While the current economic situation is challenging at best, it is not unprecedented. Most consultants and analysts are projecting declines in hotel performance on an industry-wide basis that seem shocking to some, particularly to those who have not previously experienced a down cycle. Projections published by PKF in early December suggest a 7.8% decline in RevPar for 2009 on a national basis and further suggest that the industry will not begin to see a recovery until the second quarter of 2010. For those who have only witnessed the tremendous industry growth over the last few years, these projections seem a harsh prospect; however, a look back at hotel performance in New England from 1987 to present indicates that current projections look very realistic.

The New England lodging market achieved its peak occupancy of 67% in 1987 and hit this mark again in 2000. But beginning in 1998 and continuing through 1991, occupancy declined, dropping a total of 10 percentage points during this four year period. In 1992, occupancy began to climb, increasing each year through 2000, again reaching its peak level of 67%. After September 11th and the 2001 to 2003 recessionary period, the New England market has never again reached near peak occupancy, instead occupancy rates have since hovered around the low 60 percents. This is due, in part, to an increase in room supply.

The supply of hotel rooms in the region grew at an average annual compound rate of 1.7% from 1987 through 2007. The state of Rhode Island had the greatest growth in supply, growing at an average annual compound rate of 3.6% while Vermont and Maine experienced the slowest growth in supply during this period at 1.0% (CAGR). Demand for lodging in New England over this long-term period increased at an average annual rate of 1.3%. The state of R.I. showed the greatest increase in demand at 2.7% compounded annually, while Vermont had the lowest growth in demand at 0.4% (CAGR).

Average daily room rates for the New England market do show increasing trends over the long-term period. Rates increased at an average annual compound rate of 3.1% from 1987 through 2007. During the two recessionary periods which occurred during this time however (1990 to 1992 and 2000 to 2003) rates did decline. From 1990 to 1992, average rates dropped 2.3%, while rates dropped 7.5% from 2000 through 2003. Within New England, the states of Maine and Mass. experienced the highest average rate growth at 3.4% from 1987 through 2007, while Vermont had the lowest rate growth at 2.1% over the same period.

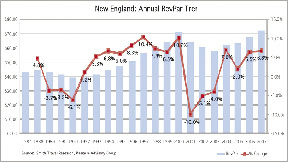

Looking at RevPar over this long-term period illustrates the combined effects of occupancy and average rate changes. The graph below depicts RevPar performance for the New England lodging market from 1987 through 2007.

As the graph shows, the overall trend in RevPar is generally an upward one. However, note the multi-year RevPar declines during the previously mentioned recessionary periods. From 1989 to 1991, RevPar declined for three consecutive years and again from 2001 to 2003, when RevPar decline was significant and prolonged. These two historic periods lend some support to the projections of negative RevPar growth that are being put forth by analysts and consultants for 2009. In fact, they indicated that negative RevPar growth should continue into 2010 and perhaps even 2011.

Some regions seem to fare better than others during times of economic decline. Other regional markets showed similar patterns of growth and decline over this long-term time period, though with variation on the length and depth of the cycles. The general composition of demand within a given market can provide an indication of how a market may fare. For instance, when the base of demand in a market is heavily comprised of leisure business, the market tends to feel the impact of a downturn almost immediately with lasting effects. However when the base of demand is comprised of business from institutions such as universities, hospitals or the government, the market seems to experience the downturn with a muted effect. These types of institutions can insulate the market, helping to minimize and delay the effects of a down cycle. The more diversified the base of business within a market, the better suited that market is to weather economic cycles. The states with larger urban areas, such as Mass. (Boston) and Rhode Island (Providence), tend to fare better during the downtown and recovery periods. However, it will be interesting to see how this cycle plays out in Boston and Providence as these markets have recently seen a sizable increase in supply.

The individual states have mixed performance results so far this year. Data from Smith Travel Research through September 2008 shows a decline in occupancy for each state with the exception of Vermont, while all states but Rhode Island have posted a modest increase in average rates. Conn. occupancy is down 1.6 points through September with average rate up by 2.6%. An increase in supply of 2.6% accounts more for the drop in occupancy than does the 0.1% decline in demand. Similar to Connecticut, occupancy in the state of Maine is down by 1.5 points while average rate is up 2.6% through September. Maine experienced an increase in supply of 1.5% with a decline in demand of 0.9%. Mass. occupancy is down by 0.5 points through September while rate is up by 4.0%. Both supply and demand are up year-to-date over the same period last year, with supply up by 2.0% and demand up by 1.2%. Massachusetts and Vermont are the only two states that show an increase in demand over last year through September. Occupancy in New Hampshire is down by 2.1 points while rate is up 3.4%. New Hampshire had an increase in supply of 2.1% while demand declined by 1.5%. Vermont occupancy is up by 1.8 points while average rate is up by 4.9%. Vermont had a decrease in supply of 0.8 points year-to-date while demand grew by 2.3%.

It is clear that the year ahead is going to be a challenging one for the hotel industry as a whole. Some markets will experience declines in revenues into the double digits, while other markets may not be so significantly impacted. So far this year, the New England states have been only moderately affected by the current economic situation. However, we believe that the New England lodging market will experience a substantial downturn in 2009 which will likely continue through early 2010.