One more year has come and gone since the pandemic began, and here at The Boulos Company, we’re constantly evaluating its ongoing overall impact on the Greater Portland office market. The dust seems to have settled somewhat in terms of the pandemic-inspired shift in office requirements, and there is some stability now on that front for both tenants and landlords. However, we do not believe we’ve seen the final impact of the pandemic on the market, and it could be another year or two before we’re out of the woods. Last year’s office market survey was somewhat of a surprise when the overall direct vacancy rate fell. Still, the trends started to resemble past disruptions in the office market, including the financial crises in 2007–2008. This year’s survey continued to display that trend. The amount of sublease space and “gray space” increased dramatically in 2021, and we wondered when and how badly this was going to affect the direct vacancy rates in 2022.

As a whole, the Greater Portland market remained strong over the last 12 months, with the direct overall vacancy rate decreasing to 6.38% in 2022. However, it’s still lower than the 2020 vacancy rate of 6.97%. In addition, the amount of sublease space on the market remained relatively the same, a good sign, possibly indicating some stability for future direct vacancy rates. The combined total vacancy rate is 9.14%, the highest it has been in six years due to the historically high sublease rate. Overall, this is a healthy vacancy rate for Greater Portland, and the increase can be attributed to specific submarkets.

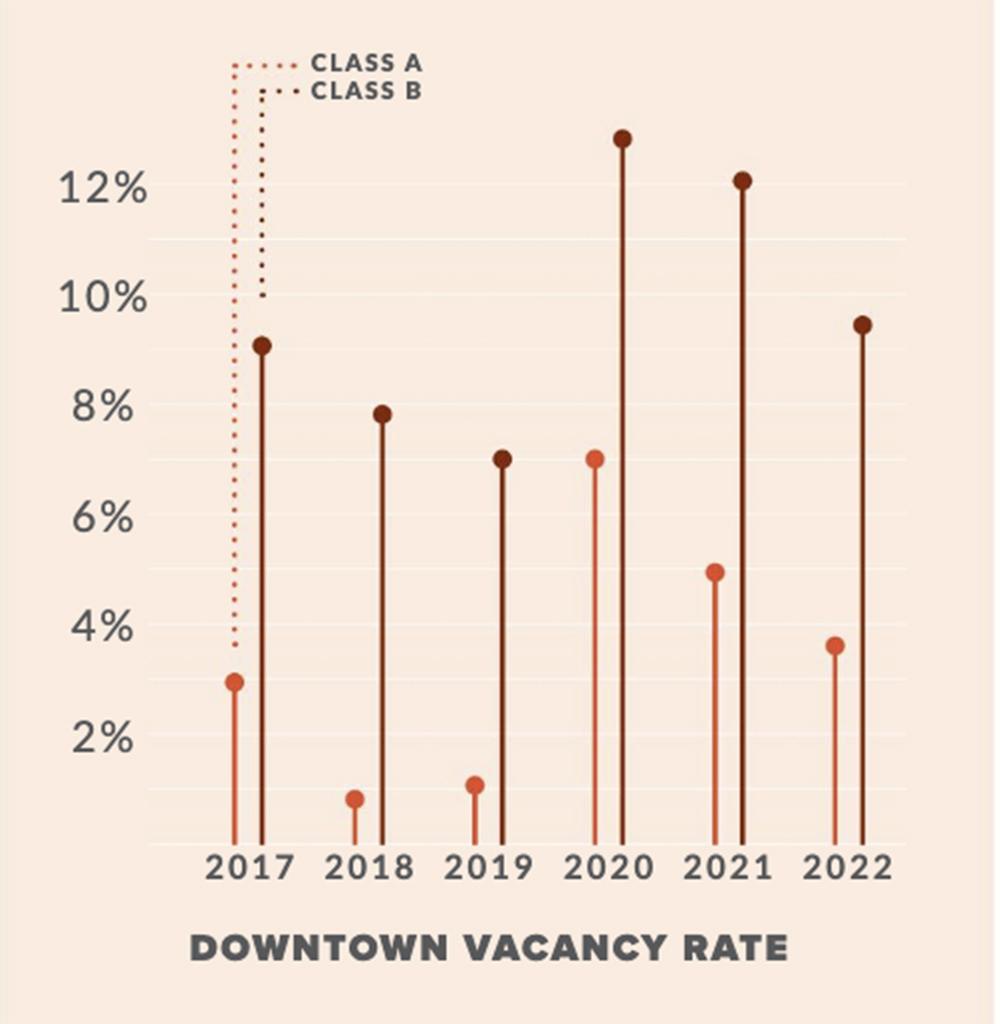

Downtown

Both the class A and class B vacancy rates fell for the second straight year, for a combined rate of just 6.41%, down from 9.92% in 2020. The 2022 vacancy rate isn’t quite back to prepandemic levels, which were driven by historically low class A rates. Still, the improvement in the market over 24 months is certainly a positive sign for the office market recovery on the Portland peninsula. The class A rate has improved to 3.75%, down from 6.60% over the previous year, and this includes the addition of two significant buildings: 110 Thames St., now occupied by Sunlife, and 12 Mountfort St., leased by Covetrus. These two buildings alone added 210,000 s/f to the market, both projects negotiated before 2020. The 100,000 s/f of sublease space downtown is almost entirely attributed to the class A market, and there is a significant amount of gray space in this market as well. This drop in the class A market may be short-lived, depending on whether demand can keep up with new vacancies in 2023.

