost Approach is perhaps the single best benchmark for valuing those elements. One such costing service is Marshall & Swift, which is perhaps the single best source, allowing the appraiser to break down the costing of a structure into separate components. Another great source is to take a survey of builders in the area who are familiar with not only what materials cost locally, but what these builders are charging to build a like structure. I typically use a combination of both, with my experience being that sometimes a nationally recognized costing service such as Marshall & Swift can lag behind the pricing curve, which is why it would be a good idea to get some pricing from a local source, such as a builder.

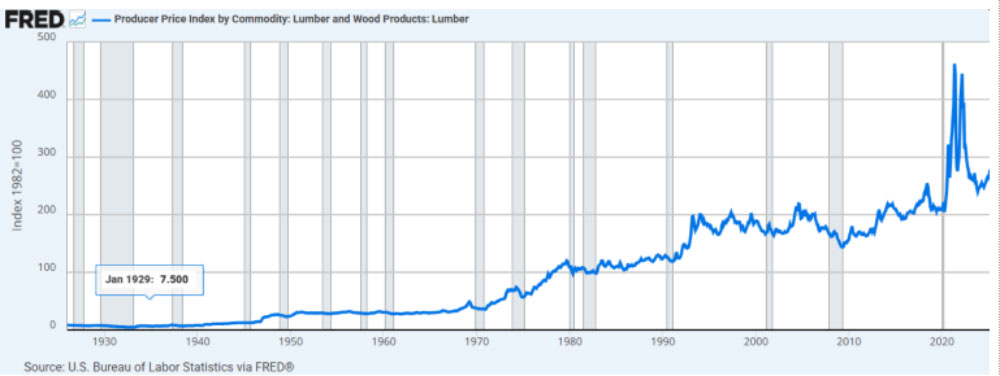

Academic to using the Cost Approach, is that since the inception of COVID, everything from toilets to general building materials have risen precipitously. A recent survey by this appraiser to remove and install a new cedar shingle roof resulted in prices that ranged from $700.00/square to $1,100.00/square, that’s a 57% difference in pricing. There is no question that the rise in the cost of materials and labor has increased the value of building materials that are already in place.

Chart 1 is lumber costs as published by the Bureau of Labor Statistics (as of July 2025).

A Second Approach to Estimating the Contributory Value of the Improvements

The Extraction Method: The Extraction Method involves estimating the value of a property as a whole (land and building), then subtracting a value estimate for the land. The value as a whole can be accomplished by a conventional appraisal utilizing the Sales Comparison Approach for a property.

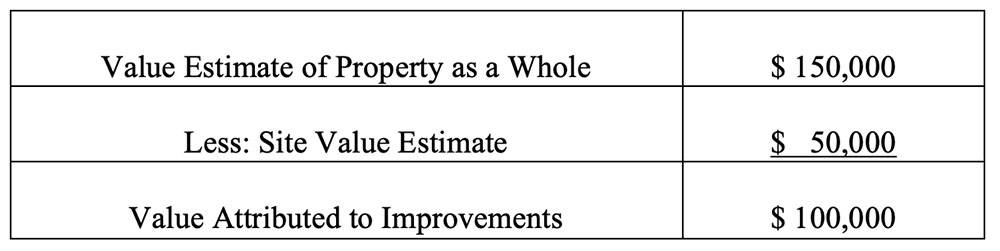

The land component can also be estimated by developing a Sales Comparison Approach. The subtracting of the estimated site value from the value as a whole would in theory isolate the contributory value of the improvements. The key to developing this approach is to carefully isolate sales of similar properties, preferably in the subject’s immediate market that have similar sizes, condition, utility and site sizes. An example of how one might present a summary of the calculation is shown in Chart 2.

Observations in the Market: This appraiser has found that many of the assessment records reviewed for properties in FEMA zones is that the land component of the assessment is over-valued, while the improvement portion of the assessment is under-valued. This inaccuracy is the product of what is typically a limited scope of the revaluation of a given property and/or when the revaluation was done. In Connecticut, municipalities are required to revalue the grand list of properties every 5 years and, the cost and value of improvements has greatly changed since the inception of COVID. Given the precipitous rise in the value of properties, along with the precipitous rise in the cost of labor and materials, the assessment may have an accurate valuation as a whole, but the division of land and improvements is often not market-supported and not reflective of the value of materials in place. If the material portion of the property is well-maintained, it is only logical that the value of those improvements would go up.

Summary: The best avenue for evaluating the contributory value of a structure is to find an experienced appraiser who is familiar with valuations for FEMA purposes. Strict attention to documenting the cost of building should result in a logical and defendable estimate of value for the structure.

Marc Nadeau, SRA is a designated appraiser, builder, Guilford, Conn.