You are going to start seeing downward adjustments in appraisal reports for changing market conditions. Although the issues within the commercial real estate, CRE market are well known, it may be a jarring experience to see the adjustment applied to your property.

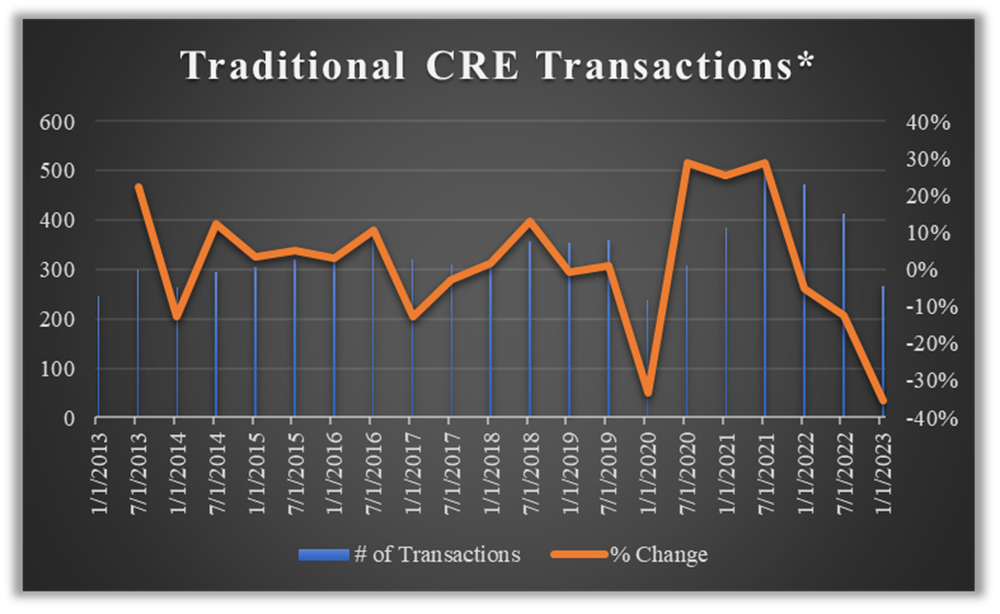

There has been a dearth of commercial real estate sales during the first half of 2023. According to Conn-Comp (a well-established company used by appraisers throughout Connecticut), commercial sales activity is down 35% from the last six months of 2022. While there are some notable bright spots in certain submarkets such as medical office and apartments, the significant uptick in interest rates coupled with cultural shifts (think “work from home”) has had a chilling effect on the market.

After the initial slow down during the quarantine days in early 2020, sales volume increased throughout the end of 2020 to end of 2021. Once interest rate hikes began, in mid-2022, sales activity began to decline. First by 5%, then 13%, and in the most recent 6 months of 2023, activity is down 35%.

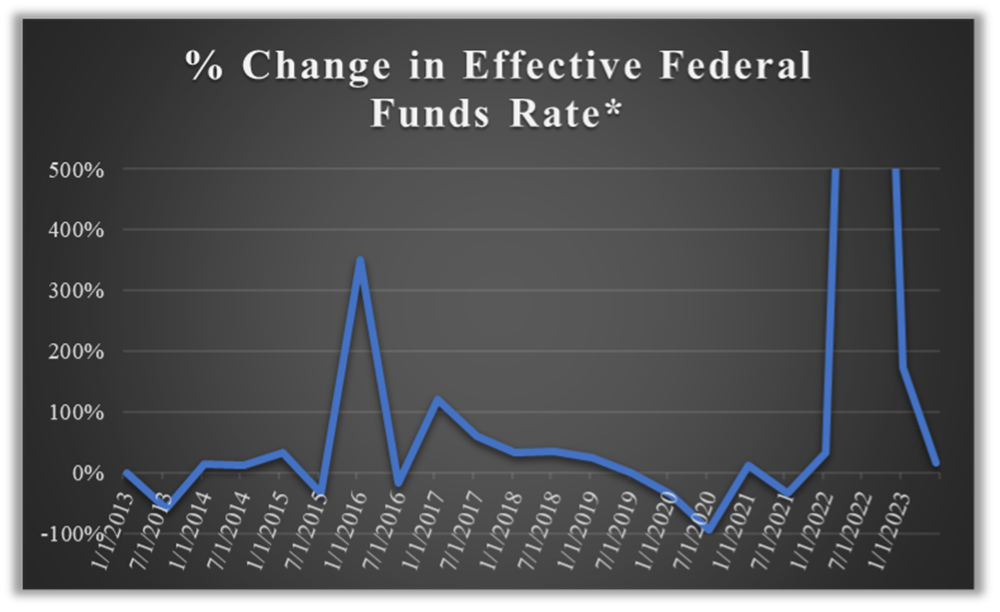

This downturn in sales activity directly correlates with the interest rate increases. Over the past 10 years, the effective federal funds rate generally changed less than 25% every six months with just two periods over 100%:

• In mid-late 2015 a 350% increase (from 0.08% to 0.36%)

• In mid-late 2016 a 120% increase (from 0.30% to 0.66%)

During COVID, to keep the economy afloat during quarantine, the Federal Reserve reduced the effective rate from 1.55% in January-2020 to 0.08% to a 95% increase in July-2020. The effective rate remained below 0.1% for roughly two years prior to increasing 1,875% during January to July 2022 (0.08% to 1.58%). During the first six months of 2023, the effective rate increased from 4.33% to 5.08%, indicating that the market, from the Fed’s perspective, may be stabilizing. However, the latest “noise” indicates that more rate increases may still be on the way.

Does this correspond with expectations in the market right now?

The answer in the market is: “Yes” and “No”. Buyers quickly adjusted to the new normal but as with any market shift it takes time to filter through to sellers who still have unrealistic expectations. We have now entered into a price discovery period or a price-reset. History suggests that this new reality will take a while to set into commercial real estate owners which may be prodded along with a nudge from some lenders.

Where does that leave appraisers?

A good appraisal should contain supporting sale data to assist in supporting adjustments. Given the dearth of closed sales there are not many datapoints from which an appraiser can discover what the market thinks. Appraisers must combine old data with current sentiment derived through constant communication with lenders, investors, mortgage brokers and property owners in an effort to interrupt where the market’s mindset is at any given point. Admittedly it’s not perfect, but that’s what typically happens in shifting markets.

Until sellers begin to understand that interest rates are unlikely to fall in the near term and that there has been a fundamental shift in demand for certain property types, sales should be anticipated to remain stagnant. Although a rising market is strongly preferred by most compared to a declining market, appraisers are going to have to start adjusting older sale transactions downward.

This adjustment is supported with simple mathematics: The late June 2023 effective federal rate is 5.08%. The last time we saw a rate over 5.0% was June 2007! As the cost of debt increases, the risk to the buyer increases, which requires sale prices to reset.

Please remember, don’t shoot the messenger!

Josephine Aberle, MAI, is managing director at Valbridge Property Advisors, Glastonbury, Conn.