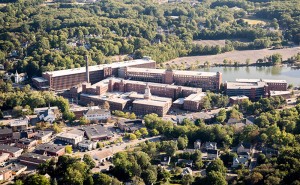

Maynard, MA Mesa West Capital has provided Artemis Saracen Investments, a joint venture between Saracen Properties LLC and Artemis Real Estate Partners, with $40.8 million in first mortgage debt to reposition an historic one million s/f office campus. Formerly known as Clock Tower Place, the newly rebranded Mill & Main is a mixed-use development 25 miles west of Boston. The 50-acre site includes 12 vintage brick and beam style buildings overlooking a 14-acre mill pond.

Loan proceeds will be used to implement an extensive capital improvement and leasing plan that will reposition the property to appeal to a wide variety of users. Planned improvements include updated building systems, pedestrian plazas, a waterfront boardwalk, fitness facilities and boutique retail and gallery venues.

This was Mesa West’s first transaction with Saracen and Artemis, but the portfolio lender was impressed with the venture’s keen knowledge of the area and its plan at the property, according to Mesa West vice president Daniel Tanner who originated the financing out of the firm’s New York City office.

“The Artemis/Saracen team has a unique vision for this property which will allow them to transform it into one of the most distinctive and highly amenitized mixed-use developments in the area,” said Tanner. “Given their successful background executing business plans in the Boston metro, we’re confident in their ability to deliver once again.”

Mesa West Capital’s floating rate financing features a three-year base term with two, one-year extension options.

Originally constructed in 1847, the property served as a woolens mill until 1950 when it was converted to an office park. It was also the headquarters for Digital Equipment Corp. from 1974 to 1993.

The Saracen led joint venture purchased the mortgage on the property from JP Morgan in February 2015 and acquired the asset a month later through a deed-in-lieu of foreclosure.

Jay Marshall, senior managing director in the New York City office of HFF arranged the financing.

The property is currently 37% leased, including a recently signed lease with Stratus Technologies for 102,000 s/f, which is set to commence this spring. A fitness center, brew pub and brewing facility are also slated to open in the Spring.

“Artemis and Saracen have already started to make headway at the property, and our loan is customized to allow them to continue their effort to reposition and lease up the asset,” Tanner said. “It’s a very exciting project.”

Mesa West Capital is a privately held debt fund manager and portfolio lender with more than $3.5 billion in assets under management. With offices in Los Angeles, New York City and Chicago, Mesa West has been one of the leading providers of commercial real estate debt since its founding in 2004. Mesa West provides non-recourse first mortgage loans for core/core-plus, value-added or transitional properties throughout the United States. Our lending portfolio includes all major property types with loan sizes ranging from $10 million up to $200 million. Since inception, the firm has sourced and closed more than 200 transactions totaling in excess of $6 billion.