Inherent in the fee simple ownership of real estate is something that is commonly referred to as the "Bundle of Rights." The Bundle of Rights is in effect the exclusive right, use and disposition of the property that belong to the property owner. The owner of the Bundle of Rights typically has the ability to convey all or some of those rights to another. The conveyance of the right to another person that enables them to occupy a property for the duration of their life is commonly known as a life estate. The beneficiary of the life estate is referred to as the tenant. The person or entity that actually has the ownership in the real property is referred to as the remainderman.

The Appraiser's Role

There are multiple scenarios where an appraiser is needed to evaluate a life estate. Sometimes the role of the appraiser is to estimate the value of the interest for the tenant and sometimes the role is to estimate the value of the remainderman. This article is aimed at creating a value estimate for the tenant's interest.

The first step in valuing the tenant's interest is to establish the life expectancy of the tenant by utilizing a life expectancy table.

Valuation Scenario -

Tenant's Interest

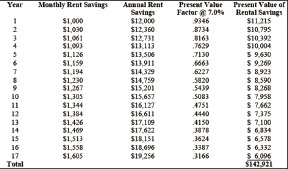

The following is an example where the appraiser's role is to value the interest of the tenant. The tenant in this case is a 70-year-old person.

There are a series of steps that must be taken in this valuation scenario which are summarized as follows:

* Estimate the annual rental value of the property. Assuming that the tenant is not being charged anything to occupy the property the annual benefits is that of the full market value. If the tenant were paying some nominal rate, the benefit would be the difference between the market rate and what is being charged to the tenant.

* Estimate the term of the life estate. This element is based upon the age of the beneficiary (The tenant) of the life estate and their life expectancy. Life expectancy can be estimated from a variety of published tables including that of the tables included in IRS publication 590, which contains a table of life expectancies based upon age. In the case of this valuation scenario, the beneficiary is 70 years old and would have a life expectancy of 17 years

* Discount the forecasted future benefits to the tenant over the remaining duration of the life estate at an appropriate discount rate. Discount rate is synonymous with what would be an expected rate of return for a like property.

* Estimate the expected rate of appreciation of rent over the life expectancy. There are a variety of statistical references that an appraiser can utilize to estimate the expected rate of appreciation. In this example, the Consumer Price Index (CPI) is being used. A review of the CPI index, as published by the Bureau of Labor Statistics between 1993 and 2013 revealed an average rate of inflation of 3.1%. Inflation over the past ten years has averaged less than 3.0%. Your appraiser has chosen a rate of 3.0% for the anticipated annual rate of appreciation.

Valuing the Tenant's Interest

The example below assumes that a survey of comparable rents reveals that the rental market value of the property is $1,000 per month and that the tenant is responsible for maintenance, insurance and taxes. Therefore, as a result of the life estate granted, the tenant is enjoying the benefit of $1,000 per month.

Other Assumptions:

* The market value of rents will continue to increase at the rate of 3% annually.

* The expected rate of return over the balance of anticipated life is 7%.

Marc Nadeau is a designated appraiser with Nadeau & Associates, Guilford, Connecticut.