Despite some normalization across sales, recreational boating continued to be a significant driver to the U.S. economy due to the estimated 85 million Americans who go boating each year. It drives an economic impact of $230 billion, up 36% from 2018, while supporting 36,000 U.S. businesses and 812,000 American jobs, according to NMMA’s 2023 Economic Impact Study on Recreational Boating. U.S. Recreational Boating by the Numbers Source: National Marine Manufacturers Association Annual U.S. sales of boats, marine products and services totaled $59.3 billion in 2022, up 4.4% from 2021. Boating and fishing are one of the leading drivers of the $1.1 trillion outdoor recreation economy, which contributes 2.2% of our nation’s GDP.

The recreational boating industry is an economic driver with more than 812,000 American jobs and more than 36,000 American businesses. Recreational boating is a uniquely American-made industry, as 95% of boats sold in the U.S. are made in America. An estimated 85 million Americans go boating each year. Recreational boating isn’t just for the one percent: 61% of boaters have an annual household income of $100,000 or less. Ninety-five percent of boats on the water in the U.S. are less than 26 ft. ? boats that can be trailered by a vehicle to local waterways.

However, there was a notable increase in sales of new boats being down (25%) versus the previous year (16%). Dealer mentions that YoY sales of used boats in 2022 were up less than 10% attained an uptick to 24% (19% in 2021). Conversely, those dealers citing sales were up more than 10% declined to 27% from 36% the year prior. Analyzing dealership optimism for last year, at the time of the survey, around 20% of respondents anticipated an increase of 10% or more in overall revenue for 2023, a significant drop versus a more confident 44% outlook in 2022. In fact, 63% of dealers expected revenue to be down, with 42% expecting it to be down more than 10% and only 21% believing their sales would be down less than 10%. The outlook for sales of new boats in 2023 was significantly less positive than 2022, with 72% of dealers projecting sales to decrease versus 36% in 2022.

However, there was a notable increase in sales of new boats being down (25%) versus the previous year (16%). Dealer mentions that YoY sales of used boats in 2022 were up less than 10% attained an uptick to 24% (19% in 2021). Conversely, those dealers citing sales were up more than 10% declined to 27% from 36% the year prior. Analyzing dealership optimism for last year, at the time of the survey, around 20% of respondents anticipated an increase of 10% or more in overall revenue for 2023, a significant drop versus a more confident 44% outlook in 2022. In fact, 63% of dealers expected revenue to be down, with 42% expecting it to be down more than 10% and only 21% believing their sales would be down less than 10%. The outlook for sales of new boats in 2023 was significantly less positive than 2022, with 72% of dealers projecting sales to decrease versus 36% in 2022.

During the survey last year, only 15% of dealers believed new boat sales would increase, which is a notable difference from 39% for 2022. The primary driver of the subdued dealer sentiment is the challenging economic environment that is projected to continue into 2024.

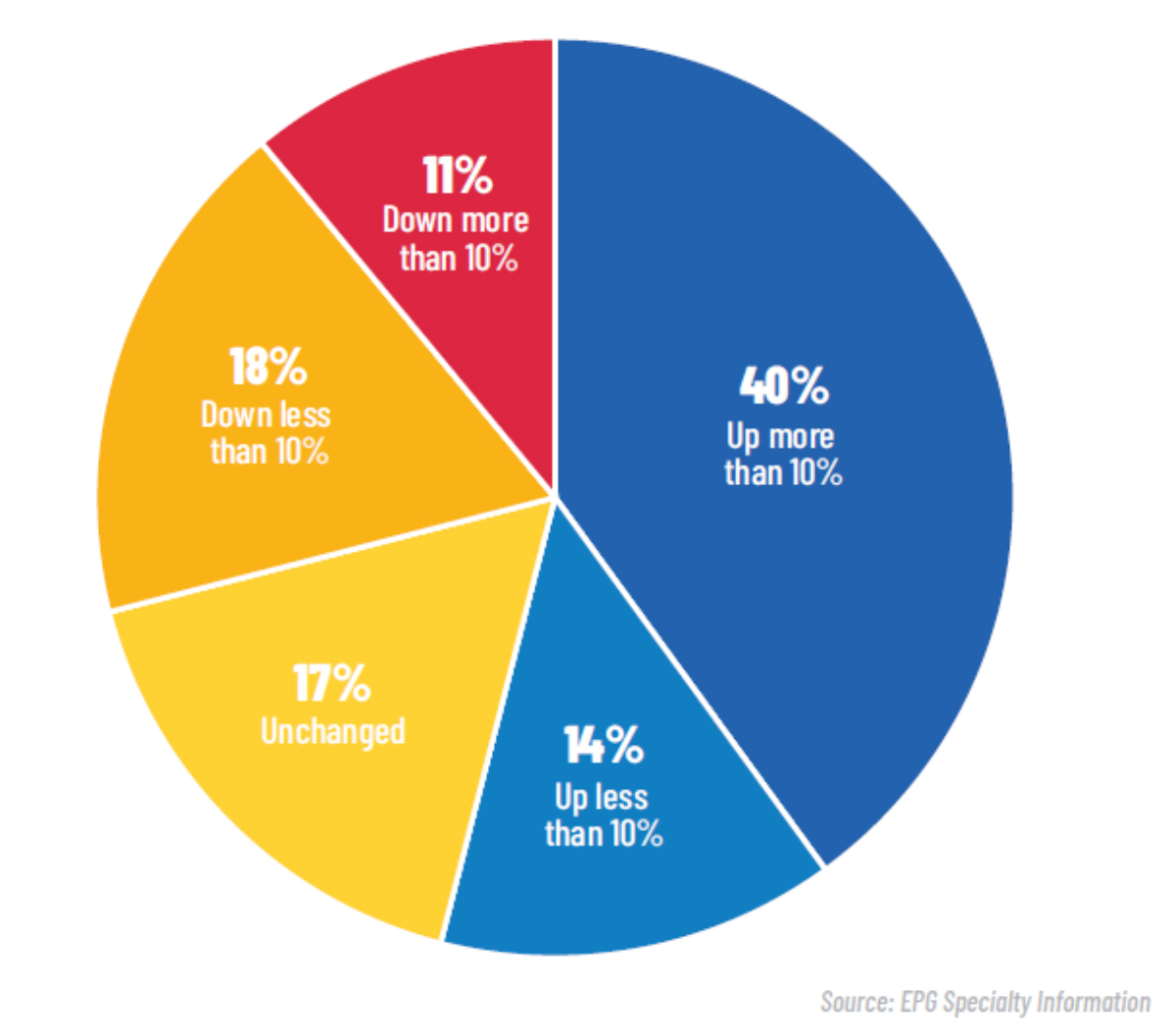

When asked how 2022 fared compared to earnings in 2021, respondents posted the following (see chart). So more than half of the owners and operators saw an increase in revenue, 17% saw no change and only 29% saw a drop in sales.

As the U.S. recreational boating industry barrels into the winter boat show selling season to kick off 2024, the National Marine Manufacturers Association (NMMA), which represents 85% of the country’s recreational boat, marine engine and accessory manufacturers, is reporting new powerboat retail sales are estimated to be down slightly in 2023 numbers, approximately 1% to 3%, to 258,000 total units. Despite this we are seeing strong demand for marinas and rising prices due to competition for quality assets and high barrier to entry. There have been a number of investment companies that have entered the industry. So despite the tightening of debt by lenders and a higher interest rate environment, returns on investment are strong due to economies of scale and superior operating models.

Jeffrey Dugas, MAI, SGA, is founder of Leisure Appraisal, Cheshire, CT and Boca Raton, FL.