The class B vacancy rate in 2022 is 9.48%, down from 13.32% in 2020. The improving class B market can be attributed to the conversion of office space to residential/ hospitality uses, as well as most class B buildings being occupied by small to medium- sized tenants that are locally owned and controlled— a subset of office tenants that best weathered the pandemic. There is also considerable gray space in the class B market, but that is likely to be offset from more significant building conversions over the next year.

Suburban

In last year’s survey, we noted that the suburban market, and two submarkets in particular, were slated for a possible increase in vacancies, given the amount of sublease space added in 2021 and the significant amount of grey space we anticipated. This prediction was unfortunately accurate, as the overall suburban vacancy rate increased to 7.59% from 6.67% the previous year. This may not seem like a significant jump, but the increase is attributed to just two submarkets, the Maine Mall area and the portion of suburban Portland closest to the Maine Mall. In fact, 82% of suburban direct vacancies are all within two square miles of each other, concentrated along I-95 and around the Maine Mall. The 2022 Maine Mall area class A vacancy rate is 16.22%—almost tripling from 2021 (5.83%) and the highest class A suburban submarket vacancy rate since we’ve started publishing this annual market outlook. In addition, nearly all of the 218,000 s/f of sublease space in the suburban markets is concentrated in the Maine Mall area. This is important to track as these subleases convert to direct vacancies, and it may be a few years before this submarket sees marked improvement.

Other suburban submarkets, including Westbrook, Scarborough/South Portland, and Falmouth/ Cumberland/Yarmouth, improved in 2022. However, they were overshadowed by the mall area, the largest of the suburban submarkets, which clearly drove the overall increase. With a lack of sublease space being offered or significant anticipated vacancies in the other suburban submarkets, we can expect similar vacancy rates in the near future.

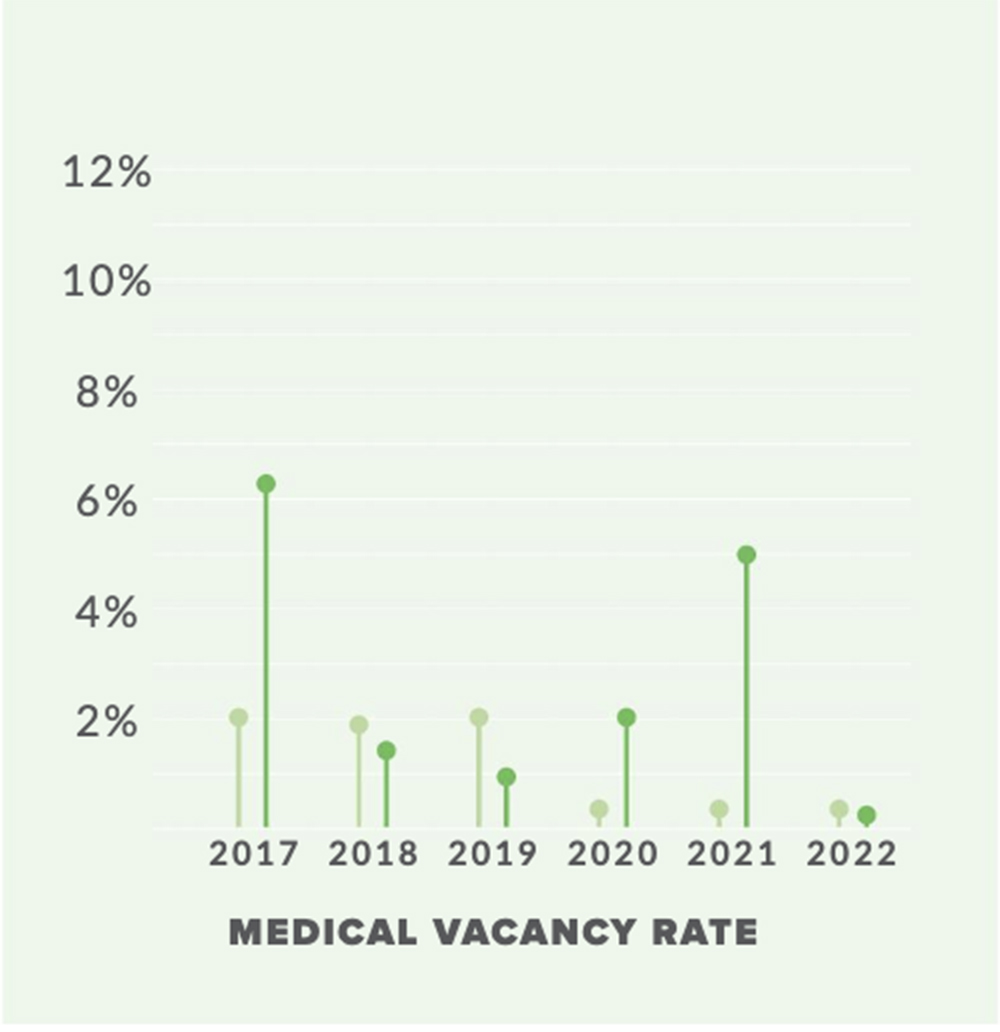

Medical

The medical office submarket continues to be the best performing class in the Greater Portland area. The total vacancy rate is 0.80%—below 1% for the third consecutive year, with only two small vacancies out of 1.5 s/f of medical office space on our survey.

The total size of the submarket increased by 35,000 s/f with construction completed on 113 W Commercial St., the new home of the Veterans Affairs outpatient clinic. While landlords are considering converting from office buildings to medical office, the significant infrastructure needs of medical office buildings, in conjunction with increasing costs of construction, are making these conversions more difficult. The demand for medical office space is also expected to continue to grow. Unfortunately, we do not see much relief for medical office tenants in the near future, as vacancy rates are projected to remain low in Greater Portland.

Forecast for 2023

Predictions on the office market are somewhat more straightforward than they have been the last two years, as office occupiers have adapted to a new way of working and meeting their evolving needs. Similar to the financial crisis in 2007–2008, it may be another year or two before vacancy rates level off and demand begins to outpace supply once again. Over the next 12 months, there will continue to be a tale of two markets, as the downtown market remains relatively strong and the suburban market experiences above-average vacancy. With the amount of grey space downtown poised to hit the market in 2023, there very well could be an increase in the downtown class A vacancy rates. At the same time, class B will likely continue to improve as more office conversions come to completion. In the suburban markets, specifically the Maine Mall area, there may not be much help from the limited demand, as negative absorption is expected again in 2023. This also creates growing opportunities for office tenants in the market, and while the best opportunities depend on a tenant’s size and location requirements, this should help create some demand in 2023.

Nate Stevens is a partner, broker with The Boulos Co., Portland, ME.

.png)