What are some of the major trends affecting travel distribution over the last several years of increasing rates, occupancy, RevPAR and now-softening profits? In this article, we discuss some major trends in travel distribution. There are probably a dozen trends of varying durations that could be examined. For this article I choose the following three key business-changing trends that have shown some clear consistency and persistence over time:

*Transaction volume continues to shift to electronic channels, particularly to the internet.

*The growth in internet volume, particularly direct internet transactions, is at the expense of voice channels and third-party channels.

*Integration of transaction-oriented booking engines with rich site design, search engine optimization and customer relationship management techniques in order to drive trial by new customers, elevate the dialog with existing customers and increase share of mind and wallet.

Transactions continue to shift to electronic channels, especially internet

"Well, I knew that," you say? And you did. Up until the global distribution systems commanded prominence in the 1970s, virtually all reservations were either voice or direct to the hotel. Since then, electronic channels have metastasized to representing more than 50% of all reservations for virtually all hotel companies, and greater than 60% for most1. And since the internet first appeared as a line item in CRS operating statistics around 1996 or so, the internet has won an increasing share of that growth as travelers around the world have made the internet the foundation for commerce, information and entertainment.

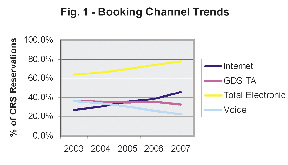

As shown in figure 1, over the last five years all electronic channels have grown from 63.6% of all CRS bookings to 77.2%. Most of this growth has come from the internet, going from 27.1% of reservations in 2003 to 42% in the second quarter of 2007.

Growth in internet volume at expense of voice and third parties

Also shown in figure 1, this growth in internet volume has come in tandem with decreasing voice channel reservations, dropping from 26.2% five years ago to 22.8% last year. Interestingly, central reservations office managers report that more than half of callers have previously researched their needs online and simply want to complete the transaction when they call, rather than asking about locations, rate and availability. GDS reservations from travel agencies have stayed pretty flat, 36.5% in 2003 and 35.2% in Q2 2007.

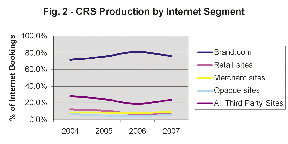

Where it gets interesting is when one gets inside of the internet channel and look at production by segment as shown in figure 2.

This data is vivid testimony to the effectiveness of hotel companies in assuming control of their inventory. As internet transactions conducted directly with the hotel company's web site (Brand.com reservations) have increased to over 80% of all internet bookings, all third-party sources have dropped over 10 percentage points, down to 18.5% of internet bookings.

Within the third-party channels, most of the decline has come at the expense of retail sites that sell the hotel's inventory for commission, rather than merchant sites, that sell the hotel's inventory for a (usually) fixed margin on a wholesale rate. Retail sites' share of internet transactions dropped from 12.5% to 5.7%. Opaque sites, which conceal the brand and name of the hotel until after the sale has been made, have also tailed off from 7.5% to 4% of internet volume.

Integration of booking with site design, SEO and CRM activities.

The earliest hotel web sites were simply storefronts offering up brochure-ware, pretty pictures with no booking capabilities. Then internet booking engines became available from multiple sources, and hoteliers quickly made getting to the transaction, the booking, the thrust of their web sites. This evolution is continuing, with leading companies treating their online presence holistically, and investing in more sophisticated site design to retain visitors, search engine optimization techniques to attract visitors and providing guests online access to their profiles in the hotel enterprise's frequency or other customer relationship management database.

Figure 3 is a screenshot from Wyndham Worldwide's leading edge frequency program, Wyndham By Request. This site allows members to maintain their profile, view folio detail from past stays, reservations records for future stay and more.

Less visibly, hotel companies have developed or engaged capabilities in search engine optimization and marketing (SEO/SEM). These capabilities include natural search, pay-per-click search and advertising placement. Cataloguing the strategies and tactics of SEO and SEM is beyond the scope of this article. These tools can drive massive amounts of internet traffic, leading to reservations revenue. For a hotel company to not employ SEO and SEM essentially means to give up that traffic to third parties without contest.

Summary

I see a number of implications of these trends for hotel investors, owners, operators and asset managers:

*All hotels need to make electronic distribution a priority.

*Evaluate flag and management company decisions in terms of distribution muscle and capabilities, particularly brand.com strength and SEO/SEM

*Owners of independent properties must commit to buying access to electronic distribution resources, integrating them into their Property Management System (PMS) and developing or buying SEO/SEM services.

Source: Proprietary research. Figure 1 and 2 data from eTRAK provided by TravelCLICK, reporting of CRS transactions. Used by permission.

Tags:

Four key business-changing trends affecting travel distribution over the last several years

July 16, 2008 - Front Section