Commercial real estate firms and private equity firms can minimize borrowing costs by paying attention to opportunities in the interest rate market. The market has been fairly flat since the beginning of the year with little concern that rates are going to spike anytime soon however timing could be advantageous now. For borrowers that are required to hedge or are looking for the right time to hedge interest rate exposure whether it is insurance financing or with a conduit or bank financing, investors should consider this market as an opportunity lock in a hedge. Caps, collars and swaps or treasury based fixed rate hedges may make sense now given the findings described below.

Hurricanes: Impact on Rates

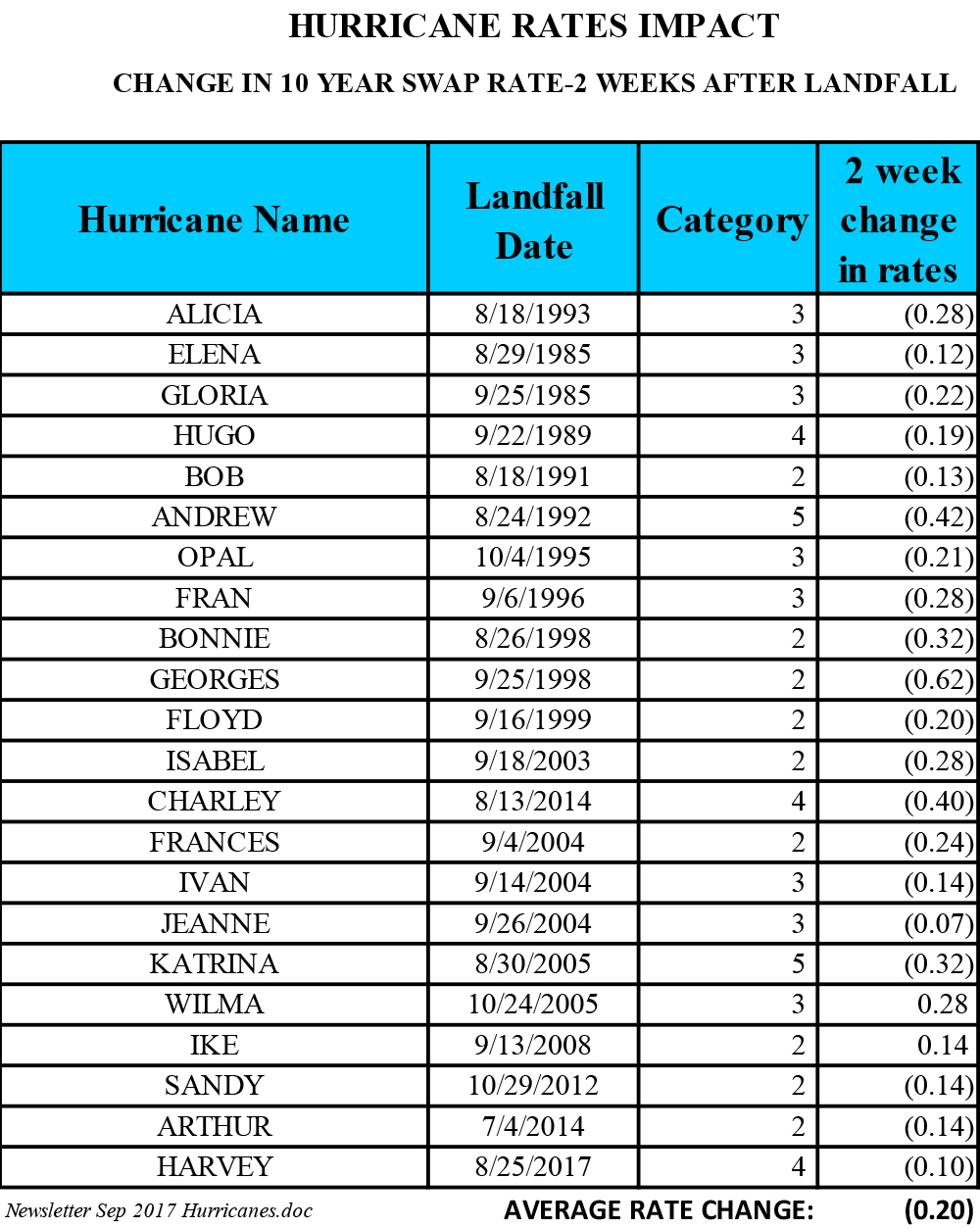

In researching hurricane activity in the Eastern U.S. for the past 25 years we found that rates tended to rise as hurricanes strengthen and head toward the coast and then tend to drop following landfall.

Twenty-one hurricanes of category 2 or higher have hit landfall in the Eastern U.S. in the past 25 years. Hurricanes typically make landfall between August and December with 80% hitting during August and September. Rates tend to inch up as a hurricane approaches as investors become defensive and statistics show rates have dropped an average of 20 basis points during the 2 weeks following landfall. The largest drop was 62 basis points following Georges in 1998. After the drop in rates over the 2 week period following landfall statistics show that interest rates increase by an average of 23 basis points during the following few weeks. Data shows that the temporary drop in rates provides a buying opportunity for borrowers who are in a need to hedge interest rate exposure.

Harbor Derivatives helps borrowers with their interest rate hedging needs with more than 25 years of derivatives experience.

Rob Pratt is principal at Harbor Derivatives, Scituate, Mass.