In our Q2 2011 report to the lodging industry, New England Hotel Realty (NEHR) and its research division, Lodging Econometrics, stated that the U.S. hotel construction pipeline totaled 2,851 projects with 347,930 guestrooms, a low not seen since 2004. This represents a 51% decline in the number of projects and a 55% decline in the number of rooms from the cyclical peak of 5,883 projects/785,547 rooms in Q2 2008.

In Q3, new project announcements into the pipeline rose incrementally, while cancellations/postponements were about the same as Q2. Meanwhile, new hotel openings continue to exit the pipeline, further depleting pipeline counts. A total of 259 new hotels, having 27,031 guestrooms, opened in the first nine months of 2011.

The credit crunch continues to significantly affect lodging real estate development. Early in the cycle, larger (150 rooms or more), high-end projects were impacted the most, as institutional-sized lenders halted real estate lending. Today, regional and community banks are still experiencing balance sheet difficulties of their own but there are signs on the horizon that things are beginning to change. In fact, the pipeline actually increased by 33 projects in Q311 vs. Q211...not a trend, but perhaps the signaling of a bottoming.

For year ending 2011, LE is forecasting 375 projects/39,636 rooms will have opened across the country. LE's Forecasts for new hotel openings account for project cancellations and postponements and reflects continued lending difficulties. As such, 2012 should see 339 projects/38,287 rooms open.

New England Hotel

Construction Pipeline

At the end of September 2011, New England's hotel construction Ppipeline consisted of 82 projects with 10,135 guestrooms (Chart 1). This accounts for about 2.9% of total projects and 2.9% of total guestrooms in the National Pipeline. New England Hotel Realty forecasts that 5 hotels with 444 new guestrooms will open in all of 2011 for a gross growth rate of .2%, which is down from last year's .7% and which is prior to any removal of hotel rooms from the current Census of Open & Operating Hotels. For 2012, NEHR forecasts that 15 hotels with 1,378 new guestrooms will open in New England.

Forecasted new hotel openings in New England for '11 and '12 combined, show the largest growth in Mass., Maine, and Conn. Six new hotel openings with 627 new rooms are expected in Mass., while 5 new hotels and 474 new rooms are anticipated in Maine through 2012. During the same period, Conn. should see 4 new hotels with 195 new rooms.

What does it mean for the region? It means that through 2012 and probably through 2013, there will be very modest supply growth in New England. These new supply projections should be great news if you are an existing owner looking for your property to continue to rebound from the recession, as demand should outpace new supply for many months to come.

New England Lodging

Transactions and Values

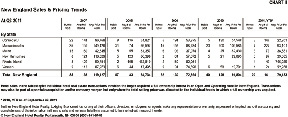

Not surprisingly, the number of lodging transactions in New England has seen a steady decrease from 2007 through 2009. However, in 2010, the regions sales volume actually eclipsed 2009 totals. Further, the average selling price on a per room basis, in freefall in 2008 compared to 2007, rebounded nicely in 2009 and 2010. With clarity through nine months of 2011, year end hotel sales activity should look more like 2009 than 2010 (Chart 2).

Notice 40% decline in the average price per room from YE 2007 to YE 2009 and the number of transactions from YE 2007 to YE 2009, about a 62% drop.

In 2008, because of the economy, slowing demand and the scarcity of financing for hotel deals greater than $15 million, many investors went to the sidelines, especially in the third and fourth quarter of 2008. However, as demand has increased, new equity groups with significant capital resources have formed and they are looking for owners interested in selling. Many of these equity groups have debt lined up. These equity groups are making their way to New England, primarily looking for well located branded hotels that have wide consumer acceptance. Our brokerage department is currently working with these equity groups and has three transactions lined up...one of which has already closed.

Some larger significant transactions that occurred in the first nine months were: the W Hotel, Boston, Mass at $380,851 per room; and Sheraton Hotel & Conference Center in Framingham, Mass at $72,989 per room.

NEHR is one of the highest volume hospitality real estate advisory and brokerage firms in the Northeast, providing acquisition, disposition, consulting and market research services to the lodging real estate and lending industries. Since 1977, the NEHR team has provided quality investment opportunities and seller representation in hundreds of hotel transactions. We are frequently called upon as advisors to assist in the analysis of a client's lodging investments.

We are prepared to advise in the strictest confidence on whether to sell an asset or hold it and sell at a more advantageous time. We can assist in the disposition of a single hotel investment or a portfolio of lodging assets of any size.

JP Ford, CHB, ISHC, is the senior vice president of New England Hotel Realty (NEHR).

NEHR provides acquisition, disposition, consulting, and market research services to the lodging real estate industry since 1977. NEHR is highly skilled in the sale of lender-owned and distressed hotels.

Ford is responsible for overseeing and directing the company's hospitality brokerage department, working with new clients, and servicing the disposition and acquisition needs of existing clients.

Tags: