Over the past six months I have been asked repeatedly by property owners, investors, appraisers and lenders alike - Which markets today offer the best investment opportunity?

At this point many of us are scratching our heads and asking, just where can we turn?

Let's face it, the residential real estate market is without question the most battered market, and logically so. Residential housing rose precipitously in value between 2002 and 2006 and often at a double-digit pace. It is only logical that the ride down is going to be just as steep and perhaps worse. The contraction of wealth in this country has curtailed consumer spending to the point that retailers, big and small, are going out of business. This in turn is impacting the retail real estate market as tenants either default on or terminate their leases. The office market, too, is seeing an increase in vacancy rates.

At the helm of this problematic market is often what amounts to a surplus of inventory. Over the past six years I have often wondered how many $1 million subdivision-like homes can the market absorb? Or, how many more shopping centers can the market continue to support? Yet, developers continued to build and in most cases, lenders continued to finance these projects.

Market Opportunity?

The one sector that thus far, appears to have survived the severe downtown is the light industrial market. This particular sector (at least in the shoreline market in southern Connecticut) never grew by leaps and bounds but instead expanded at a slow but steady pace. As it stands, most towns along the shoreline only have a small percentage of area zoned to accommodate light industrial improvements. The majority of those areas are built out or nearly fully developed leaving little available land for new development. And, I have yet to see any of the area municipalities re-zone any land in recent years to accommodate like new development.

Occupancy Levels

A poll of area brokers and owners along with a review of current offerings available in the market reveal occupancy levels that range between 85% and 90%. Mind you. I'm talking about relatively clean light industrial space with relatively good utility, not older factories that have functional or utility issues. This appraiser has even found better examples in the market as far as occupancy. An interview with Madison developer, David Milano of Milano Properties, revealed an overall occupancy level of nearly 95% for the 140,000 s/f owned by his company. In as much this may represent the best occupancy level for this particular market sector, the rate none the less is representative of what potentially can be achieved in this market.

Market Dichotomy

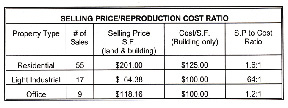

An interesting dichotomy that exists in the light industrial market is the fact that the cost to replicate the typical light industrial building greatly exceeds that of what the typically selling prices are on a per s/f basis. Much of this dichotomy has been driven by the precipitous increase in the cost of raw materials, in particular steel and petroleum-based products. A survey of area builders, brokers and developers revealed that the expected cost per s/f for a good quality steel building with 20' ceilings, multiple overhead doors and a good percentage of office space will typically eclipse $90 per s/f with the average being $100 per s/f. A survey of area builders indicated that the cost per s/f for a good quality single family dwelling along the shoreline is weighing in at $125 per s/f whereas, a good quality frame office building is in the neighborhood of $100 per s/f. When comparing the typically selling prices of the various market sectors, an interesting market dichotomy is revealed. The light industrial properties remain to be selling for a fraction of the cost of replicating the building alone whereas, the residential properties (the softest of all markets) tend to sell for a substantial premium over and above the cost. Now, for the sake of sounding like Jim Cramer of CNBC, the light industrial sector appears to be the most undervalued of all the real estate markets. The following chart depicts the dichotomy of selling prices vs. the cost of construction for light industrial, office and residential properties:

The following table includes a sampling of 55 residential home sales from Guilford and Madison that occurred in 2007. All of the homes were of the same style and similar size (3,000 s/f to 4,000 s/f), all of which are located in subdivisions. The sales of the light industrial and office properties include all such sales from January of 2006 through present date. These sales are located in the towns of Guilford, Madison, Branford, Clinton, Westbrook and Old Saybrook. The size range on the buildings was 5,000 s/f to 50,000 s/f.

The cost to selling price analysis is clearly telling of the afford ability of the light industrial market especially when taking into consideration the healthy occupancy levels. One may argue that this sector is next to be hit by the contracting labor market and that may be true to some extent, however, there are some encouraging indicators in the general marketplace as well as expected byproducts of Obama's Stimulus Plan that will only enhance the desirability of this market and create further demand.

Better Days Ahead....

The inventory of available homes is starting to fall and, homes are becoming more affordable due to the fall in prices.

Housing inventory is finally moving coupled with the fact that housing starts are at a record low. The combination of the elements should contribute to a recovery in the marketplace.

Frugal is the new trend

Even the most optimistic real estate market watchers must concede that the road to recovery is long and that most sectors, (especially the residential market) will take a while to re-establish itself. At this point, I like the chances of the light industrial market, its record low value to cost ratios may be telling of what could be a truly undervalued class of real estate.

Â

Marc Nadeau, SRA is an appraiser, developer and investor, Nadeau & Associates, Guilford, Conn.

Tags: